As one more week concerns a enclose this active macroeconomic environment, allow’s take a consider exactly how the globe of cryptocurrency looks, prior to all of us take a breath over the weekend break.

Key Points

Bitcoin web discharges from exchanges breach $1 billion for the week

Tuesday sees greatest day-to-day discharges in ETH because October

Moderate uptick in brand-new and energetic addresses for Bitcoin

Bitcoin

Net Flows

Data by means of IntoTheBlock

A wonderful landmark for Bitcoin today, as web discharges from exchanges breached the billion buck mark, as shown on above chart. One of the best indications of belief, a web discharge from exchanges usually suggests buildup, while a web inflow signals marketing stress.

Volatility

Price-smart, we “closed” last Friday at $39,200, while presently we rest at $40,700. Looking at volatility, the 30-day annualised conventional discrepancy continued to be fairly steady at circa 63%. This is revealed on the listed below chart, however if we intend to equate these numbers to basic English, we can just claim that today Bitcoin was … cool. As the globe appears to be dropping around it, Bitcoin has actually been really been rather well acted. Who would certainly have assumed?

Data by means of IntoTheBlock

Data by means of IntoTheBlock

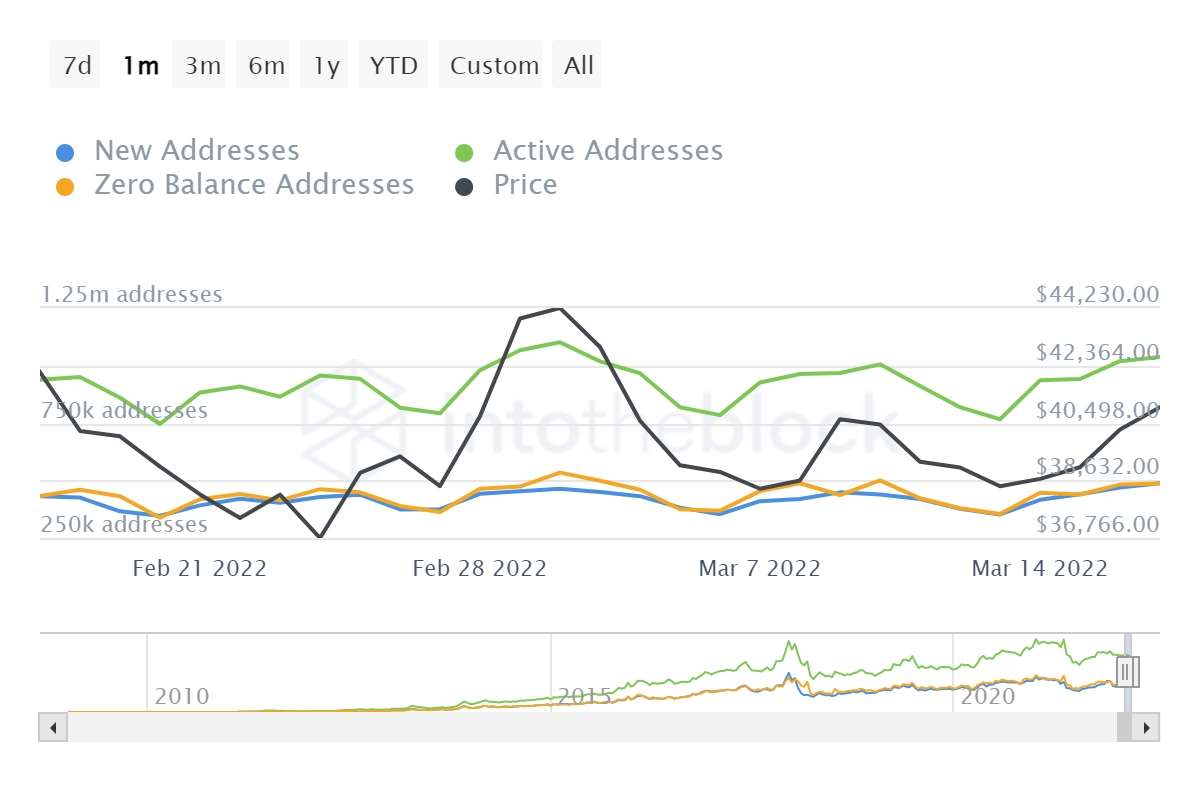

Addresses

Some modest uptick right here as well, with an 11% rise in brand-new addresses because recently. Active addresses were fairly steady (up 3%) and there was a autumn of 2% in zero-balance addresses. All directing, once again, to a constant however unimpressive week for Bitcoin. If just all the weeks resembled this – this must be what it seems like to hold supplies, right? Maybe following week we will certainly obtain some even more motion, aiding to make this item a little bit extra amusing!

