Key Takeaways

Arbitrum, an Optimistic Rollup scaling option for Ethereum, has actually effectively introduced for designers.

Layer 2 scaling purposes to lower blockage on the base chain while still gaining from its safety.

Reduced blockage on Ethereum will certainly lower gas costs for each individual, not just the ones utilizing Layer 2.

Share this write-up

Scalability has actually been Ethereum’s most significant difficulty as its appeal increases. One of the secret Layer 2 options wanting to fix the concern, Arbitrum, has actually currently introduced for designers.

The Road to Scaling Ethereum

During the current market accident on May 19, when BTC and also ETH both dropped over 30% in a day, gas costs got to as high as 1,500 gwei. Some DeFi customers reported Uniswap purchases setting you back upwards of $1,000. Miners made a document $110 million throughout the day from gas costs.

The description behind these high costs is straightforward. For a deal to be devoted to Ethereum, the individual has to incentivize miners to consist of the purchase in their block by including an idea. Miners choose the highest possible ideas readily available and also include them in concern in their blocks to guarantee one of the most productivity from their purchases.

Ethereum has a reduced throughput, concentrating on safety and also decentralization over performance. While this wasn’t an especially pushing concern in its very early years, the increase in the cost of ETH and also boosting need for purchases have actually resulted in high buck worths for any type of purchase on the blockchain.

As the above chart programs, purchase costs have actually just recently ended up being the major resource of earnings for miners in advance of the block incentives obtained after every block extracted. The little throughput of the chain and also high need have actually resulted in high gas costs, which have actually driven DeFi customers to various other Layer 1 systems like Binance Smart Chain and also Polygon.

The option to these concerns is to enhance the throughput of the chain. To do so, there are 2 alternatives. One of them is to scale the blockchain’s base layer. This is what Ethereum 2.0 is working with via sharding, which will certainly divide the on-chain work flat in between 64 fragment chains while still gaining from the safety of the whole network.

The 2nd choice is to relocate component of the procedures off-chain, on a 2nd layer improved top of Layer 1, while leveraging its safety. While Ethereum procedures around 15 purchases per 2nd (tx/s), Layer 2 might enhance throughput to 2,000-4,000 tx/s. The greater the throughput, the reduced the gas costs need to be. This is the vision Ethereum creator Vitalik Buterin provided in his Oct. 2020 item ‘A rollup-centric ethereum roadmap,’ which defined the future of the Ethereum chain and also the function rollups might play. He created:

“The Ethereum ecosystem is likely to be all-in on rollups (plus some plasma and channels) as a scaling strategy for the near and mid-term future.”

How Rollups Will Help Ethereum Scale

Layer 2 is a basic term that describes a range of options that aid enhance the capacities of a blockchain by bring purchases off-chain while still maintaining the safety of Layer 1. Examples of scaling options consist of Bitcoin’s Lightning Network. Users secure their funds and also perform any type of variety of professions in between themselves, just requiring one last purchase to be offered to the major chain.

Another sort of option is Plasma, which functions by unloading purchases to youngster chains. Polygon makes use of Plasma. However, the concern with it depends on bringing the funds back to the major chain; a deal can last hrs. Sidechains like xDai are independent, suitable chains that decentralized applications can port their clever agreements onto to ease stress from the major chain.

The scaling option of option for Ethereum is rollups. Rollups can pack countless sidechain purchases with each other right into a solitary purchase that the major chain can validate. If that solitary purchase is proper, it verifies the legitimacy of all the packed purchases with each other.

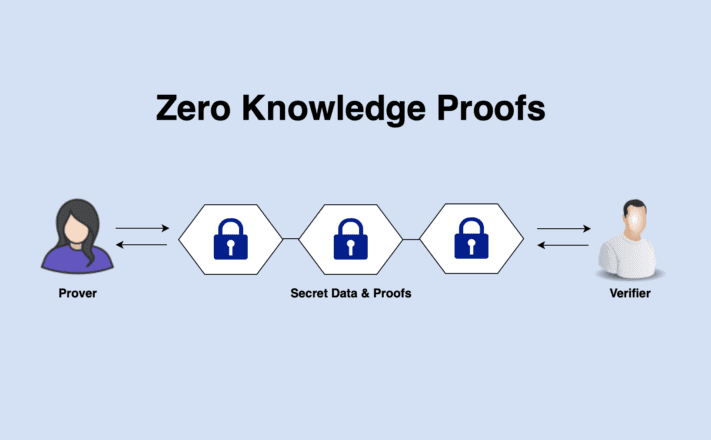

That purchase is a kind of zero-knowledge evidence called a SNARK, which represents “succinct non-interactive argument of knowledge.” A SNARK is a type of evidence where one star can show property of particular details without exposing stated details.

Arbitrum, Optimism, and also Zero-Knowledge

Zero-understanding evidence are one of the most reliable method of scaling Ethereum and also the one Buterin advanced as the most effective choice for the close to mid-term future. Rollups are split right into 2 subcategories, zk-Rollups and also Optimism. While zk-Rollups are quicker, they’re not conveniently suitable with Ethereum clever agreements. Optimistic Rollups like Arbitrum permit decentralized applications to port their clever agreements with extremely marginal adjustments.

