Key Takeaways

Bitcoin is battling to get over the $60,000 resistance degree.

Likewise, Ethereum has actually fallen short to breach $4,500.

If BTC as well as ETH can conquer their obstacles, they might publish additional gains.

Share this short article

Bitcoin as well as Ethereum have both battled to recuperate from their current losses as well as currently deal with resistance in advance. Still, the network characteristics recommend that the disadvantage possibility is restricted.

Bitcoin Is Under Pressure

Bitcoin remains to trend downwards as it deals with resistance.

The leading cryptocurrency attempted to reclaim the 100-twelve-hour relocating standard as assistance on Nov. 20, quickly after the Tom DeMark Sequential offered a buy signal. Although BTC recoiled from a reduced of $55,600, the $60,000 resistance obstacle decreased the increase. The being rejected caused a 5.5% improvement that pressed costs back listed below $57,000.

As Bitcoin falls short to get over the $60,000 difficulty, market individuals seem transforming cynical.

Behavior analytics system Santiment videotaped a modification in BTC investors’ understanding because of the down cost activity previously today. The last time the marketplace revealed such unfavorable view remained in very early October. Still, the unpredictability might be taken a “good sign of capitulation.”

Bitcoin should appear the 100-twelve-hour relocating standard at $60,000 to progress greater. More notably, it requires to publish a 12-hour candle holder close over the 50-twelve-hour relocating standard at $62,400 to verify the uptrend has actually returned to. Once both of these turning points are attained, BTC might climb to retest its previous all-time high at almost $70,000.

Failing to appear the $60,000 to $62,400 supply wall surface might cause additional losses. A spike in offering stress might cause a drop-off towards the current reduced at $55,600. If this assistance degree is not substantial adequate to hold, an examination of the 200-twelve-hour relocating standard at $53,600 might be brewing.

Ethereum Holds Strong

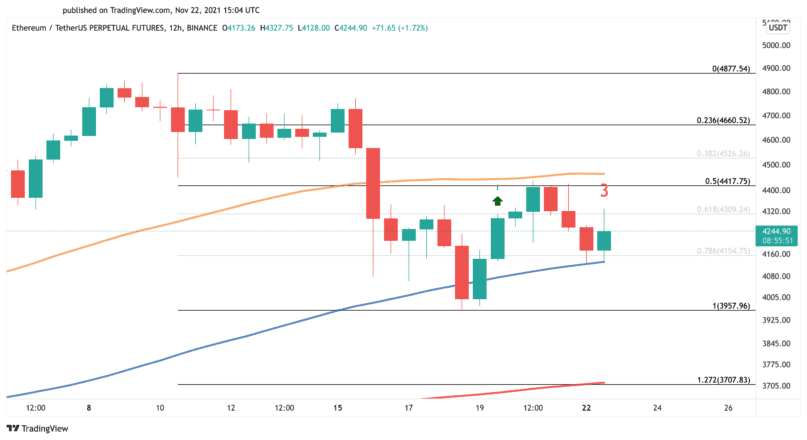

Ethereum is trading over a solid need obstacle that might spark one more boost.

The second-largest cryptocurrency by market cap has actually seen a huge quantity of symbols obtained of blood circulation in current months. Since applying its EIP-1559 charge shedding proposition in August’s London hardfork, almost 978,000 ETH worth greater than $4 billion have actually been shed. The substantial supply decrease paints a favorable image for Ethereum’s future cost development as it practically lowers the variety of ETH offered to offer, subsequently covering the disadvantage possibility.

This might discuss exactly how Ethereum has actually had the ability to hold over $4,000 after the current improvement seen throughout the whole cryptocurrency market. From a technological point of view, it shows up that the 100-twelve-hour relocating standard is serving as a secure assistance degree. Still, ETH should appear the 50-twelve-hour relocating standard at $4,500 to publish greater highs.

Slicing with such a considerable supply location might see Ethereum march towards its previous all-time high at almost $4,900, with $4,660 serving as an intermediate resistance degree.

It deserves keeping in mind that Ethereum should remain to trade over the 100-twelve-hour relocating typical to progress better. A violation of this assistance degree might postpone the hopeful expectation, bring about a modification in the direction of the 200-twelve-hour relocating standard at $3,700.

Disclosure: At the moment of creating, the writer of this function had BTC as well as ETH.

Share this short article

The info on or accessed with this site is gotten from independent resources our company believe to be exact as well as trustworthy, yet Decentral Media, Inc. makes no depiction or guarantee regarding the timeliness, efficiency, or precision of any type of info on or accessed with this site. Decentral Media, Inc. is not a financial investment expert. We do not provide tailored financial investment guidance or various other economic guidance. The info on this site undergoes alter without notification. Some or every one of the info on this site might end up being out-of-date, or it might be or end up being insufficient or incorrect. We may, yet are not bound to, upgrade any type of out-of-date, insufficient, or incorrect info.

You ought to never ever make a financial investment choice on an ICO, IEO, or various other financial investment based upon the info on this site, as well as you ought to never ever analyze or otherwise rely upon any one of the info on this site as financial investment guidance. We highly suggest that you speak with a certified financial investment expert or various other competent economic specialist if you are looking for financial investment guidance on an ICO, IEO, or various other financial investment. We do decline payment in any type of type for assessing or reporting on any type of ICO, IEO, cryptocurrency, money, tokenized sales, safeties, or assets.

See complete conditions.

El Salvador Is Building a City Dedicated to Bitcoin

President Nayib Bukele revealed that El Salvador would certainly develop ”Bitcoin City” at Bitcoin Week 2021 last evening. El Salvador Plans Bitcoin City El Salvador is increasing down on its dedication…

VanEck Bitcoin Futures ETF Will Debut on Cboe

The most current Bitcoin futures exchange-traded fund (ETF) from VanEck is readied to go survive on the Cboe BZX Exchange on Nov. 16. VanEck’s Bitcoin Futures ETF To Be Listed Tomorrow…

Brave Introduces Built-in Browser Wallet for Ethereum

The most current upgrade to Brave Browser (variation 1.32) currently provides an indigenous purse for the Ethereum environment. Brave Introduces Native Ethereum Wallet In a Tuesday news release, the group revealed Brave Wallet…

MDEX: Overlooked Decentralized Exchange That Pays You to Trade

Based on stats from DeBank and dapp.com, among the top-performing decentralized exchanges by TVL as well as trading quantity this year is MDEX—an AMM-based DEX operating throughout the Huobi Eco-chain (HECO), Binance Smart Chain…