In the crypto market, sudden worth actions can ship shockwaves. Recently, a Bitcoin flash rally on Bitfinex raised issues over the dangers related to low liquidity on crypto exchanges.

It is essential to grasp the elements contributing to such occasions, the potential risks for merchants, and the measures that they’ll take to mitigate these dangers.

Understanding Liquidity in Crypto Markets

Liquidity refers back to the ease with which an asset might be purchased or bought in a market with out considerably affecting its worth.

In crypto exchanges, excessive liquidity implies a big buying and selling quantity and a slender unfold between purchase and promote orders, main to cost stability. On the opposite hand, low liquidity can lead to vital worth swings and elevated vulnerability to market manipulation.

A key issue affecting liquidity within the crypto market is the variety of market contributors, together with retail and institutional buyers.

As the market grows and attracts extra contributors, liquidity sometimes will increase, resulting in extra environment friendly worth discovery and lowered worth volatility. However, latest occasions have proven that even well-established cryptos like Bitcoin will not be resistant to the consequences of low liquidity.

Bitcoin Flash Rally: A Case of Low Liquidity

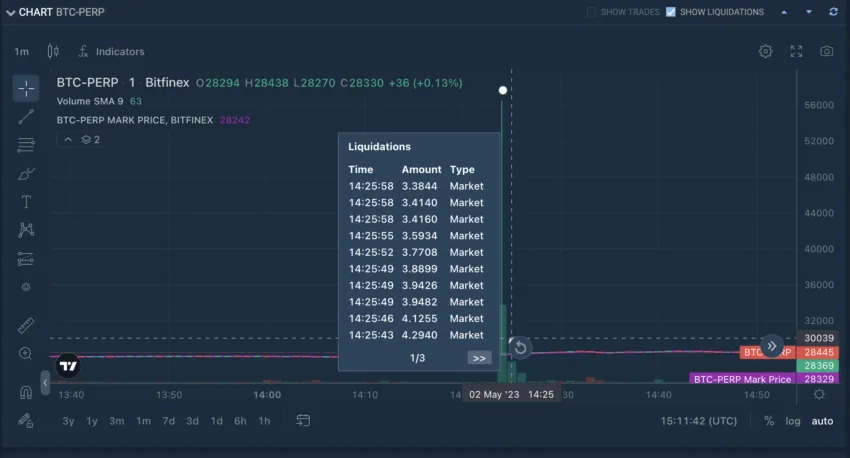

On May 2, Bitcoin skilled a flash rally on Bitfinex, a preferred cryptocurrency change. Its worth briefly surged above $56,000, representing a 100% enhance.

The sudden spike in worth was short-lived and adopted by an equally speedy decline, leaving many merchants perplexed.

The phenomenon might be attributed to low liquidity on the platform, which bred an surroundings ripe for worth manipulation and exacerbated the affect of enormous orders on the market. A mix of things contributed to the low liquidity on the time, together with elevated regulatory scrutiny and a basic decline in buying and selling quantity.

The flash rally on Bitfinex is a cautionary story, highlighting the dangers related to buying and selling on low-liquidity exchanges.

The Dangers of Trading on Low-Liquidity Exchanges

Price Manipulation

Low liquidity permits market manipulators to affect asset costs of their favor. A single massive transaction could cause vital worth fluctuations with out adequate purchase and promote orders.

This permits unhealthy actors to have interaction in practices like “pump and dump” schemes, artificially inflating an asset’s worth after which promoting their holdings at a revenue, leaving unsuspecting merchants with vital losses.

Slippage

When buying and selling on low-liquidity exchanges, the distinction between the value at which a dealer intends to purchase or promote an asset and the precise execution worth might be vital.

This phenomenon, often known as slippage, can result in surprising losses for merchants and is especially problematic in periods of excessive market volatility.

Difficulty in Exiting Positions

Traders who maintain massive positions in illiquid property might face challenges when making an attempt to promote their holdings.

The lack of counterparties on low-liquidity exchanges can lead to prolonged ready instances for commerce execution. This can power merchants to both settle for unfavorable costs or stay locked into their positions.

The Impact of Regulation on Crypto Exchange Liquidity

Regulatory actions can considerably affect liquidity on cryptocurrency exchanges.

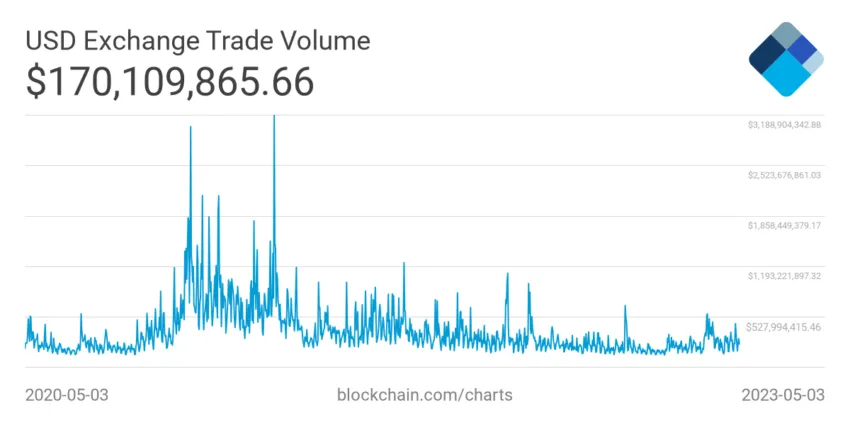

In latest years, regulatory authorities just like the U.S. Securities and Exchange Commission (SEC) and the Federal Deposit Insurance Corporation (FDIC) have tightened oversight of the crypto trade. Consequently, resulting in elevated scrutiny and enforcement actions in opposition to exchanges.

These regulatory developments have chilled the crypto market. Some institutional buyers are pulling again from the sector attributable to issues about compliance and potential penalties.

This has, in flip, contributed to declining liquidity on some exchanges, as evidenced by the Bitcoin flash rally on Bitfinex.

How to Mitigate the Risks of Low Liquidity

Traders can take a number of precautions to cut back their publicity to the dangers related to low liquidity on crypto exchanges:

Trade on respected exchanges with excessive buying and selling volumes and slender spreads.

Monitor market depth and order books to gauge liquidity ranges earlier than inserting orders.

Use restrict orders as an alternative of market orders to attenuate slippage.

Diversify buying and selling actions throughout a number of exchanges to keep away from overexposure to a single platform.

The Future of Liquidity within the Crypto Market

As the crypto market matures, exchanges should prioritize excessive liquidity to make sure a good and environment friendly buying and selling surroundings. Technological advances, similar to decentralized exchanges and liquidity aggregation options, will play a vital function in addressing liquidity challenges within the crypto market.

Furthermore, regulatory readability and a extra welcoming strategy from authorities may also help to spice up institutional adoption of cryptocurrencies, resulting in elevated liquidity on exchanges.

While the dangers related to low liquidity can’t be completely eradicated, a mix of market maturity, technological innovation, and regulatory help can contribute to a extra steady and sturdy crypto market.

Disclaimer

Following the Trust Project tips, this characteristic article presents opinions and views from trade consultants or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially replicate these of BeInCrypto or its workers. Readers ought to confirm info independently and seek the advice of with knowledgeable earlier than making selections primarily based on this content material.