Last Thursday, adhering to the information Russia attacked Ukraine, I created this item analyzing the bush abilities of Bitcoin amidst the situation. With gold standing up its end of the deal well as it breached a 17 month high, Bitcoin allow the group down as well as dropped 7%.

Gold pests buffooned the crypto lovers, as Bitcoin apparently blew its best chance, providing the long-supported disagreement that Bitcoin is a sovereign bush as hopeful reasoning. Bitcoin was trading at circa $37,400, while Gold went to circa $1,920.

Bitcoin Revives

But there’s never ever a boring minute in crypto, as well as points have actually transformed drastically because. Bitcoin is up 17% from those lows, trading at circa $44,000. Gold, at the same time, is trading at comparable degrees as previous ($1,920).

It’s intriguing to review my evaluation from Thursday in light of the current motions of gold as well as Bitcoin, as well as the assault of economic sanctions which have actually been levelled versus Russia. Last week, adhering to the news of the Russian intrusion, I wrapped up that the 7% loss in Bitcoin confirmed that the cryptocurrency had actually not yet attained the condition of a shop of worth possession. Instead, I said that the red candle light confirmed capitalists had actually disposed it for safe house possessions such as cash money as well as gold amidst the marketplace volatility. In situations, connections go to 1, as well as there’s a trip to top quality. People lost crypto direct exposure as the globe went bananas – similar to what took place in March 2020, when the COVID pandemic came knocking on our doors.

So, does that final thought requirement to be taken another look at?

Well, yes as well as no. There’s still no navigating the reality that in the instant consequences of the intrusion, Bitcoin plunged while the “hedge” possession that it is making every effort to change – gold – held company, climbing up to a 17 month high. But such has actually been the range of the rebound of crypto, we require to dig much deeper as well as re-examine.

Economic Sanctions & The Modern Fiat System

The essential advancement because recently’s evaluation has actually been the assault of sanctions versus Russia. Airspaces are shut to Russian airplane, Russian financial institutions are obtaining iced up out of the SWIFT network as well as Moscow’s capacity to utilize its warchest of $630 billion in international books has actually been limited. This last factor pertaining to the international books is specifically engaging when analyzing Bitcoin’s rate motions. The United States, UK, EU as well as Canada concurred to “prevent the Russian central bank from deploying its international reserves in ways that undermine the impact of our sanctions”.

Remember, in the contemporary economic system, fiat cash is in fact something you are owed, instead of something concrete which you in fact have. So while the cash money you hold in your checking account is thought about something you “have”, in fact it is owed to you by your financial institution, which you gather when you take out from an atm machine or transfer to one more account (whereupon the recipient of the transfer will certainly after that be “owed” the financial institution’s obligation).

What we are seeing in the marketplaces currently is that these possessions, provided Russia don’t fairly “have” them, can be removed. Putin has actually discovered by hand that those $630 billion in international books aren’t fairly as fluid as he believed.

Alternatives

Of training course, there are options to fiat. Were Russia’s $630 billion in books held in gold bullions, there can be no such limitations. Gold secured away in a Russian safe is no one else’s obligation, Russia just “have” it, in every feeling of words. As Canadian people might have become aware lately adhering to the cold of savings account for militants, fiat cannot constantly assure that accessibility.

Of training course, in the last years we have actually seen the appearance of one more possession which supplies this top quality – Bitcoin. Holding your exclusive secrets is equally comparable to tucking away a gold bullion under your bed (as well as dramatically less complicated). However, as Bloomberg’s Joe Weisenthal explained in his e-newsletter today, it’s not fathomable for Russia to hold considerable books in Bitcoin, provided the dimension of the marketplace. While gold’s market cap floats around $12 trillion, Bitcoin’s market cap is just $826 billion (with a tendency sometimes to dip a lot reduced). So it’s not viable for federal governments to hold huge quantities of Bitcoin at the existing market cap (Russia’s $630 billion in international books would certainly amount to 3 quarters of the Bitcoin supply).

