The previous year has actually been an additional excellent year for the cryptoasset market, with bitcoin (BTC) having virtually increased in price year-to-date, and the complete crypto market capitalization raising from simply over USD 750bn to virtually USD 3trn.

For bitcoin’s component, the price gains this year were sustained by significant advancements like El Salvador ending up being the very first nation to make the cryptocurrency lawful tender, and electrical auto manufacturer Tesla ending up being the most significant business until now to include bitcoin to its annual report.

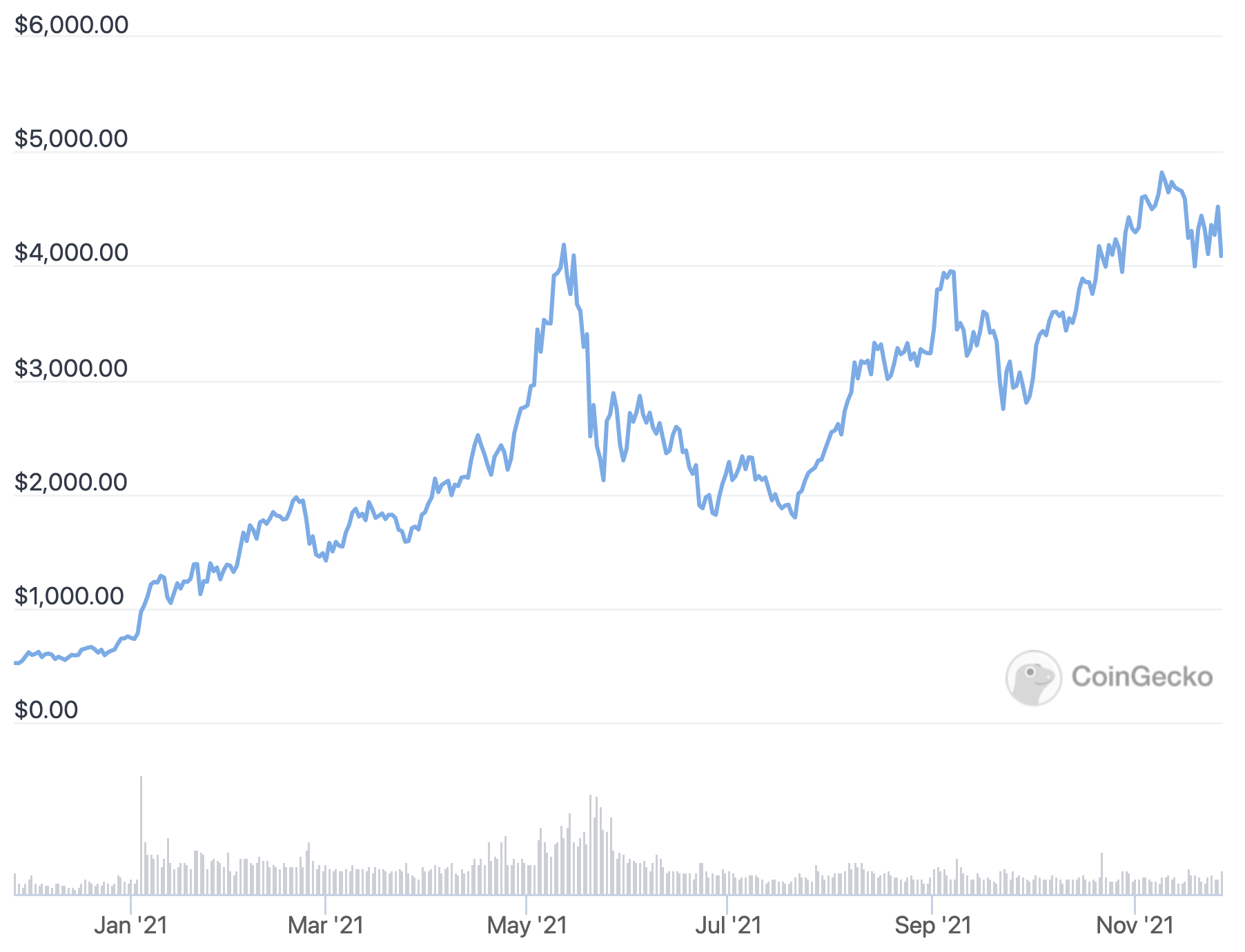

Similarly, ethereum (ETH) likewise saw significant favorable advancements this year, with the execution of the EIP-1559 upgrade which for the very first time presented a supply-reducing token melt system, probably being one of the most vital one.

