The variety of Ethereum tokens locked in liquid staking derivatives protocols has surpassed seven million, based on knowledge from Defillama.

Currently, the full worth of belongings locked on these platforms stands at practically $12 billion. The market is dominated by the highest three liquid staking platforms, which management 95% of the market.

Huge Spike in Locked Ethereum

Lido is the largest participant, chargeable for over 70% of the locked ETH, holding over 5 million ETH valued at $8.7 billion. Coinbase is available in second with 1.1 million staked ETH, whereas DeFi protocols RocketPool and Frax Ether cumulatively have round 500,000 ETH staked on their platforms.

The quantity of locked ETH on platforms has risen since Ethereum builders introduced that they might prioritize staked ETH withdrawals within the Shanghai improve. Additionally, the US Securities and Exchange Commission’s costs in opposition to Kraken crypto change have made liquid staking protocols extra enticing to buyers.

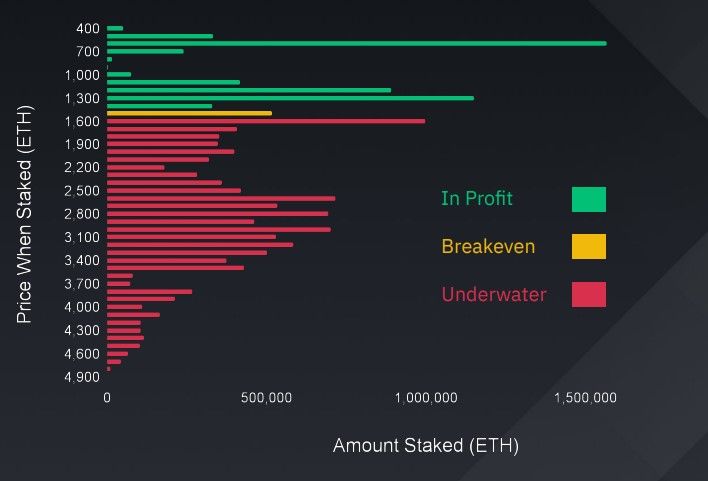

Most ETH Stakers are Underwater

However, the elevated ETH staking exercise over the previous few months has not translated into earnings for buyers. Although greater than 16 million ETH items have been staked, most stakers are presently at a loss.

According to Binance Research, round 69% of ETH stakers are underwater because of having staked their belongings when ETH was buying and selling above $1,600. Binance added that about 2 million ETH have been staked when the digital asset was buying and selling between the $400 to $700 vary in December 2020.

These stakers are possible illiquid since liquid staking was not as well-known on the time. Binance notes that this cohort are “some of the strongest Ethereum believers,” which means they possible wouldn’t promote even when withdrawals change into accessible.

Despite these challenges, Ethereum’s worth has elevated by 42% on a year-to-date foundation. The second-largest cryptocurrency by market cap has risen 11.8% previously seven days and gained 2% within the final 24 hours to commerce at $1,693 as of press time.

Since finishing its transition to a proof-of-stake community, Ethereum’s provide has change into deflationary, with its provide having diminished by over 28,000 ETH, based on knowledge from ultrasound.cash.

Disclaimer

BeInCrypto strives to supply correct and up-to-date info, but it surely won’t be chargeable for any lacking information or inaccurate info. You comply and perceive that it’s best to use any of this info at your individual danger. Cryptocurrencies are extremely risky monetary belongings, so analysis and make your individual monetary selections.