Exchange-traded funds (ETFs) backed by bitcoin (BTC) futures agreements sold the United States mainly preserved their trading quantities recently, despite a slump in the bitcoin price throughout January.

According to trade information, the ProShares Bitcoin Strategy ETF (BITO) – the very first bitcoin ETF to go reside in the United States in October in 2014 – saw trading quantities of 40.83m shares throughout the week from February 7 to 11.

The trading quantity notes a boost from the week prior to when 31.53m shares were traded, and also it’s about according to the ordinary regular trading quantity of 38.98m shares considering that the ETF released.

BITO price and also trading quantity (base) considering that launch:

Even a lot more shocking, probably, is that trading quantities in the 2nd bitcoin ETF to launch, the Valkyrie Bitcoin Strategy ETF (BTF), have actually enhanced considerably considering that in 2014, despite bitcoin’s price slump.

During the week from February 7 to 11, 7.54m shares of BTF were traded, its highest degree ever before, exchange information programs. Notably, the ETF saw a significant uptick in trading quantity around completion of in 2014, with the greater ordinary quantity still continuing to be to this day.

Compared with in 2014’s ordinary regular trading quantity of 2.52m shares, the quantity in BTF has greater than increased this year to a typical regular quantity of 5.3m shares.

The launch of BTF was mainly eclipsed by the effective very first launch of BITO, with the 2nd bitcoin ETF to this particular day continuing to be a much cry behind BITO in regards to quantity.

BTF price and also trading quantity (base) considering that launch:

