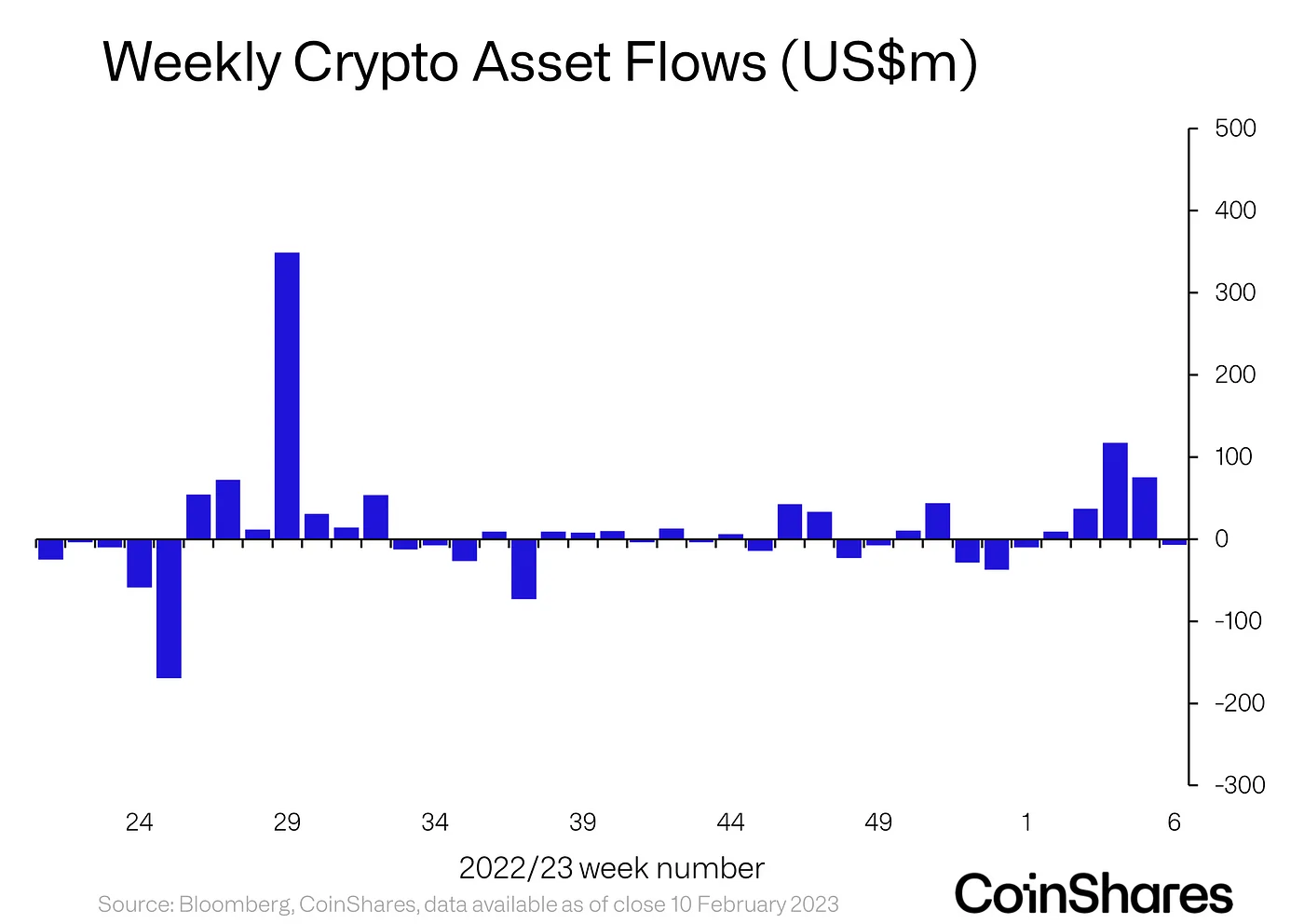

After dominating crypto inflows for many of the 12 months to date, Bitcoin fell out of favor within the eyes of traders final week. That’s in accordance with the newest weekly Digital Asset Fund Flows report produced by crypto analytics agency CoinShares, which tracks funding flows into and out of digital asset funding merchandise. Bitcoin fell again beneath $22,000 final week for the primary time since mid-January final Thursday, and in the end dropped 5.0% final week.