And while 2021 was a fantastic year, 2022 might end up also far better for the crypto market, according to some experts Cryptonews.com has actually spoken to. However, customarily, viewpoints differ hugely.

To provide a concept concerning what to anticipate for 2022, we connected to a variety of crypto market gamers to hear their price predictions for BTC and ETH in 2022.

(At the moment of composing, BTC trades at around USD 56,250 and is down 11% in a month, cutting its gains over the previous twelve month to much less than 193%. ETH rises and fall around USD 4,500 and is down by virtually 2% in a month. It rallied by 656% in a year.)

Bitcoin price predictions for 2022

Although the previous year never has actually been smooth cruising for bitcoin owners, with both sharp rallies and deep modifications seen throughout the year, every one of the commenters were hopeful concerning its price for the following year.

“My prediction is that it will continue to be volatile, however the long-term trend will point upwards and it is going to more than double in terms of total market cap per annum on average,” Kjetil Hove Pettersen, CHIEF EXECUTIVE OFFICER of Norwegian Bitcoin miner Kryptovault, claimed, including:

“I expect a sharp increase short-term, in 2022 we may see 140k USD or higher.”

However, Pettersen likewise emphasized that it is “impossible to predict with any accuracy” where the price could go, and that technological evaluation will certainly not always function when exterior elements enter into play.

“[…] there are so many factors and external influences in play which makes it difficult to apply traditional [technical analysis] or historical comparisons,” the Bitcoin miner claimed.

Meanwhile, Bernardo Schucman, Senior Vice President of Bitcoin miner CleanSpark’s Digital Currency Division, was likewise hopeful concerning the top cryptocurrency over the following year.

“I believe in 250K USD per BTC at the end of 2022 based on the huge number of Bitcoin mining companies that were founded in the United States in 2021,” Schucman anticipated.

He included that these brand-new miners are not just raising the hashrate, or the computational power of the Bitcoin network, yet that they are likewise “strong holders of the asset.”

“The last, but very important, key factor to maximize the BTC price increase will be bigger adoption of the use of the BTC wallets implemented in social media, such as Twitter,” Schucman additionally claimed, keeping in mind that Bitcoin’s Lightning Network will certainly provide “a great push for BTC mass adoption.”

Most favorable amongst the specialists we spoke with concerning the following year was Julian Liniger, CHIEF EXECUTIVE OFFICER of Switzerland-based bitcoin broker Relai, that claimed we might will see BTC fostering required to an entire brand-new degree in 2022.

“Individuals, companies and now even countries start to adopt bitcoin more and more and inflation of fiat currencies is on the rise,” Liniger informed Cryptonews.com. He included that the everyday price swings in bitcoin “went from hundreds to thousands to tens of thousands, and will end up in the hundreds of thousands of USD in 2022.”

And if Relai’a chief executive officer is right, the following year is looking incredibly favorable for the top cryptocurrency:

“I think 2022 will be the year bitcoin reaches 500K USD,” Liniger approximated.

Others were likewise hopeful concerning the following year, although much less so than the Relai chief executive officer’s incredibly favorable phone call.

As anticipated by the prominent independent bitcoin on-chain and technological expert Matthew Hyland in very early November, bitcoin might strike USD 250,000 as quickly as in January 2022, although this would certainly need a big and quick rise where the cryptocurrency stands currently.

