The newest Bitcoin (BTC) worth pump, which has seen the world’s largest cryptocurrency rally into the mid-$30,000s per token, has obliterated hundreds of thousands price of brief positions.

Indeed, in the final two days, $107 million price of Bitcoin futures brief positions have been liquidated throughout main cryptocurrency exchanges, in accordance to crypto derivatives analytics web site CoinGlass.

Around $60 million in brief place have been liquidated on Tuesday alone, the highest every day tally since the sixteenth of March.

A separate chart introduced by CoinGlass reveals that bulls are gaining the higher hand when it comes to demand for Bitcoin futures leverage.

The Bitcoin futures leverage funding price just lately rose to 0.03% on decentralized cryptocurrency derivatives trade dYdX, its highest stage since the finish of March.

A constructive funding price implies that merchants opening leveraged lengthy positions are paying funding to these opening leveraged brief positions, indicative of a better diploma of demand for the latter place quite than the former.

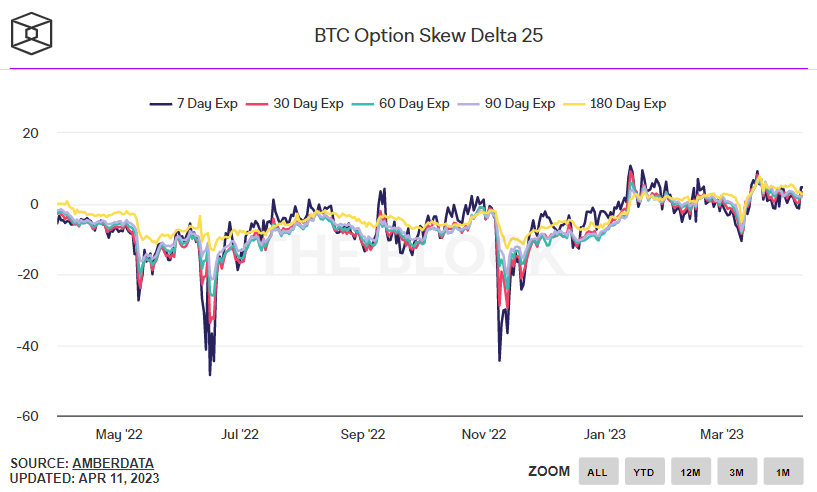

Bitcoin choices markets additionally level to a bullish lean.

According to knowledge introduced by The Block, the 25% delta skew of Bitcoin choices expiring in 7, 30, 60, 90 and 180 days are all above zero and never far beneath their highest ranges for the 12 months.

A skew of above zero means that buyers are paying a premium for bullish name choices versus their mirror reverse name choice counterparts.

This is the Key BTC Price Target to Watch

The newest Bitcoin worth pump seems to have been catalyzed by short-term technical developments, together with the latest breakout from a multi-week pennant formation.

Other technical observations such as 1) the incontrovertible fact that BTC had regularly discovered help at its 21DMA in latest days, 2) all the main transferring averages are transferring larger in ascending order, 3) the latest sturdy bounce from the 200DMA halfway by way of March and 4) the “golden cross” from early February all add to the the reason why the BTC worth has been pushing larger.

While the danger of profit-taking is rising in wake of the 14-Day Relative Strength Index (RSI) rising again into “over-bought” territory, bulls will now have their sights set on the subsequent main bullish goal in the $32,500 space.

These are the highs from late May 2022 and likewise roughly coincide with the January 2022 lows.

Will Macro Spoil the Party?

Bitcoin’s sturdy begin to the week comes forward of the launch of a barrage of key US knowledge factors on Wednesday, Thursday and Friday.

Those embody the newest Consumer and Producer Price Index experiences, the newest Retail Sales report and the preliminary model of the April University of Michigan Consumer Sentiment survey.

These knowledge releases, alongside the launch on Wednesday of the minutes from the newest FOMC assembly of Fed policymakers, might considerably alter expectations relating to US progress and the Fed’s rate of interest outlook.

That might affect crypto costs in a giant manner.

If this week’s knowledge pushes again towards the narrative that the Fed will begin a rate-cutting cycle later this 12 months (i.e. if inflation knowledge is hotter than anticipated and different knowledge reveals the US shopper to nonetheless be in good condition), this might push up the US greenback and US yields and weigh on Bitcoin, probably sending it sharply again below $30,000.

On the different hand, if this week’s knowledge reveals that 1) inflation continues to fall quickly and a couple of) {that a} US recession later this 12 months is getting more and more doubtless, this might help Bitcoin, if it triggers recent weak point in the US greenback and yields.