The U.S. greenback has been very sturdy in contrast to a myriad of fiat currencies worldwide and this week, the euro dropped under the USD for the second time in 20 years after assembly parity with the greenback in mid-July. The greenback’s current brawniness has resulted in the largest weekly rise since March 2020, in accordance to Commodity Futures Trading Commission (CFTC) knowledge.

US Dollar Rises, Euro Falters — Stocks, Precious Metals, and Cryptos Drop Lower

On Monday, the Dow Jones Industrial Average dropped 400 factors as inflation fears proceed to grip Wall Street. The 4 main inventory indexes — NYSE, Nasdaq, Dow, and S&P 500 — all began off the morning (EST) in crimson in contrast to the positive aspects recorded final week. Gold and silver markets have felt downward stress this week as each valuable metals are down in worth on Monday morning. Furthermore, the international cryptocurrency market capitalization is down 1.4% immediately as properly, and hovering simply above the $1 trillion mark.

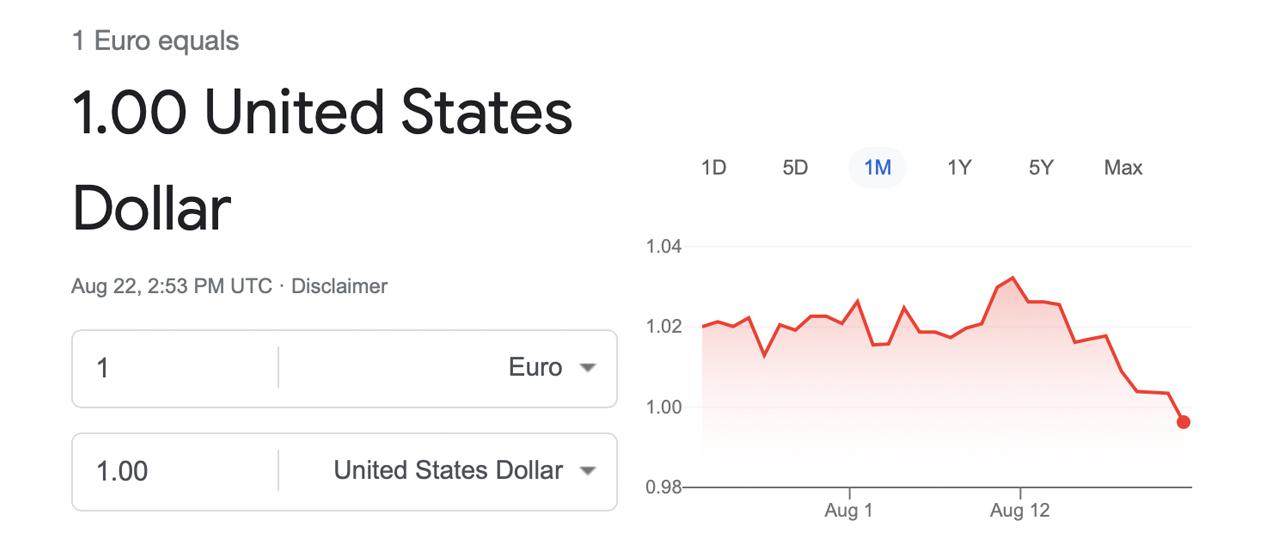

The begin of the week has seen the euro falter under the U.S. greenback for the second time in 20 years. At the time of writing, the two fiat currencies are buying and selling for the very same quantity of worth however the euro slipped down to $0.99 early Monday morning (EST). The euro dropping under and assembly parity with the USD additionally befell on July 12, 2022, when the USD rose to 1.0098. On Monday, August 22, the greenback index (DXY) continues to present power at 108.711.

Reuters studies that the euro’s drop on August 22 is due to an vitality and petroleum disaster Europe has been coping with since the begin of the Ukraine-Russia warfare. Meanwhile, Reuters additionally crunched knowledge stemming from the CFTC and the numbers present the “U.S. dollar net longs hit highest since early March 2020.” Many imagine so long as the warfare persists and the Federal Reserve continues rate of interest hikes and financial tightening, the dollar will stay sturdy.

China’s Real Estate Mayhem Causes Central Bank to Slash Rates Amid US Federal Funds Rate Hike Fears

In addition to the sturdy greenback and the warfare in Europe, China’s financial system has been coping with a significant actual property disaster. Earlier this week the mega theater chain in China Cineworld, has proven indicators of monetary weak spot and it was speculated that the firm was close to chapter. On Monday, China’s central financial institution minimize the benchmark lending fee and the mortgage reference fee to ease the financial system’s pressures.

With the sturdy greenback, Wall Street’s primary indexes in the crimson, gold and silver down, and the crypto financial system floundering, studies point out that the concern stems from the Federal Reserve’s subsequent fee hike. However, after the U.S. central financial institution raised the federal funds fee by 75 foundation factors (bps) final month, estimates gathered by Reuters say the Fed could also be softer this month.

“The U.S. Federal Reserve will raise rates by 50 basis points in September amid expectations inflation has peaked and growing recession worries, according to economists in a Reuters poll,” the report detailed.

What do you consider the U.S. greenback’s power and the euro dropping under the USD’s worth? What do you consider the macroeconomic points plaguing immediately’s monetary markets? Let us know what you consider this topic in the feedback part under.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the firm nor the writer is accountable, straight or not directly, for any harm or loss induced or alleged to be attributable to or in reference to the use of or reliance on any content material, items or providers talked about in this text.