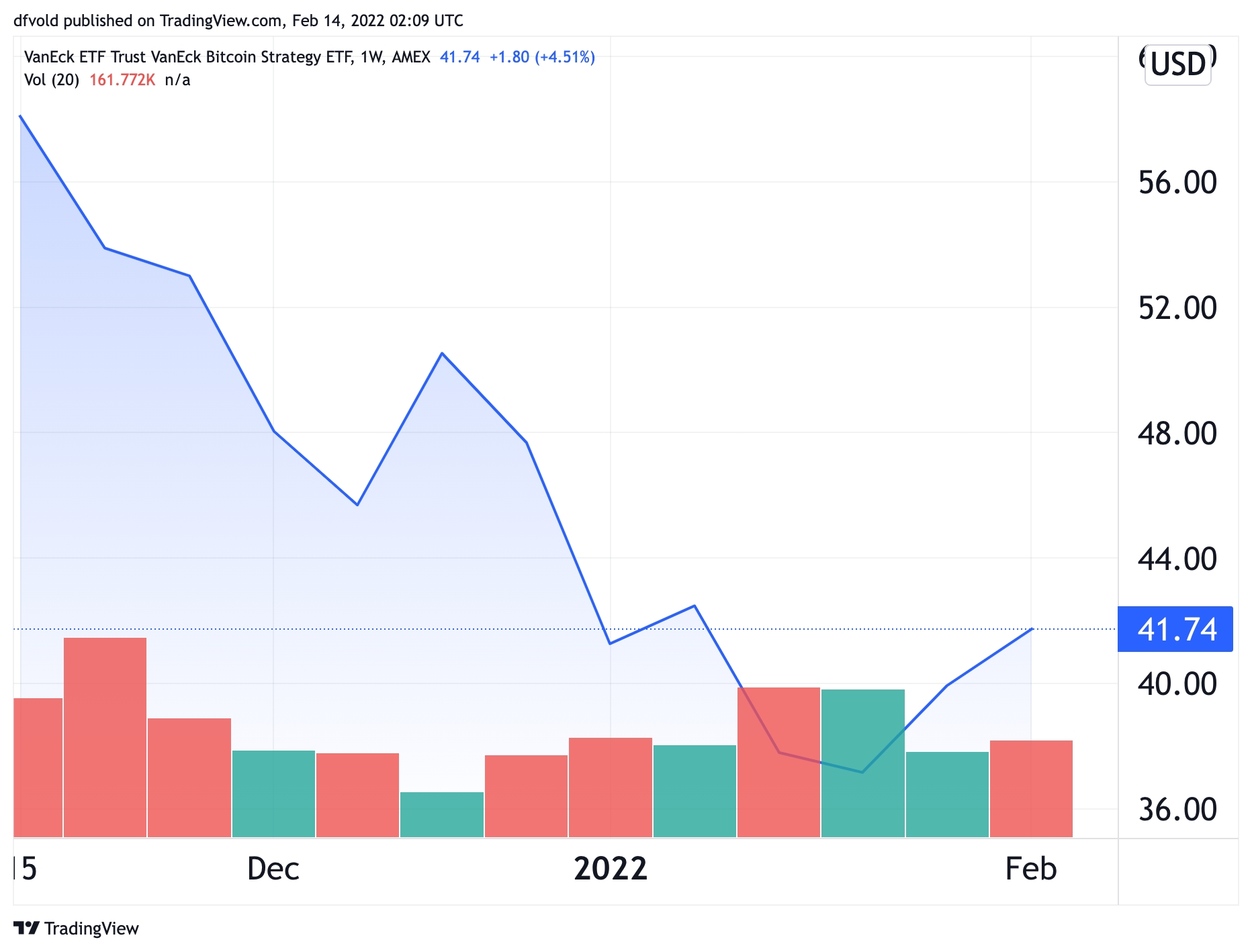

Lastly, the 3rd US-listed bitcoin ETF, the VanEck Bitcoin Strategy ETF (XBTF), has actually additionally seen an amazing toughness in regards to quantity considering that the bitcoin price came to a head in November in 2014.

Although the all-time high in the regular quantity of 0.34m shares for this ETF adhered to quickly after the price came to a head, trading quantity was back at near the exact same degree as just recently as in January, with 0.25m shares sold the week from January 17 to 31, exchange information programs.

XBTF price and also trading quantity (base) considering that launch:

Between January 1st and also 31st, bitcoin’s price visited regarding 17% from around USD 46,200 at the start of the month to 38,400 at the end of the month.

BTC price considering that January 1:

The significant toughness in the trading quantities of ETFs backed by bitcoin was highlighted on Twitter recently by Bloomberg’s elderly ETF expert, Eric Balchunas, that claimed that the ETFs “have retained their trading volume and much of their investor base.”

This has actually taken place despite “a brutal 50% drawdown” in the place market, Balchunas claimed, calling it “a great sign for [the ETFs] staying power and growth potential.”

Balchunas’ tweet came as a Bloomberg Intelligence record by experts Rebecca Sin and also James Seyffart claimed that trading quantity in “crypto ETFs” stayed secure in January, with reasonably little circulation decreases.

Spot-based bitcoin ETFs in the United States remain a ‘possibly’

Bitcoin continues to be the only cryptoasset in which investors can spend using ETFs on the controlled United States stock market. However, some experts have actually guessed that an ethereum (ETH) ETF can be following.

Also worth keeping in mind is that the bitcoin ETFs that are presently readily available have actually handled to preserve high trading quantities despite in some cases being afflicted by tracking mistakes about the place price of bitcoin. These monitoring mistakes happen since agreements dated right into the future usually profession at either a costs or a discount rate to the place price of bitcoin.

In enhancement, the futures agreements backing the ETFs need to be surrendered every month as they end, including intricacy and also expenses to the administration of the funds.

To prevent this issue, a variety of business have actually related to checklist spot-based bitcoin ETFs that would certainly track the hidden price straight.

So much, the United States Securities and also Exchange Commission (SEC) has actually refuted all such applications. However, one indication that it might will reconsider its position arised today when the regulatory authority looked for public guidance regarding whether place bitcoin ETFs can be made use of for scams or market control, per a Bloomberg record.

For currently, nonetheless, futures-based bitcoin ETFs remain the only video game around and also have actually ended up being the recommended selection for the traditionally-minded investors that are looking for direct exposure to the possession.

And with high trading quantities lingering with the previous couple of months’ price slump, it shows up that solid need for bitcoin exists also among conventional supply investors.

____

Learn a lot more:- First Bitcoin ETF Moves to November Contracts as Competition Heats Up- Bitcoin ETFs in Europe & Canada Remain Popular Even With United States ETFs Widely Available

– Grayscale Finds Rising Interest in Bitcoin as it Pushes for Spot BTC ETF- Ethereum ETFs Struggle in Europe, however See Rising Volumes in Canada- Grayscale Makes an ETF Move