Bitcoin’s issue decreased 0.49% on Feb. 12, 2023, following a sustained all-time excessive of 39.35 trillion over the earlier two weeks (2,016 blocks). The lower in issue gives a quick respite for bitcoin miners, after the community recorded a 14.94% improve in the final month.

Bitcoin Difficulty Drops 0.49% Lower; Top Five Mining Pools Continue to Command Majority of Global Hashrate

At the time of writing, Bitcoin’s hashrate is coasting alongside at 289.14 exahash per second (EH/s) after a 0.49% lower in issue at block top 776,160. The community issue has been working at roughly 39,350,942,467,772 hashes for the previous 2,016 blocks, or two weeks. With the latest 0.49% lower in issue, the community’s issue will now be set at 39.16 trillion hashes for the subsequent two weeks.

Since the most recent issue change, block instances — the intervals between mined blocks — have been 10 minutes, 7 seconds to roughly 11 minutes, 14 seconds in size. Bitcoin’s subsequent issue retarget is scheduled for round Feb. 26, 2023. The common hashrate over the past 2,016 blocks was roughly 280.6 exahash per second (EH/s), and the typical block time for these blocks was 10 minutes, 2 seconds.

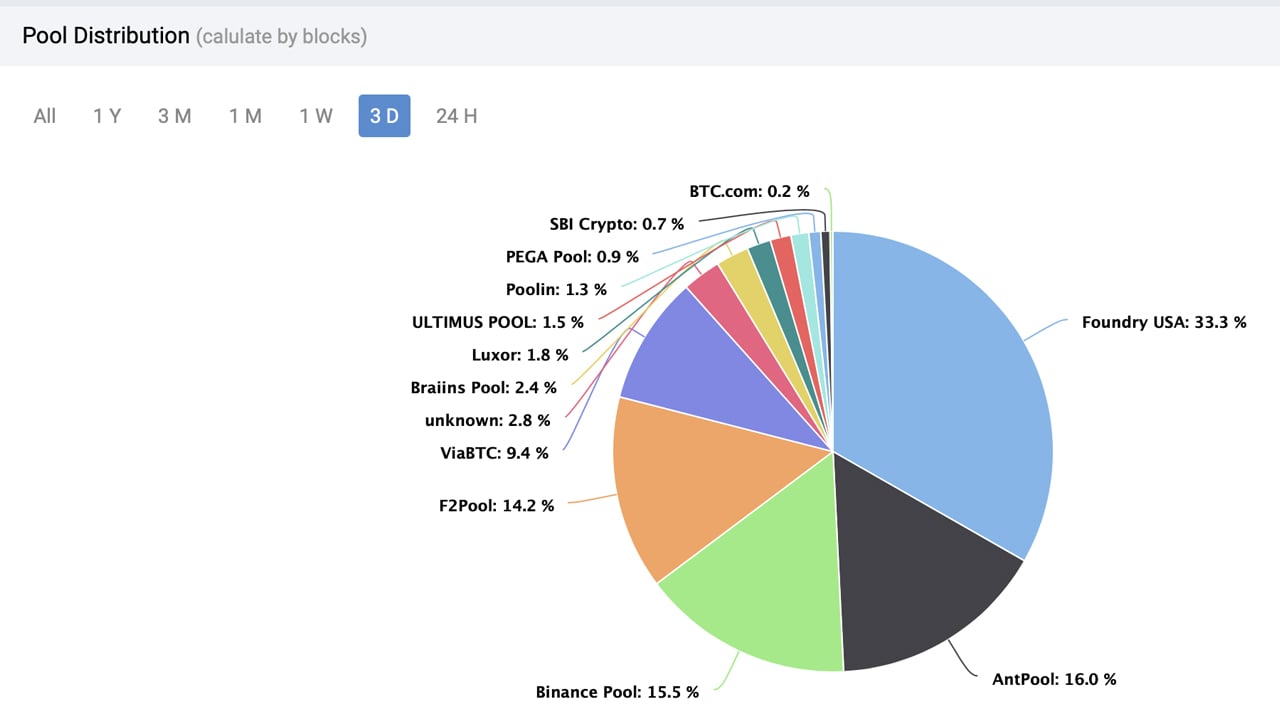

During the previous three days, Foundry USA has been the highest mining pool with 33.26% of the worldwide hashrate, or roughly 95.89 exahash per second (EH/s) of hashpower. Foundry is adopted by Antpool with 15.97% of the worldwide hashrate and Binance Pool with 15.54% of computational energy. F2pool (14.22%) and Viabtc (9.41%) are subsequent, respectively. There are roughly 12 identified mining swimming pools immediately, and the highest 5 management 88.4% of the worldwide hashrate.

According to macromicro.me statistics, the price of producing bitcoin (BTC) stays increased than its present spot market worth. Macromicro.me calculates its estimates based mostly on knowledge on electrical energy consumption and each day bitcoin issuance supplied by Cambridge University. Currently, the typical value of mining a single bitcoin is round $24,119, whereas its spot market worth is roughly $21,901 per unit.

What impression will the latest lower in issue have on the way forward for Bitcoin mining and the distribution of hashpower amongst mining swimming pools over the subsequent two weeks? Share your ideas in the feedback beneath.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational functions solely. It just isn’t a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any harm or loss brought about or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about in this text.