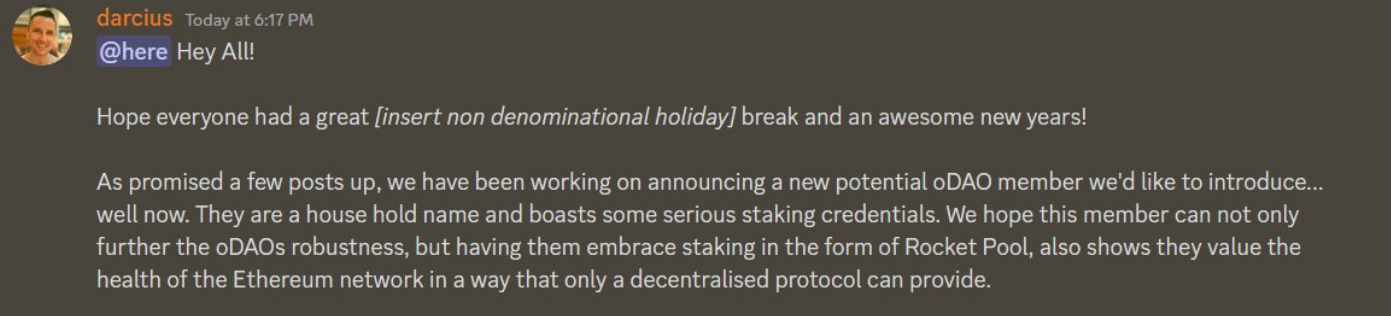

Rocket Pool, the third largest Ethereum liquid staking protocol by commerce worth locked (TVL), has joined forces with Coinbase Ventures. According to an announcement on Rocket Pool’s discord channel, Coinbase Ventures might be becoming a member of Rocket Pool’s Oracle DAO (oDAO).

Rocket Pool is ruled by two decentralized autonomous organizations (DAOs), with the oDAO tasked with the accountability of operating Rocket Pool’s ETH staking nodes and voting on upgrades to Rocket Pool’s sensible contracts. Members of the oDAO are compensated with Rocket Pool’s governance and utility token RPL.

Partnership Tipped to Boost Rocket Pool

Analysts suppose that the brand new partnership might assist Rocket Pool achieve floor on the present market chief in ETH liquid staking, Lido. According to DeFi Llama, Lido at present has 4.88 million ETH tokens staked through its platform. That compares to simply beneath 360K staked through Rocket Pool.

Coinbase Ventures is the enterprise capital arm of Coinbase, the most important US-based cryptocurrency change. Coinbase is itself the second largest supplier of ETH liquid staking providers, with 1.042 million ETH tokens at present wrapped.

That’s why analysts suppose the partnership might assist Rocket Pool topple Lido as the highest ETH liquid staking service. “Coinbase is a household name and having their engineers securing data gives the protocol legitimacy to some institutions,” mentioned pseudonymous Rocket Pool neighborhood advocate Jasper. “Further, the whole ecosystem is getting a boost”, he added.

It is price noting that, in response to DeFi Llama, Lido nonetheless presents essentially the most enticing ETH staking yield of 5.0% versus Rocket Pool’s 4.43%. Unless Rocket Pool can shut this hole in yield, they might have a powerful time closing the hole in TVL.

That might not matter to crypto buyers who take a extra hard-line view on decentralization. Rocket Pool is seen by many within the crypto area as essentially the most decentralized supplier of ETH liquid staking providers, owing to its decentralized governance construction.

In wake of the partnership, with the latest collapse of FTX the newest reminder of the dangers of crypto centralization, and with the upcoming Ethereum Shanghai improve in March anticipated to permit staked ETH withdrawals for the primary time, Rocket Pool is tipped to carry out properly within the coming months.

But some members of the Rocket Pool neighborhood expressed concern about how the affect of a distinguished centralized crypto entity (Coinbase) would have an effect on the oDAO’s governance.

RPL Surges to Multi-month Highs

RPL, Rocket Pool’s utility and governance token, has been rallying in latest periods. RPL was final altering palms slightly below $32 per token, with month-to-month good points at present round 65%. Traders are eyeing a potential check of pre-Ethereum merge highs close to $44 within the coming weeks.

The information of the partnership with Coinbase Ventures has clearly given costs a increase, whereas the aforementioned upcoming Ethereum improve that may unlock staked ETH withdrawals on the finish of Q1 can also be giving costs a increase.

If the broader cryptocurrency markets rally continues on bets that easing US inflationary pressures and slowing progress will allow to US Federal Reserve to chop rates of interest later this 12 months, then RPL will probably proceed its latest path larger.

RPL’s technical outlook is actually wanting good. The cryptocurrency stays in an aggressive uptrend for the reason that begin of the 12 months and lately loved a “golden cross”. This is the place the 50-Day Moving Average crosses above the 200DMA, an indicator some merchants see as bullish.