Hyland warranted his soaring price target by claiming that we have actually not yet seen ecstasy like we saw in 2017 in the present market cycle, clarifying that this ought to be seen in “the final part of a bubble.”

“I predict euphoria will begin when bitcoin breaks USD 100,000,” Hyland composed on Twitter right before the marketplace started remedying reduced in late November.

Lastly, Simon Peters, a crypto expert at the foreign exchange and crypto trading system eToro, did not offer a strong price target, yet claimed the bitcoin price usually focuses on the block benefit cutting in half every 4 years.

“We saw a bull market in 2013, 2017 and we’re seeing it now in 2021. However, where we saw parabolic price increases towards the latter end of the 2013 and 2017 bull markets, we haven’t yet seen it this year, which suggests there could be further price increases to come before we reach the ultimate top,” the expert claimed.

Ethereum price predictions for 2022

Like bitcoin, ethereum has actually likewise seen its reasonable share of bullishness in 2021.

However, the second-most useful cryptoasset is understood to be much more unstable than bitcoin, and according to several of the experts we talked to, it is likewise harder to anticipate. As such, less commenters wanted to provide strong price targets on ETH.

“I dare not speculate” where the price of ethereum is entering 2022, Kryptovault’s Kjetil Hove Pettersen claimed, while likewise stressing that it will likely be “even more volatile than bitcoin.”

“It is possible that it will outperform bitcoin, but there is also a lot more risk associated with it, just like with every altcoin,” Kryptovault’s chief executive officer claimed.

On a comparable note, eToro’s crypto expert Simon Peters claimed that ETH might see greater costs as a result of a mix of raised need and much less supply, although he was not happy to provide a company target.

Demand from both organizations and retail financiers looking for alternate financial investments, integrated with a “supply tapering and slowdown of new ETH coming into circulation” as a result of EIP-1559 might bring about “a potential price increase” for ETH, the expert claimed.

He included that even more of the existing supply of ETH is currently secured laying agreements. This is available in enhancement to the supply that is currently secured in decentralized money (DeFi) applications, and a decreasing supply of ETH on exchanges, the expert clarified.

Among those that attempted to provide an extra details target was CleanSpark’s Bernardo Schucman, that anticipated that development in DeFi and a basic pattern in the direction of even more tokenization would certainly press the possession to brand-new highs in 2022.

ETH “will move towards 20K USD because of the great number of new DeFi and tokenization projects that are catching on in the ecosystem,” Schucman claimed.

Lastly, Bloomberg’s Senior Commodity Strategist Mike McGlone likewise has an instead obscure forecast for ETH, claiming in a November crypto market record that it “appears on track for USD 5,000, with support around USD 4,000,” albeit with an undefined duration.

The forecast last month complies with favorable remarks from the expert in September’s crypto expectation, where he claimed that ETH is “gaining traction” in the middle of “diminishing supply” and raising need.

____Learn much more: – ‘Failing’ S2F Model Refuels Debate on Bitcoin Price Model’s Usefulness- 2022 Crypto Regulation Trends: Focus on DeFi, Stablecoins, NFTs, and More

– Watch: CryptoBirb on Trends in Crypto Trading, His Exit Strategy, Bear Market, and More- Watch: Tone Vays on Bitcoin Narratives, Bear Market, DeFi, NFTs, and Ethereum

– Crypto Investment Trends in 2022: Brace for More Institutions and Meme Manias- Crypto Adoption in 2022: What to Expect?

– ‘Paper Money’ Hits All-Time Low Against Bitcoin & Other Hard Assets – Pantera’s chief executive officer- Altcoins in for a Bumper 2022 as Number of Crypto Traders Set to Double – Report

– Mt. Gox Payouts Nearing, But Is the Market Ready for It?- Huge Differences Seen in Banks’ Ethereum Valuation as ETH Tests All-Time High

– USD 20,000 Weekly Moves in Bitcoin’s Price Likely This Year, Author Says- ‘Extreme Volatility’ Expected as Bitcoin Investors Learn to Value It