Key Takeaways

Bitcoin gained over 1,000 in market worth early Monday.

Meanwhile, Ethereum noticed its value leap above $1,800.

The technicals and fundamentals now level to additional beneficial properties on the horizon.

Share this text

The whole cryptocurrency market capitalization has elevated by roughly $49 billion because the begin of Monday’s buying and selling session, serving to Bitcoin and Ethereum publish vital beneficial properties.

Bitcoin and Ethereum on the Rise

Bitcoin and Ethereum have kicked off the week within the inexperienced, signaling the start of a brand new uptrend.

The prime cryptocurrency has gained over 1,000 factors in market worth following the opening of Monday’s buying and selling session. The sudden spike in upward stress stunned many cryptocurrency fans given the prevailing macroeconomic uncertainty. Still, Bitcoin seems to have breached a vital resistance space that would enable it to advance additional.

From a technical perspective, BTC bounced off the center trendline of a parallel channel that had developed on its each day chart. The technical formation means that it may now march towards the higher trendline at round $25,700. Bitcoin should proceed buying and selling above the $23,300 help degree to obtain its upside potential.

On-chain knowledge add credence to the technical outlook as IntoTheBlock’s In/Out of the Money Around Price (IOMAP) mannequin exhibits that Bitcoin has developed a big help flooring. Roughly 1.4 million addresses bought over 1 million BTC between $22,650 and $23,325. The vital quantity of curiosity round this degree may assist include any spike in profit-taking, probably permitting costs to rebound.

It is value noting that the IOMAP exhibits little to no vital resistance forward. The most appreciable provide barrier is $26,670, the place 63,530 addresses have beforehand bought over 181,270 BTC.

Ethereum has additionally gained vital bullish momentum in the present day. The rising shopping for stress has helped ETH’s value surge by almost 7%, hitting a excessive of $1,800 at press time. As hypothesis mounts across the blockchain’s long-awaited “Merge” improve, it seems that ETH has extra room to ascend.

The second-largest cryptocurrency by market cap has damaged out of a symmetrical triangle that had developed on its four-hour chart. The top of the sample’s Y-axis means that Ethereum may now enter a 22.5% uptrend. Further bullish momentum may assist ETH validate the optimistic outlook and attain $2,130.

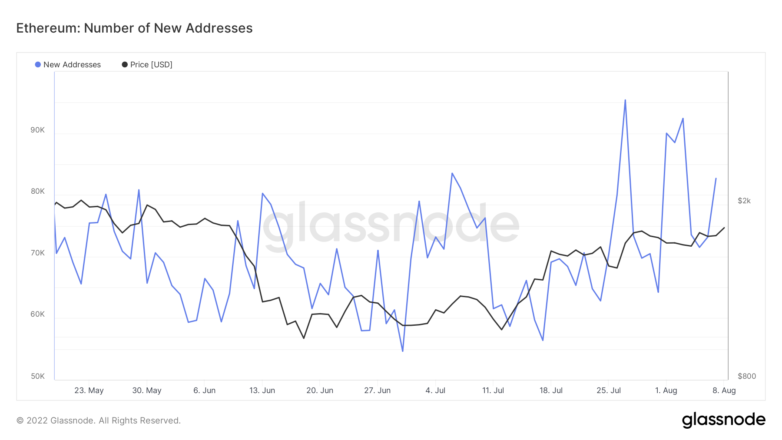

On-chain exercise additionally signifies a spike in curiosity for Ethereum. The variety of new each day addresses on the community seems to be rising, making a collection of upper highs and increased lows. The uptrend means that sidelined traders have been accumulating ETH across the present value ranges.

Network progress is commonly thought-about one of the correct value predictors for cryptocurrencies. Generally, a gradual improve within the variety of new addresses created on a given blockchain leads to rising costs over time.

Despite the bettering technical and elementary situations, ETH should stay buying and selling above $1,700 to proceed trending upward. If it drops beneath the essential degree, it may face a sell-off that invalidates the bullish thesis and triggers a correction to $1,600 and even $1,450.

Disclosure: At the time of writing, the writer of this piece owned BTC and ETH.

For extra key market developments, subscribe to our YouTube channel and get weekly updates from our lead bitcoin analyst Nathan Batchelor.

Share this text

The info on or accessed by way of this web site is obtained from unbiased sources we imagine to be correct and dependable, however Decentral Media, Inc. makes no illustration or guarantee as to the timeliness, completeness, or accuracy of any info on or accessed by way of this web site. Decentral Media, Inc. shouldn’t be an funding advisor. We don’t give customized funding recommendation or different monetary recommendation. The info on this web site is topic to change with out discover. Some or the entire info on this web site could turn into outdated, or it could be or turn into incomplete or inaccurate. We could, however are usually not obligated to, replace any outdated, incomplete, or inaccurate info.

You ought to by no means make an funding choice on an ICO, IEO, or different funding primarily based on the data on this web site, and it is best to by no means interpret or in any other case depend on any of the data on this web site as funding recommendation. We strongly suggest that you just seek the advice of a licensed funding advisor or different certified monetary skilled if you’re searching for funding recommendation on an ICO, IEO, or different funding. We don’t settle for compensation in any type for analyzing or reporting on any ICO, IEO, cryptocurrency, forex, tokenized gross sales, securities, or commodities.

See full phrases and situations.