Founder and CEO of crypto alternate Gemini, Cameron Winklevoss, is once more threatening to sue Digital Currency Group (DCG) and its CEO Barry Silbert over delays in resolving the problem of funds owed to Gemini by bankrupt lender Genesis, slamming the CEO for allegedly making an attempt to play the sufferer card.

In the July 4 “Open Letter to Barry Silbert,” Winklevoss alleged the DCG enterprise had engaged in “fraudulent behavior” by way of a “culture of lies and deceit” — coming on the expense of Gemini’s 232,000 Earn customers.

Earn Update: An Open Letter to @BarrySilbert pic.twitter.com/ErsYpcEjQD

— Cameron Winklevoss (@cameron) July 4, 2023

Among the accusations in Winklevoss’ strongly-worded letter is that Silbert deliberately delayed decision via “abuse” of the mediation course of. The letter states:

“Mediation has given DCG an indefinite forbearance on the $630 million it owes Genesis — for free.“

Most disturbing, according to Winklevoss, has been Silbert’s apparent claim of being the “victim” within the debacle.

“It takes a special kind of person to owe $3.3 billion dollars to hundreds of thousands of people and believe, or at least pretend to believe, that they are some kind of victim,” stated Winklevoss, including:

“Not even Sam Bankman-Fried was capable of such delusion.”

DCG’s Genesis was the lender behind Gemini’s Earn program, which promised returns as excessive as 8% to depositors. However, on Nov. 16, 2022, Genesis introduced it briefly suspended withdrawals, citing “unprecedented market turmoil.”

Genesis later filed for chapter on Jan. 19, 2023, with Gemini looking for to get well its share of the billions owed by Genesis to collectors since.

However, after what Winklevoss has described as a number of delays, he seems to have had sufficient.

“I write to inform you that your games are over,” Winklevoss stated, explaining that skilled charges have now “ballooned” to over $100 million on the expense of credit and Earn customers. “Enough is enough.”

Winklevoss has given Silbert an ultimatum, settle for his agency’s “best and final offer” by 4 pm Eastern Time on July 6 — or face a lawsuit on July 7.

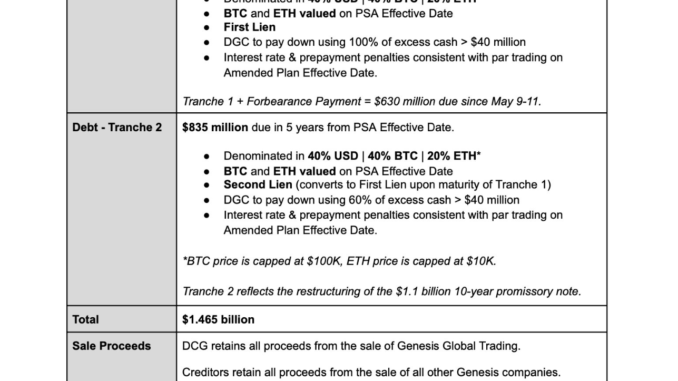

The supply pitched calls on DCG to make a $275 million cost by July 21, an extra $355 million earlier than July 21, 2025, and a closing cost of $835 million by July 21, 2028 — 5 years from the “Plan Support Agreement” date proposed by Winklevoss.

The whole cost will come to $1.47 billion.

Related: Gemini, Genesis file to dismiss SEC lawsuit in opposition to Earn product

Winklevoss desires the funds to be made within the type of Bitcoin (BTC), Ether (ETH) and the United States greenback, with the funds sourced from Genesis Global Trading, potential payouts from FTX and Alameda Research’s chapter estates, along with Avalanche (AVAX) and Near (NEAR) tokens that it could have a declare to from the Three Arrows Capital’s chapter property.

Cointelegraph reached out to DCG for remark however didn’t obtain an instantaneous response.

Magazine: Unstablecoins: Depegging, financial institution runs and different dangers loom