Binance has dedicated $1 billion to a crypto trade restoration initiative to restore confidence following the collapse of crypto alternate FTX. Several different crypto firms have joined Binance’s efforts and dedicated capital for the restoration fund.

Crypto Industry Recovery Initiative Launched

Cryptocurrency alternate Binance unveiled Thursday some particulars of its Industry Recovery Initiative (IRI), which the crypto agency described as “a new co-investment opportunity for organizations eager to support the future of web3.”

The announcement states:

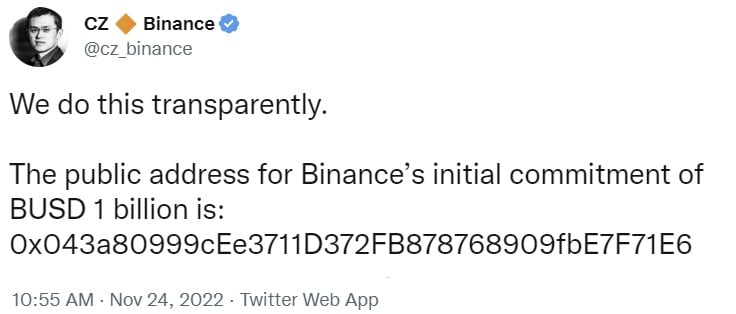

Initially, Binance will commit USD 1 billion to IRI-themed funding alternatives with an intent to ramp up that quantity to USD 2 billion within the close to future if the necessity arises.

“So far, Jump Crypto, Polygon Ventures, Aptos Labs, Animoca Brands, GSR, Kronos, and Brooker Group have also committed to participating with an initial aggregate commitment of around USD 50 million, and we expect more participants to join soon,” Binance added. Each participant has put aside dedicated capital in stablecoins or different tokens.

Binance defined that will probably be in search of tasks characterised by “innovation and long-term value creation,” “a clearly delineated and viable business model,” and “a laser focus on risk management.”

The world crypto alternate famous:

What makes this initiative distinctive is the collaborative strategy to restoring confidence in web3.

The CEO of Binance, Changpeng Zhao (CZ), first revealed that his firm is organising a crypto trade restoration fund final week. The govt defined on the time that the aim of the restoration fund is “to reduce further cascading negative effects of FTX” by serving to tasks that “are otherwise strong, but in a liquidity crisis.” CZ has in contrast the FTX fiasco to the 2008 monetary disaster, warning of “cascading effects.”

FTX filed for Chapter 11 chapter on Nov. 11 and former CEO Sam Bankman-Fried stepped down. The firm is underneath investigation in a number of jurisdictions. In the U.S., quite a few authorities are investigating the alternate for mishandling buyer funds.

Binance defined that the IRI isn’t an funding fund. “We have already received around 150 applications from companies seeking support under the IRI,” the alternate famous, elaborating:

The mandate of this new effort is to assist essentially the most promising and highest high quality firms and tasks constructed by one of the best technologists and entrepreneurs that, via no fault of their very own, are dealing with important, brief time period, monetary difficulties.

The announcement additional particulars that the initiative is anticipated to final about six months and “will be flexible on the investment structure — token, fiat, equity, convertible instruments, debt, credit lines, etc — as we expect individual situations to require tailored solutions.”

What do you consider Binance organising a crypto trade restoration fund? Let us know within the feedback part beneath.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any harm or loss induced or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.