Over the last thirty days, Bitcoin’s hashrate has actually been drifting along at the highest degree ever before videotaped throughout the network’s life time. Bitcoin’s price enhanced lately yet it is still down 38% from the crypto possession’s high, making bitcoin much less lucrative to mine. However, bitcoin mining is still lucrative, in comparison to 10 years earlier, when the leading crypto possession’s worth crashed below the cost of production.

Bitcoin’s Price Is 38% Lower Than It’s All-Time High, Bitcoin Miners Still Profit

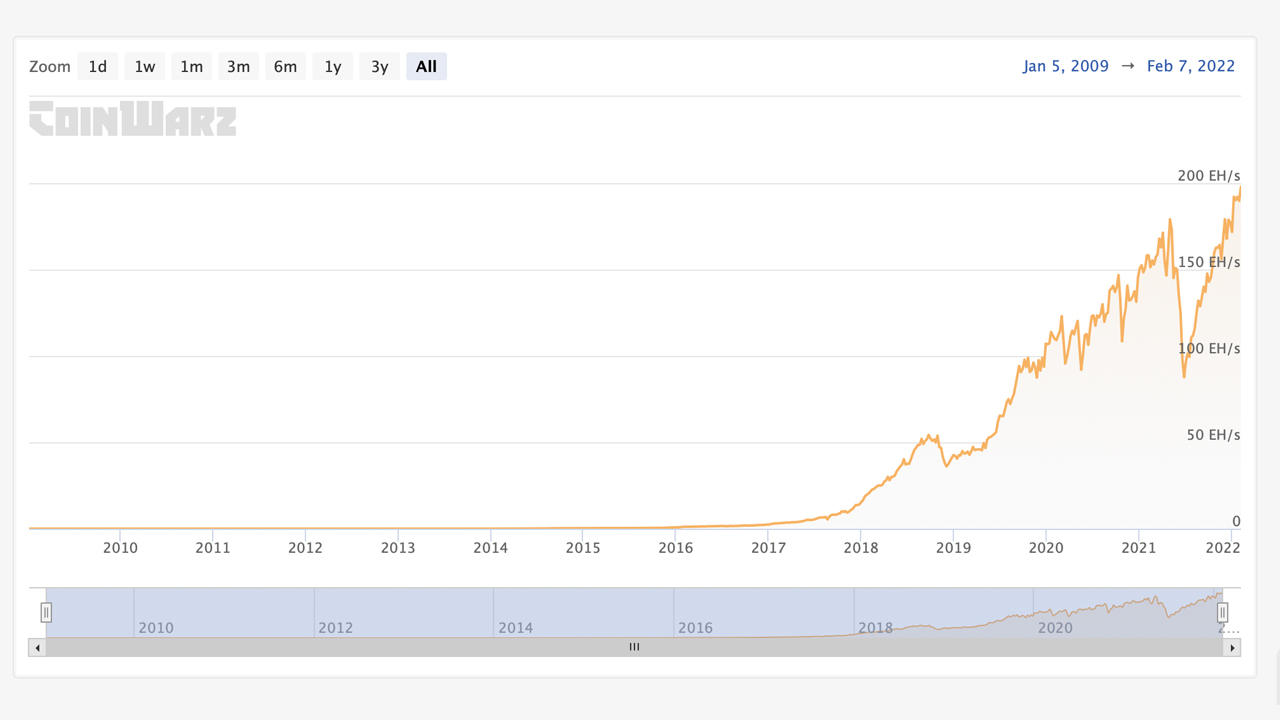

While bitcoin’s price worth has actually climbed up rather high versus the U.S. buck throughout the last 13 years, the network’s hashrate has actually additionally climbed to all-time highs. Today, the hashrate is drifting along over 2 hundred quintillion hashes per 2nd (H/s) which is a great deal more powerful than the Bitcoin network’s hashrate got on January 5, 2009. On that day, stats reveal that 9 hundred forty-eight thousand H/s was committed to the method’s safety and security. Calculations program Bitcoin’s hashrate has actually enhanced by twenty-one quadrillion percent — or 21,093,375,098,215,930% — considering that January 5, 2009.

Bitcoin’s hashrate is drifting along at all-time highs, yet the crypto possession’s worth is 38% less than it was 3 months earlier, on November 10, 2021. This consequently has actually made it much less lucrative to mine bitcoin (BTC), yet still lucrative for a good bulk of high-powered mining gears. For circumstances, utilizing today’s BTC currency exchange rate, the Bitmain Antminer S19 Pro with 110 terahash per 2nd (TH/s) will certainly create $16.81 each day if the device’s electric prices are around $0.12 per kilowatt-hour (kWh). SHA256 makers that create at the very least 25 TH/s will certainly still profit utilizing today’s BTC currency exchange rate as well as $0.12 per kWh.

