Key Takeaways

Ethereum has retraced by greater than 20% over the previous 4 days.

Meanwhile, almost 193,000 Ethereum has been despatched to crypto exchanges.

Further promoting strain may set off a correction towards $600.

Share this text

Ethereum appears prefer it’s susceptible to a steep correction as crypto’s rocky June attracts to a detailed. Market members are speeding to exchanges to exit their positions, whereas Ethereum is sitting on little to no help.

Ethereum Faces Lower Lows

Ethereum appears primed for a big worth motion as promoting strain accelerates.

The quantity two cryptocurrency has suffered from a worth drop of over 20% over the previous 4 days. It was buying and selling at a neighborhood excessive of $1,280 on Jun. 26 earlier than dipping as low as $1,015. Notably, Ethereum broke beneath the essential $1,000 degree on Jun. 18, and the losses may prolong additional as downward strain seems to be on the rise.

On-chain information from Glassnode reveals that the variety of Ethereum held on identified cryptocurrency change wallets has considerably elevated. Nearly 193,000 ETH price roughly $200 million has flowed into buying and selling platforms since Jun. 26. The spike within the stability held on exchanges coincides with the latest downward worth motion, hinting at a sell-off.

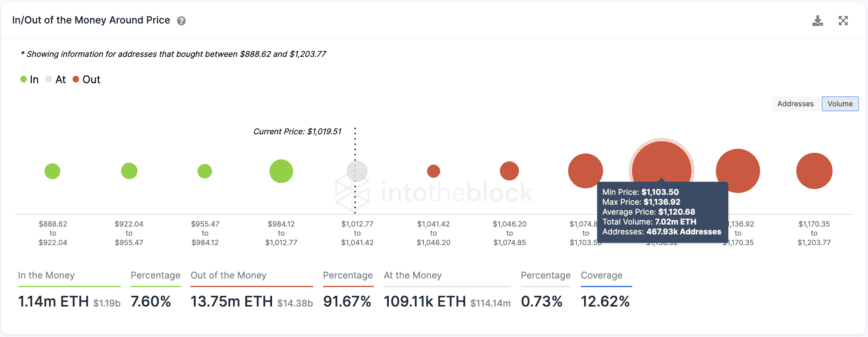

Moreover, transaction historical past reveals that Ethereum lacks the demand it wants to stop additional losses. Ethereum’s subsequent important help degree is at $600, the place 12.8 million addresses maintain 9.55 million ETH. This curiosity zone is essential as market members could promote their holdings in a bid to stop their investments from going “Out of the Money.”

The most crucial resistance degree for Ethereum is at present at $1,120, the place 468,000 addresses have beforehand bought over 7 million ETH. A every day candlestick shut above this hurdle may invalidate the pessimistic outlook, probably main to a surge to $1,300 and even $1,500.

Disclosure: At the time of writing, the creator of this characteristic owned BTC and ETH.

For extra key market developments, subscribe to our YouTube channel and get weekly updates from our lead bitcoin analyst Nathan Batchelor.

Share this text

The data on or accessed by way of this web site is obtained from unbiased sources we consider to be correct and dependable, however Decentral Media, Inc. makes no illustration or guarantee as to the timeliness, completeness, or accuracy of any data on or accessed by way of this web site. Decentral Media, Inc. isn’t an funding advisor. We don’t give personalised funding recommendation or different monetary recommendation. The data on this web site is topic to change with out discover. Some or all the data on this web site could grow to be outdated, or it might be or grow to be incomplete or inaccurate. We could, however will not be obligated to, replace any outdated, incomplete, or inaccurate data.

You ought to by no means make an funding resolution on an ICO, IEO, or different funding based mostly on the data on this web site, and it is best to by no means interpret or in any other case depend on any of the data on this web site as funding recommendation. We strongly advocate that you simply seek the advice of a licensed funding advisor or different certified monetary skilled if you’re in search of funding recommendation on an ICO, IEO, or different funding. We don’t settle for compensation in any kind for analyzing or reporting on any ICO, IEO, cryptocurrency, foreign money, tokenized gross sales, securities, or commodities.

See full phrases and situations.