Financial companies large JP Morgan has launched its newest e-Trading Edit report. It reveals the emotions of institutional buyers worldwide concerning the long run of buying and selling expertise, crypto and AI.

The report, now in its seventh 12 months, was drawn from a January survey of 835 institutional merchants in 60 world markets. The annual survey assesses dealer sentiment throughout a number of asset lessons. It goals to uncover “upcoming trends and the most hotly debated topics.”

AI Dominates as Top Technology for Institutional Investors, Outshining Crypto

JP Morgan concluded that 53% of the institutional buyers surveyed imagine that synthetic intelligence (AI) and machine studying would be the most influential expertise in shaping the long run of buying and selling over the following three years, a big enhance from 25% the earlier 12 months.

This makes AI the clear winner, 4 occasions extra usually cited than blockchain and distributed ledger expertise (DLT), which got here in third place with 12% of the vote. API integration was second with 14% and cellular buying and selling apps fell to 7% from first place final 12 months with 29%.

The e-Trading Edit report additionally appeared into the long run of crypto. Around 72% of the institutional buyers stating that they haven’t any plans to commerce crypto or digital cash.

Despite this, the report famous that contributors predict that 64% of their exercise will probably be within the crypto house by 2024.

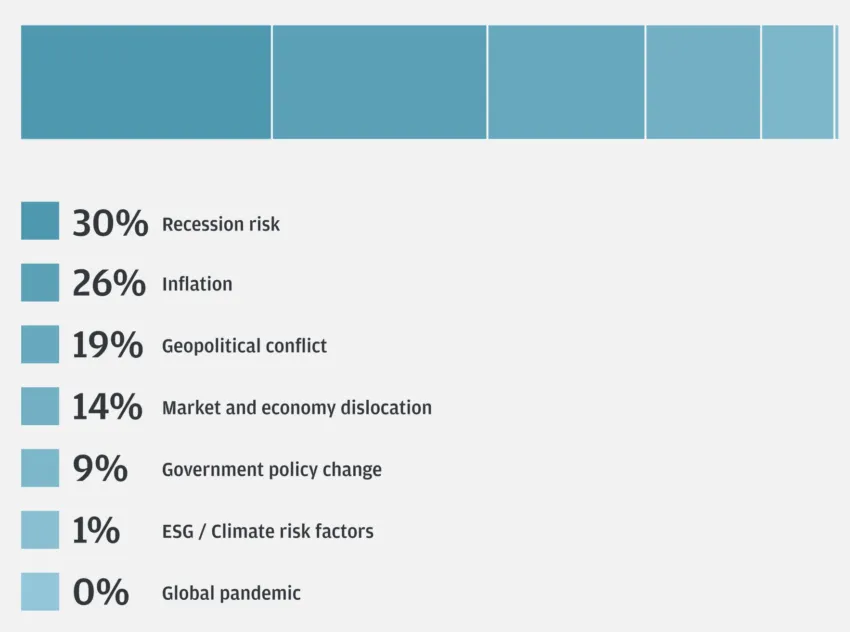

In 2023, merchants anticipate to face some challenges. Recession threat (30%) and inflation (26%) have been recognized as the highest potential developments that would influence markets. Geopolitical battle got here in third place with 19%.

This report follows a number of latest JP Morgan research and studies associated to crypto and digital belongings. The agency has predicted “significant challenges” for Bitcoin and Ethereum. It additionally famous that Solana and different tokens are gaining traction on the earth of decentralized finance (DeFi) and non-fungible tokens (NFTs).

JP Morgan appeared on the prospects for main crypto trade Coinbase final month. The agency anticipates that the upcoming Shanghai replace for Ethereum “could usher in a new era of staking.”

Overall, the e-Trading Edit report highlights the growing significance of AI and machine studying in shaping the long run of buying and selling, whereas merchants stay cautious concerning the future of crypto. Regardless of the challenges forward, the report notes that merchants are unanimous of their perception that digital buying and selling will proceed to develop.

Disclaimer

BeInCrypto has reached out to firm or particular person concerned within the story to get an official assertion concerning the latest developments, but it surely has but to listen to again.