Bitcoin’s meteoric rise continues to captivate the monetary world as the main cryptocurrency has not too long ago blasted previous the important $30,000 milestone. With this unprecedented surge in worth, crypto fanatics are keenly watching the market, looking for to foretell the way forward for Bitcoin.

As the digital asset’s worth trajectory defies conventional market evaluation, we delve into the components driving its development, discover the potential dangers and rewards, and try to forecast Bitcoin’s subsequent strikes on this quickly evolving panorama.

Key Fundamentals Driving BTC Prices

In the US, 236,000 extra jobs have been added than anticipated within the nonfarm payroll institution survey, exceeding expectations of 230,000. Moreover, wage development has endured at a fee that deviates from a 2% inflation fee.

Investor Focus Shifts to Inflation and Upcoming CPI Report

Investor consideration now shifts from the job market to inflation, with the CPI report scheduled for Wednesday, April 12. This report is likely one of the most crucial financial knowledge factors forward of the US Federal Reserve’s assembly.

Several market consultants consider the assembly will sign the tip of the central financial institution’s lengthy cycle of fee hikes.

US Inflation Shows Signs of Slowing Down

Inflation within the US decreased to 0.4% in February from 0.5% the earlier month and 6% yearly from 6.4% the month earlier than. However, the upcoming knowledge will seemingly reveal a major enhance, as core CPI may need grown greater than headline CPI for the primary time in a very long time.

US Dollar Index Drops Amid Strong Labor Market

Nevertheless, the US Dollar Index (DXY) declined by 0.19% to 102.05. The US Dollar took a break after its largest month-to-date acquire in opposition to main rivals, as a sturdy US labor market bolstered the necessity for a Fed fee hike subsequent month.

Bitcoin Rises as Traders Anticipate Fed’s Response to CPI Report

Bitcoin’s worth will increase as merchants focus on whether or not the Fed will change course after the essential CPI report. If the info signifies that inflation is declining, this is likely to be the following potential set off for the upward motion of BTC/USD.

Impact of Fed Rate Hikes on Bitcoin Prices

According to the CME FedWatch Tool, the market expects a 71% likelihood of the Fed elevating charges by 25 foundation factors at its May assembly. A tighter labor market could also be chargeable for this, giving the Fed motive to proceed elevating rates of interest sooner or later.

However, these odds are extremely versatile and rapidly react to any new macro knowledge releases, such as CPI. A decline in headline CPI may enhance the potential for a shift in Fed coverage in direction of dovishness. Conversely, persistent inflationary pressures would encourage markets to foretell additional rate of interest hikes in May.

Furthermore, the upcoming Fed minutes anticipated on Wednesday might be one other vital set off for the BTC/USD alternate fee. These minutes will illuminate what Fed officers mentioned final week and what to anticipate.

Crypto-Related Stocks Rises

Stocks of corporations with vital ties to cryptocurrencies are experiencing notable features, together with Marathon Digital (MARA), Coinbase (COIN), which grew by greater than 7%, and MicroStrategy (MSTR), which elevated by over 7.5%.

Additionally, Monday’s highest proportion of inventory will increase belong to Bitcoin miners. Besides Marathon Digital’s 12% acquire, different Bitcoin miners such as Riot Blockchain (RIOT) and Hut 8 Mining (HUT) are up 13% and 10%, respectively.

The crypto-related shares soar as BTC/USD reaches its highest stage since June 2022.

Bitcoin Price

The present stay Bitcoin worth stands at $30,257, with a 24-hour buying and selling quantity of $20.8 billion. Bitcoin has risen 3.50% within the final 24 hours. It holds the #1 place on CoinMarketCap, with a stay market capitalization of $585 billion.

From a technical evaluation perspective, the BTC/USD pair shows a particular bullish pattern on the $30,000 milestone. If this stage is overcome, resistance could also be encountered at $30,000 earlier than the BTC worth advances towards $31,000 or presumably even $32,250.

Conversely, Bitcoin’s help continues to carry regular across the $28,900 mark.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

To keep up-to-date with the most recent ICO tasks and altcoins, it’s advisable to usually seek the advice of the expert-curated checklist of the highest 15 cryptocurrencies to look at in 2023.

Doing so will aid you stay well-informed about rising developments and alternatives throughout the crypto market.

Disclaimer: The Industry Talk part options insights by crypto trade gamers and isn’t part of the editorial content material of Cryptonews.com.

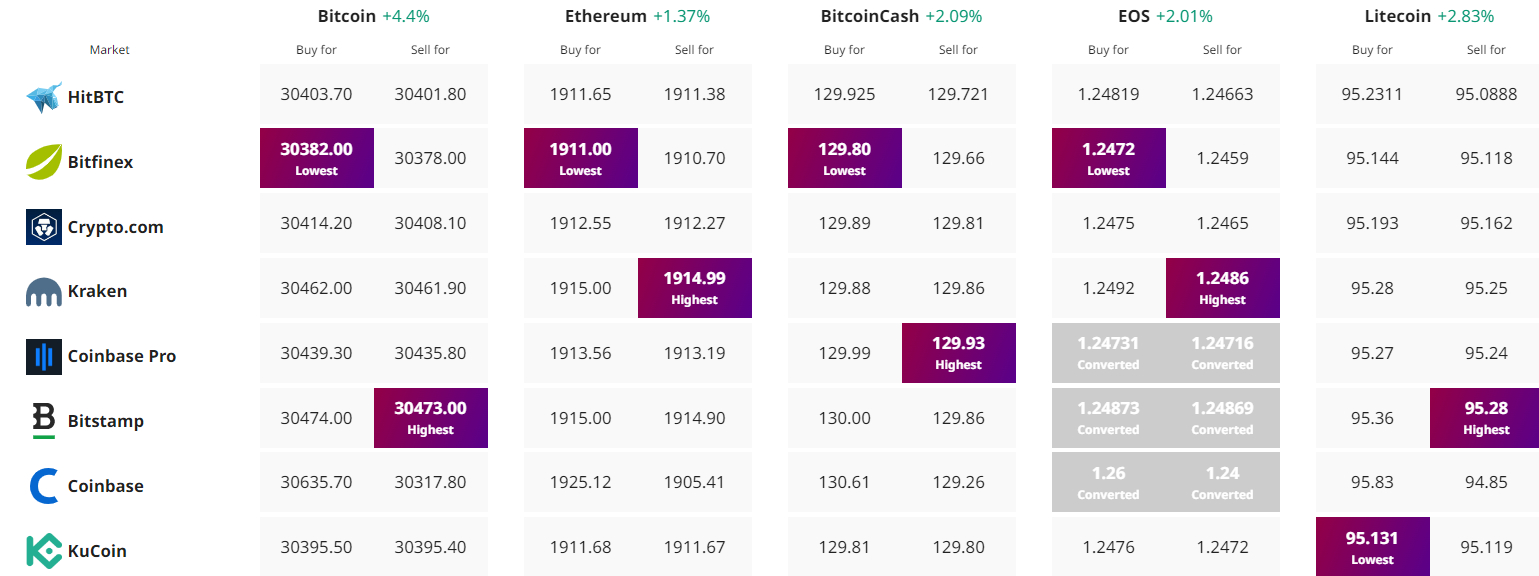

Find The Best Price to Buy/Sell Cryptocurrency