The European Union Parliament has handed into legislation its MiCA act, and big-time business participant and CEO of Binance Changpeng Zhao is elevating help following the brand new crypto laws.

EU introduces Markets in Crypto-assets Law, MiCA

The European Union Parliament has handed a invoice into legislation to fight its long-standing battle in opposition to the crypto market.

For a very long time, the crypto business has gone with out laws and has been a priority for a number of regulatory our bodies.

In a bid to curb this menace, a number of regulatory our bodies throughout the EU, the UK, and the US have since continued to clamp down on crypto exchanges and companies.

The MiCA laws ought to come as a welcome growth to many, particularly traders, because the legislation would guarantee crypto exchanges are made liable for losses accrued on their platforms.

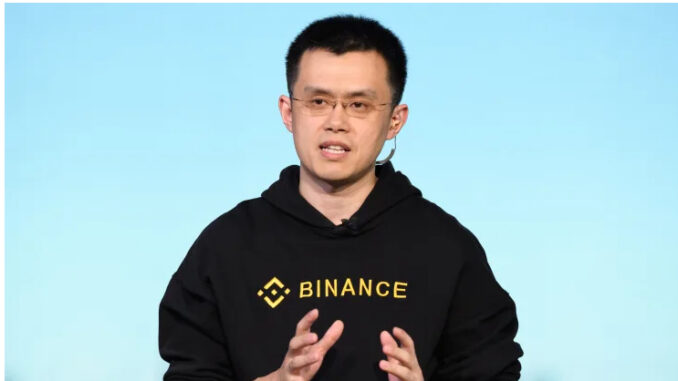

Crypto business Bigwig Changpeng Zhao of Binance trade fame took to Twitter to acknowledge the brand new crypto regulation.

According to CZ, as he’s fondly known as, this new invoice from the European bloc creates tailor-made laws that might higher shield traders as a substitute of outrightly witch-hunting facilitators within the burgeoning business.

“The fine details will matter, but overall, we think this is a pragmatic solution to the challenges we collectively face. There are now clear rules of the game for crypto exchanges to operate in the EU,” he added.

The business chief expressed willingness to make a number of adjustments to the Binance trade’s operational framework over the following 12-18 months to adjust to these newly launched legal guidelines absolutely.

The EU lawmakers voted on Thursday to cross a brand new legislation for Transfer of Funds laws, with 529 in favor, 29 opposed, and 14 abstentions.

There was additionally a vote to cross the Markets in Crypto Assets (MiCA) legislation, which acquired 517 votes in favor, 38 votes in opposition to, and 18 abstentions.

In a tweet, the European Commission’s Mairead McGuinness applauded the initiative by the European lawmakers, describing the transfer as a world first for the crypto house.

It must be famous that these final two classes don’t embrace decentralized finance (DeFi) or non-fungible tokens (NFTs).

MiCA and Its Implications for Crypto

The MiCA goals to guard cryptocurrency transactions, and transfers above €1000 from self-hosted wallets could be traced and even blocked on suspicion.

This rule doesn’t apply to person-to-person transfers that don’t contain a supplier or transfers between suppliers performing on their behalf.

The crypto asset regulation market is considered a major milestone in cryptocurrency, because it establishes a constant algorithm and laws for crypto-related actions throughout the European Union.

This transfer is predicted to deliver readability, stability, and safety to the business and pave the best way for wider adoption and integration into the mainstream monetary system.

The MiCA laws addressed a number of considerations, together with utilizing cryptocurrency for cash laundering and financing terrorism and different crimes.

Another concern raised within the MiCA is the beforehand talked about problems with transparency, disclosure, authorization, and supervision of transactions.

The provision additionally ensures that customers and traders are knowledgeable about their operations’ dangers, prices, fees, and implications.

The MiCA additionally agrees to stringent measures in opposition to manipulating the markets.

The Act additionally addresses the environmental implications of cryptocurrencies, imploring service suppliers to reveal their power consumption and discover various power sources to scale back their carbon footprint.

Big Win as EU Races Ahead of the US in Providing Clarity

Given that the discourse round crypto regulation has been ongoing for years, the European Union’s (EU) latest resolution to supply readability demonstrates the area’s open-handed method to the digital asset economic system.

So far, a number of world governments have outrightly banned something associated to cryptocurrencies whereas embracing the know-how it runs on or offered little readability, making it unimaginable to draw mainstream traders into the house.

One such nation with a reactive method to crypto regulation is the United States which has gone on a clampdown spree because the 12 months started.

After its profitable subpoena of the Ripple blockchain, a number of centralized entities like Gemini, Binance, and Coinbase, amongst others, have come into the crosshairs of federal authorities on the planet’s largest economic system.

The continued lack of readability is presently driving extra companies overseas, with Gemini opening an engineering hub in India.

Coinbase has adopted go well with and is presently lending a hand to the UK’s blockchain division after securing an working license from the Bermuda authorities.