As Bitcoin hits its highest stage in 9 months, many are questioning simply how excessive the cryptocurrency can go. With a market cap of over $1 trillion and a surge in demand, as traders search a protected haven amid financial uncertainty, Bitcoin’s worth has skyrocketed in latest months.

This has left many questioning whether or not the cryptocurrency is in the midst of a sustained bull run or whether or not it’s due for a correction.

US Banking Crisis: Impact on Financial Market and Cryptocurrency Prices

Last week, the abrupt downfall of three banks, specifically Silvergate, Silicon Valley Bank (SVB), and Signature Bank, highlighted the fragility of the traditional banking sector. Analysts have recognized unfavorable market circumstances and insufficient danger administration as main contributors to the collapse of SVB and Silvergate.

The downfall of SVB had far-reaching implications for the worldwide banking trade. Credit Suisse, the second-largest Swiss banking establishment, was additionally affected, dealing with a extreme disaster that necessitated a $54 billion rescue package deal from the Swiss Central Bank.

With the banking disaster unfolding, traders are turning to cryptocurrency as a dependable different. As fears of a possible international monetary disaster escalate, the worth of BTC/USD has continued to rise.

The Connection Between the Federal Reserve and BTC

The Federal Reserve’s in a single day steadiness sheet knowledge revealed that roughly $300 billion had been injected into the economic system to handle the monetary disaster, sparking a brand new upward pattern.

This motion successfully reversed months of liquidity withdrawal below the Federal Reserve’s quantitative tightening (QT) coverage, and specialists are anticipating the reintroduction of quantitative easing (QE).

The latest reversal of the Federal Reserve’s quantitative tightening coverage, which had been in impact since 2021, has buoyed BTC/USD bulls, who at the moment are trying to push the value larger.

Additionally, rising considerations a couple of international banking collapse have decreased the probability of the Fed implementing a 50 foundation level rate of interest hike. Instead, Reuters predicts that the Federal Open Market Committee (FOMC) might solely increase the federal funds fee by 25 foundation factors at its upcoming assembly on March 22.

Inflation and Federal Reserve fee hikes can have a big influence on the worth of Bitcoin. When the Fed’s rate of interest resolution turns into unsure, the greenback index tends to lower.

Currently, the greenback index is at 103.86 and should proceed to say no, which could be advantageous for BTC/USD as a declining US greenback can result in an increase in Bitcoin’s worth.

Binance CEO: BTC Resistant to Inflationary Pressures

On March 18, Binance CEO Changpeng Zhao took to Twitter to reward a elementary function of Bitcoin know-how. He emphasised the cryptocurrency’s potential to withstand inflationary pressures, a high quality that conventional fiat currencies lack.

In his tweet, Zhao identified that, in contrast to fiat currencies, Bitcoin can’t be printed out of skinny air by anybody, and mining is a key perform in its creation.

Zhao’s feedback got here in response to reviews that the US authorities had issued a $300 billion rescue package deal “out of thin air” following the collapse of three main banks in the nation.

In the final 24 hours, BTC/USD has surpassed $27,500, in line with knowledge from the market monitoring web site CoinMarketCap. This worth stage is without doubt one of the highest that BTC/USD has reached in the previous 9 months.

Bitcoin Price

On March 18, Bitcoin started buying and selling at $27,350. Within the previous 24 hours, its worth has elevated by 2.75%, and it’s at present buying and selling at $27,416. BTC/USD has skilled fluctuations, reaching its highest worth at $27,605 and its lowest at $27,053.

Furthermore, the worth of Bitcoin has surged by greater than 35% in the previous week, with the latest information of financial institution failures and considerations about potential rate of interest hikes enjoying a big position in driving up its worth.

Bitcoin’s worth noticed a pointy decline after a short consolidation interval at round $26,500. This led to a short-term detrimental pattern as it fell under the $25,000 and $25,500 help ranges.

