The intersection of politics and finance usually leads to vital market shifts, and the crypto market isn’t any exception. As the United States Congress prepares for a pivotal vote to lift the debt ceiling, Bitcoin and Ethereum register notable fluctuations.

These market modifications define potential implications for the cryptocurrency trade.

Crypto Market Awaits Debt Ceiling Vote

On Wednesday, the crypto market, particularly Bitcoin and Ethereum, encountered a downturn in response to the upcoming vote on the proposal to extend the US debt ceiling, alongside the potential of one other surge in rates of interest by the Federal Reserve as a result of strong labor market knowledge.

Legislation aiming to reinforce the $31.5 trillion US debt ceiling whereas implementing contemporary federal spending cuts progressed to the House of Representatives on Tuesday. The invoice is slated for deliberation and a consequent vote afterward Wednesday.

Should the House approve the laws, it could proceed to the Senate, the place discussions would possibly prolong into the weekend, with the June 5 deadline swiftly approaching.

“Although indicators suggest that the agreement will eventually pass, there are some rumblings from Congress members who express opposition. Until the agreement is finalized, an air of uncertainty will persist,” commented Joe Saluzzi, co-manager of buying and selling at Themis Trading.

April’s knowledge revealed an unanticipated uptick in US job vacancies, indicating continued vigor within the labor market that would doubtlessly immediate the Federal Reserve to implement one other rate of interest hike in June.

“I think the Fed is going to have to decide between two policy mistakes: hit the brakes too hard and risk a recession or tap the brakes in a stop-go pattern… And risk having inflation well into 2023,” mentioned economist Mohamed El-Erian.

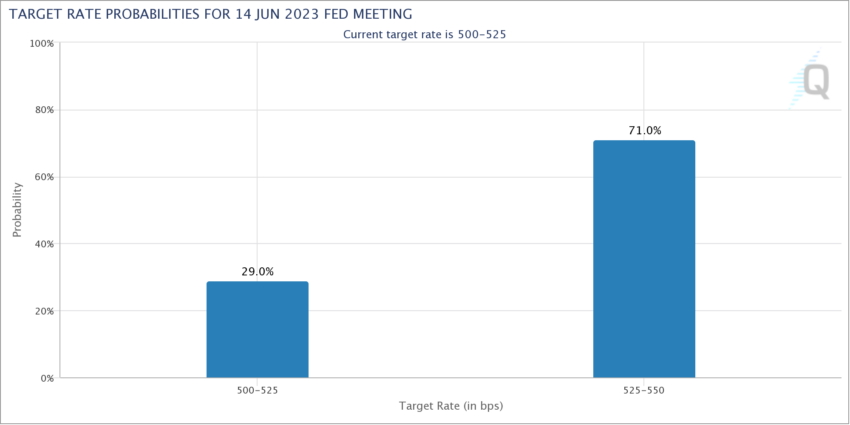

Current market predictions place the probability of a 25-basis level hike on the Fed’s June 13-14 assembly at roughly 71%.

As the week progresses, buyers eagerly anticipate the Labor Department’s much-observed job report for May, slated for launch on Friday. This report may present insights into the resilience of the US economic system within the face of high-interest charges and inflation.

Bitcoin and Ethereum React to Debt Limit Bill

The debate surrounding the debt ceiling has solid a shadow over the crypto market. However, indications of developments beforehand propelled Bitcoin up by 5.26% to a excessive of $28,500 on Sunday, and Ethereum ascended by 5.53% to $1,930 in May.

However, the tide turned on Wednesday because the crypto market reversed as a result of waning optimism across the debt ceiling rally.

Bitcoin, the main cryptocurrency, noticed a lower of 3%, buying and selling at $26,830. Concurrently, Ethereum additionally took successful, dipping 2.89% to $1,845.

The two digital currencies are seemingly bracing for his or her inaugural dropping streak in 2023. Bitcoin is on target for an 8% droop, which might mark its worst month since November 2022. Ethereum is down 2.5% for the month. If this downward pattern continues till the tip of the day, May shall be ETH’s poorest-performing month since December 2022.

Disclaimer

In adherence to the Trust Project pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. However, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material.