In the future, zk-Rollups might be an extra enticing choice for decentralized applications as the modern technology progresses however, in the prompt future, Optimistic Rollups are a lot more reasonable. Two tasks are working with Optimistic Rollups with 2 items that will certainly be fighting for market share in the future: Optimism and also Arbitrum.

Optimism has actually fulfilled some hold-ups in the previous couple of months, pressing the launch day for their public mainnet to July, while Arbitrum releases today.

Uniswap’s very prepared for v3 upgrade introduced a couple of weeks ago with an intended launch on Optimism, however hold-ups have actually led the area to recommend a launch on Arbitrum also. The ballot obtained prevalent assistance, and also Uniswap creator Hayden Adams has actually verified one of the most preferred decentralized exchange would certainly release its clever agreements on Arbitrum.

2/

Assuming the photo passes we mean to sustain the area by releasing the v3 clever agreements to Arbitrum!

We have actually currently started deal with user interface assistance and also intending the release.

— Hayden Adams 🦄 (@haydenzadams) May 26, 2021

An effective Uniswap launch on Arbitrum would certainly bring a high quantity of liquidity to their option contrasted to Optimism. Adams verified that Uniswap V3 would certainly likewise release on Optimism as prepared. Synthetix, Ethereum’s leading artificial possessions procedure, is likewise presently checking a beta variation of Optimism. Arbitrum makes use of ChainWeb link to protect the link in between on-chain clever agreements and also off-chain sources, spending for these solutions with web link symbols.

How Will Arbitrum Benefit Ethereum Users?

DeFi customers will certainly have the ability to trade on the Arbitrum variation of preferred decentralized applications like Uniswap for a couple of cents with faster purchase rate. The effects of the Arbitrum launch don’t quit there. Offloading a substantial quantity of purchase quantity off-chain will certainly have causal sequences on the Ethereum network. At the minute, Uniswap is among the most significant gas customers on the marketplace. If that quantity leaves the major chain, the remainder of the purchase will certainly likewise pay substantially much less in gas costs.

The (modern-day) background of Ethereum translucented gas use: pic.twitter.com/PnZbuke7mp

— Alex Svanevik 🧭 (@ASvanevik) May 26, 2021

The presence of Layer 2 scaling options alleviates stress from the major chain. This advantages gas costs for investors on both sides, reducing purchase costs for every person. It’s crucial to keep in mind that rollups are a complicated and also speculative modern technology, suggesting that the launch of Arbitrum will absolutely not lack concerns. Only web traffic, time, and also strikes will certainly aid produce the best Layer 2 scaling for Ethereum.

Disclaimer: The writer held ETH and also numerous various other cryptocurrencies at the time of creating.

Share this write-up

The details on or accessed via this site is acquired from independent resources our team believe to be precise and also dependable, however Decentral Media, Inc. makes no depiction or guarantee regarding the timeliness, efficiency, or precision of any type of details on or accessed via this site. Decentral Media, Inc. is not a financial investment expert. We do not offer individualized financial investment recommendations or various other monetary recommendations. The details on this site goes through alter without notification. Some or every one of the details on this site might end up being obsolete, or it might be or end up being insufficient or incorrect. We may, however are not obliged to, upgrade any type of obsolete, insufficient, or incorrect details.

You need to never ever make a financial investment choice on an ICO, IEO, or various other financial investment based upon the details on this site, and also you need to never ever translate or otherwise depend on any one of the details on this site as financial investment recommendations. We highly advise that you seek advice from a certified financial investment expert or various other professional monetary specialist if you are looking for financial investment recommendations on an ICO, IEO, or various other financial investment. We do decline payment in any type of kind for examining or reporting on any type of ICO, IEO, cryptocurrency, money, tokenized sales, protections, or assets.

See complete conditions.

Optimistic Rollups Finally Make It to Ethereum, Synthetix Offers Rewar…

Optimism PBC has actually introduced the initial stage of its Layer-2 scaling option for Ethereum. Leading DeFi systems starting with Synthetix Network, Chainlink, and also Uniswap are currently aligning to delight in…

Uniswap to Launch on Layer 2 Solution Arbitrum

A proposition for Uniswap to release on Arbitrum has actually obtained enormous assistance on the procedure’s administration discussion forums today. Following the ballot, Uniswap will release its V3 agreements on the…

What is Kusama? How Polkadot’s play area suits blockchain de…

Kusama is fairly young and also was established in 2019 by Dr. Gavin Wood, that likewise established the Web3 Foundation and also co-founded Ethereum. The group behind Kusama is basically the very same…

Uniswap v3 Is the Perfect Market Maker for Venture Capitalists

Uniswap’s vital function raises the gamification of one of the most preferred DEX. But this is a video game retail doesn’t have the devices to win. Everyone’s a Market Maker on Uniswap After…