As of Saturday, the BTC/USD pair is buying and selling with a robust bullish bias, however it’s dealing with quick resistance close to the $27,750 stage. A bullish breakout above this stage may propel the Bitcoin worth towards the $30,750 milestone.

However, if the $27,750 stage proves to be a resistance level, a sell-off might happen, doubtlessly driving the value all the way down to $25,200 and even $23,020.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

Industry Talk has compiled a curated listing of the highest 15 cryptocurrencies to observe in 2023, that includes insights from the specialists at Cryptonews. Whether you are an skilled crypto investor or new to the market, this listing supplies precious info on promising altcoins that would have a big influence on the trade.

Stay up to date with new ICO tasks and altcoins by checking again often.

Disclaimer: The Industry Talk part options insights by crypto trade gamers and isn’t part of the editorial content material of Cryptonews.com.

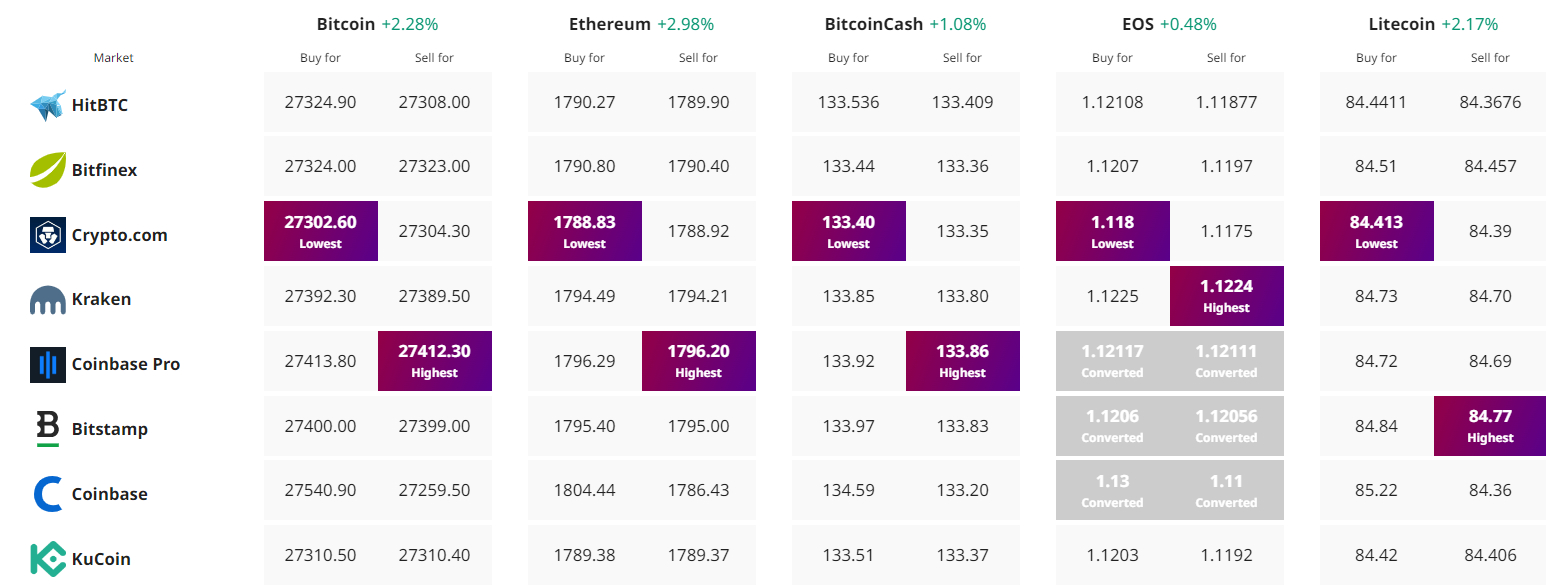

Find The Best Price to Buy/Sell Cryptocurrency