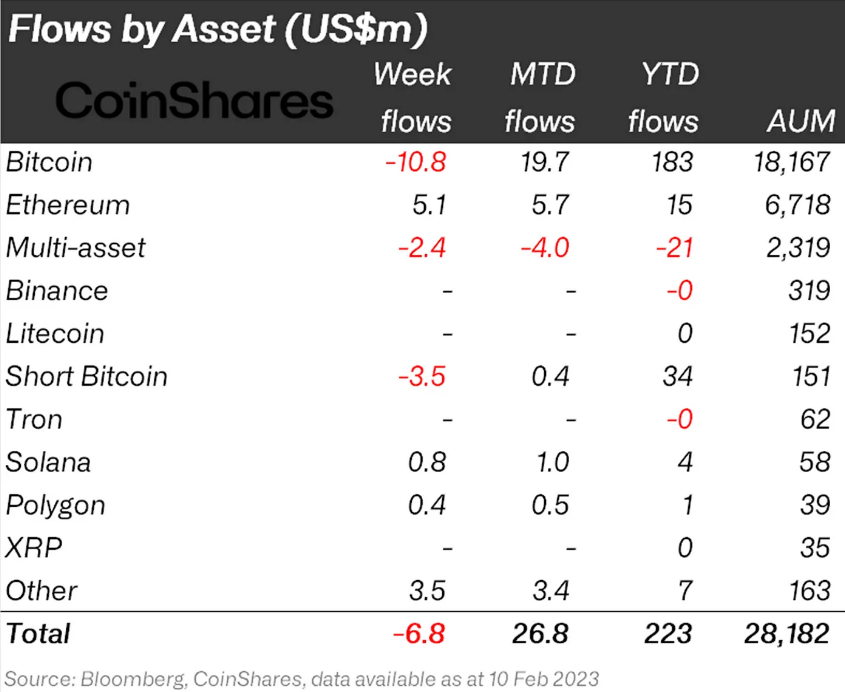

According to CoinShares, Bitcoin funding merchandise noticed a web outflow final week of $10.9 million, whereas altcoin funding merchandise noticed a web influx of $3.9 million. It is price noting that short-Bitcoin merchandise noticed an outflow of $3.5 million, with some traders seemingly taking benefit of the current pullback to take earnings or reduce losses on brief positions in wake of 2023’s rally.

Ethereum lastly began seeing some love. The world’s second-largest cryptocurrency by market capitalization and dominant Decentralized Finance/Application blockchain infrastructure supplier noticed inflows of $5.1 million, taking its year-to-date influx to $15 million. That nonetheless lags Bitcoin by a great distance, which has seen associated funding merchandise obtain inflows of $183 million.

Net Crypto Outflows Triggered By Fear of Fed Tightening

CoinShares put the online outflow of $7 million in digital asset funding merchandise all the way down to traders getting “spooked by the prospect of additional rate hikes by the US Federal Reserve” in wake of “a week of macro data that significantly beat expectations to the upside”. The week earlier than final, US jobs and ISM companies PMI survey knowledge for January each shocked massively to the upside, signaling that the US financial system nonetheless stays pretty sizzling and boosting confidence on the Fed that they’ll press forward with price hikes with out triggering a recession.

Investors Face Another Testing Week of Macro Risks

This week may simply comply with within the footsteps of final, with additional outflows from digital asset funding merchandise extremely possible if macro headwinds persist. Crypto merchants might be nervously monitoring Tuesday’s US Consumer Price Index (CPI) report. Worryingly for the crypto bulls, economists are forecasting an uptick in MoM inflationary pressures that, if confirmed, would possibly fear Fed policymakers and enhance their resolve to take and maintain rates of interest above 5.0% for a while.

This might reinforce the current uptrend seen within the US greenback in opposition to most of its main G10 friends and in US bond yields, which may weigh closely on crypto. An uptick in US inflation may push Bitcoin decrease in the direction of the $20,500 assist space (the 18th of January low and 50DMA). A break under right here would open the door to a check of the 200DMA and Realized Price within the higher $19,000s.

Crypto merchants may even be monitoring US Retail Sales knowledge out on Thursday which can inform expectations as to how possible the US is to fall right into a recession someday later this 12 months. Market members may even be retaining an eye fixed on remarks from a smattering of Fed policymakers who might be talking all through the week.