Data by means of IntoTheBlock

Data by means of IntoTheBlock

Ethereum

Let’s see if we can jab about with Ethereum a little and reveal any type of patterns.

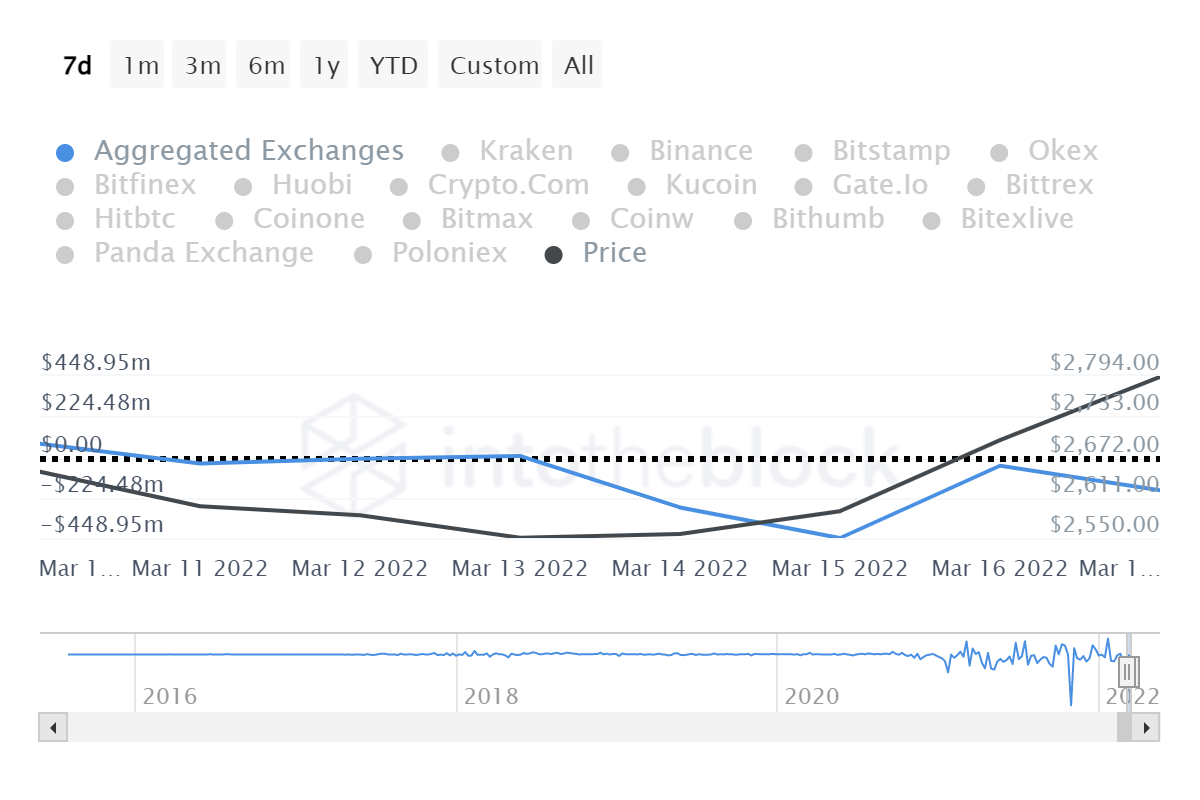

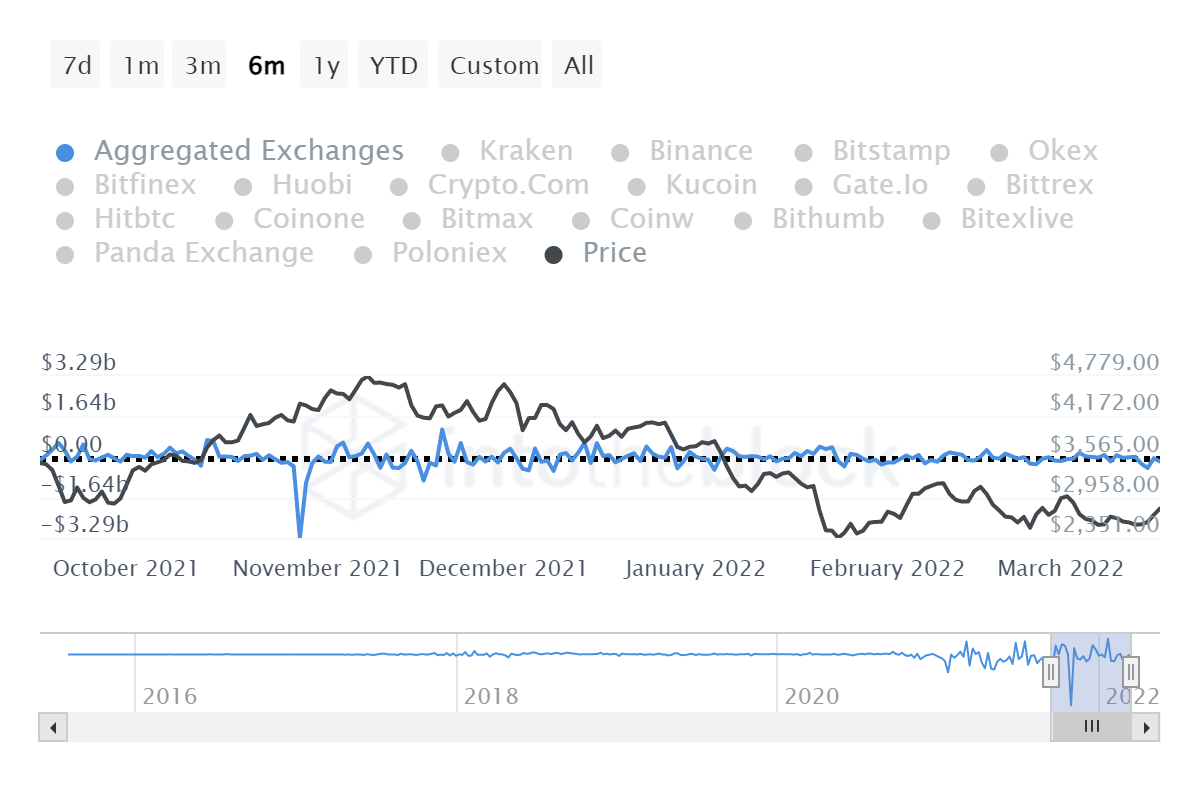

Net Flows

There behaved web quantity right here as well, with near a billion bucks draining of exchanges over the recently. This was buoyed primarily by Wednesday, which saw $448 million in web discharges. For context, in buck terms that’s the 24th biggest day-to-day discharge quantity ever before – and the 2nd biggest this year.

Data by means of IntoTheBlock

Data by means of IntoTheBlock

Precedent

The biggest of 2022, you might be questioning, was January fourth. Known as “Blue Monday”, they claim it’s one of the most dismal day of the year – the go back to function after the vacations. Apparently, individuals settled to their computer systems to withdraw their crypto presents right into their chilly budgets this year. Unfortunately, Ethereum dove 21% in the following 4 days – so allow’s really hope that’s not a signal of what’s ahead right here.

I’m not actually certain just what triggered such a increase this Tuesday, offered the absence of task somewhere else. Maybe, simply possibly, it’s plain old coincidence, huh? Or possibly someone hesitated they would certainly be lured to retrieve their ETH to purchase a lots of Guinness in advance of St Patrick’s Day. I do not recognize.

Denominated in ETH terms, nevertheless, it notes the biggest day-to-day withdrawal because last October, at near 180,000 ETH. In Ocotober, Ethereum did the contrary to January– ramping 14% in simply over a week. Although it’s important to keep in mind that at 750,000 ETH, the withdrawal last October mored than 4X what we saw on Tuesday. The chart listed below highlights the dimension of this relocation contrasted to last October, in addition to the rate activity (black line). So beware with your verdicts.

Data by means of IntoTheBlock

Data by means of IntoTheBlock

Closing Thoughts

So, a rather remarkable bit to shut the week from Ethereum after that. Bitcoin acted, while the crypto markets greatly complied with. A wonderful week without excessive volatility. If just they were all such as this, I believe my heart price would certainly be substantially reduced. Then once again, wouldn’t life be much less enjoyable?

Still, following time we obtain those unsightly red candle light days, I’ll consider weeks such as this with green-eyed envy. In crypto, it might constantly be even worse. Happy Weekend !