Mid-October, 2011: Bitcoin’s Price Drops Below the Cost of Production

Over 10 years earlier, on October 18, 2011, the cost of a solitary bitcoin dropped below the price to create bitcoin (BTC). It wasn’t the just time this has actually taken place, yet it was one of the very first times the price of bitcoin was claimed to be less than the cost to mine the electronic money. That week in 2011, the network’s hashrate was around 8.596 TH/s or 8,596,000,000,000 hashes per secondly. While the hashrate was a lot less than today, it was still nine-hundred-six million percent (906,593,161.72%) greater in 2011 than on January 5, 2009.

At the time, when BTC’s price dropped below the cost of production, it made worldwide headings. The Guardian’s factor Charles Arthur covered the occurrence on October 18, 2011, when he clarified exactly how BTC’s price crashed from a high of over $30 each to $1-2 per BTC in mid-October. That year, Arthur called BTC a “‘Hackers’ virtual currency and favoured means of exchange.” The Guardian author’s record claimed that BTC’s price “plummeted across exchanges – to a level where it costs more to ‘mine’ them than they are worth.”

Bitcoin’s Value Drops Below Production Cost in 2015, 2018, as well as 2020 — Estimates Say ‘Current Production Cost Is $34K’

About a year after the 2013 price high, BTC’s worth began to near going down below the cost of production once more. During the very first week of December, the network hashrate decreased as well as the CHIEF EXECUTIVE OFFICER of Spondoolies-Tech, Guy Corem, clarified exactly how the crypto possession’s market price was impacting miners at the time. “Under the current bitcoin value, mining gear efficiency of 0.5–0.7 J/GH range and energy cost, we’ll reach equilibrium very soon,” Corem claimed. The cost to extract BTC was apparently greater than they deserved in mid-January 2015 after Corem made those declarations. That month in 2015, the price of bitcoin (BTC) went down below the $200 mark.

According to records in mid-December 2018, BTC’s price was less than production prices once more. At that time in 2018, BTC was altering hands for $3,200 each. Furthermore, on March 12, 2020, typically described as ‘Black Thursday,’ BTC’s price shivered as well as tanked to the mid-$3K array, making it unlucrative for a bulk of the network’s mining individuals. While BTC’s price is 38% less than the all-time high, some think that it is still close to present mining prices. In mid-January of this year, the prominent Twitter account called ‘Venture Founder’ informed his 14,600 social networks fans that “current production cost is $34K.”

Venture Founder additionally stated the crypto possession’s worth collapsing below the cost of production in December 2018 as well as March 2020. “The worst dumps bitcoin ever had were due to miners capitulation (Dec 2018, Mar 2020), when BTC fell below production costs, it is at risk for miner capitulation,” Venture Founder tweeted. “BTC was at risk for miner capitulation at $30K in May. The current production cost is $34K,” he included.

Can Bitcoin’s All-in Sustaining Production Cost Rise?

Knowing precisely what the cost of production is, as well as what a bitcoin miner’s all-in maintaining cost is, would certainly be incredibly difficult to approximate, yet there have actually been several that think there is a number. The abovementioned circumstances defining the times as well as price-points where individuals thought the price of BTC had actually dropped below the cost to mine the crypto possession are an excellent instance of this idea.

For instance, while a miner leverages a 100 TH/s device as well as obtains an everyday earnings for that device of around $16.81 each day with electrical power setting you back $0.12 per kWh, an additional miner can pay $0.06 per kWh. Moreover, one research study released in October 2020 cases that “the cost of bitcoin mining has never really increased.”

What do you consider the reported circumstances where it’s been claimed that the price of bitcoin dropped below the cost of production? What do you consider the approximated $34K present cost of production declaration? Let us understand what you consider this topic in the remarks area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This post is for informative functions just. It is not a straight deal or solicitation of a deal to get or offer, or a referral or recommendation of any kind of items, solutions, or business. Bitcoin.com does not supply financial investment, tax obligation, lawful, or accountancy suggestions. Neither the firm neither the writer is accountable, straight or indirectly, for any kind of damages or loss created or affirmed to be brought on by or about the usage of or dependence on any kind of material, items or solutions stated in this post.