Other Implications

So up until Bitcoin develops as well as broadens to much more soaring degrees, it can’t use what gold can today. Indeed, lots of experts often direct to gold’s market cap in theorizing the capacity for Bitcoin’s development, as well as it definitely provides an engaging standard. But in the meantime, all capitalists aren’t as huge as the Russian state as well as Bitcoin can still have worth. The Russian ruble’s motions in the last couple of days reveal this clearly. Shedding 20% of its worth versus the United States buck, Russian people have actually seen their total assets crater in genuine terms.

Via XE.com

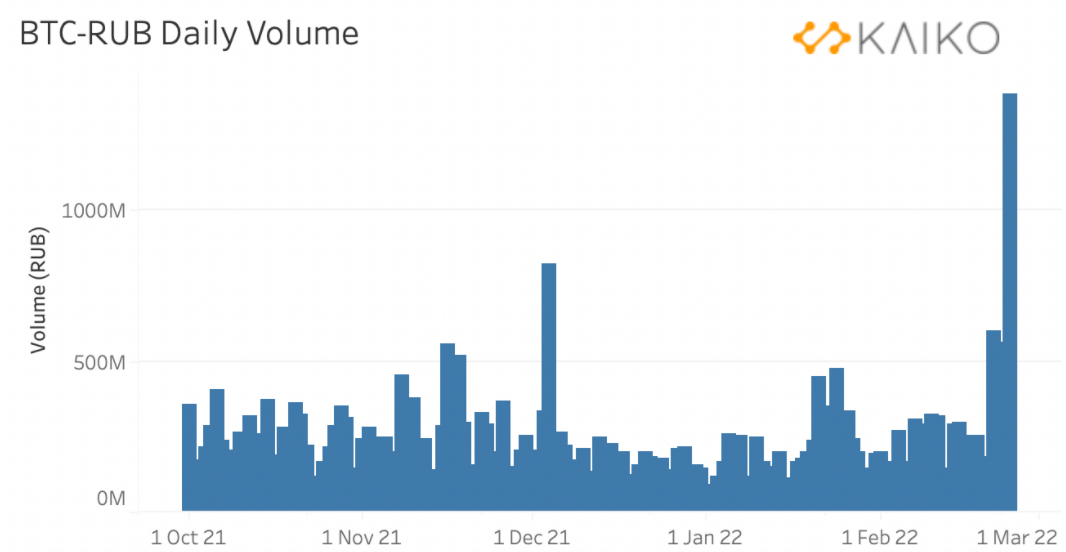

Of training course, if they had Bitcoin, they can have left this fiat misusage. So exactly how regarding we have a look at the quantity on the BTC-Ruble exchanges? Ah yes, the other day we struck a 9 month high, as Russians took off to exchanges as they was afraid even more sanctions as well as ruble weak point.

Via Kaiko

Via Kaiko

It’s not the initial situation of (active)rising cost of living we have actually seen (ask Venezuela or Zimbabwe) neither the initial situation of people being afraid for their cost savings (hello there Greece as well as Cyprus) as well as it highlights simply exactly how effective Bitcoin can be as a property course, needs to it proceed to expand as well as ever before secure. So the means I consider the previous week of fascinating rate activity is this: Bitcoin isn’t a trustworthy shop of worth today, yet we are seeing all the right indications that it’s arriving, as well as it’s provided us a glance of the power it can hold.

Watershed Moment

What’s occurring presently is a watershed minute in background, in that formerly self-governing reserve banks are no more in control of the possessions they typically make use of to conduct economic procedures. And presently, Bitcoin is still a young child discovering to stroll with relates to to its advancement as well as needed facilities (in addition to the marketplace cap stated over), so it would certainly be challenging for a country such as Russia to prevent sanctions using cryptocurrency. The obstacle would certainly be worsened also by the clear nature of the blockchain – a crucial disagreement utilized by crypto lovers in battling versus the idea that crypto can be a device for sovereign malevolence down the line.

But it might not be also away. Indeed, we currently have a famous instance of a state delving into wonderful web cash to prevent sanctions, otherwise on the range of what would certainly be needed for Russia in battling versus half the globe’s limitations: Iran.

Iran’s crypto methods

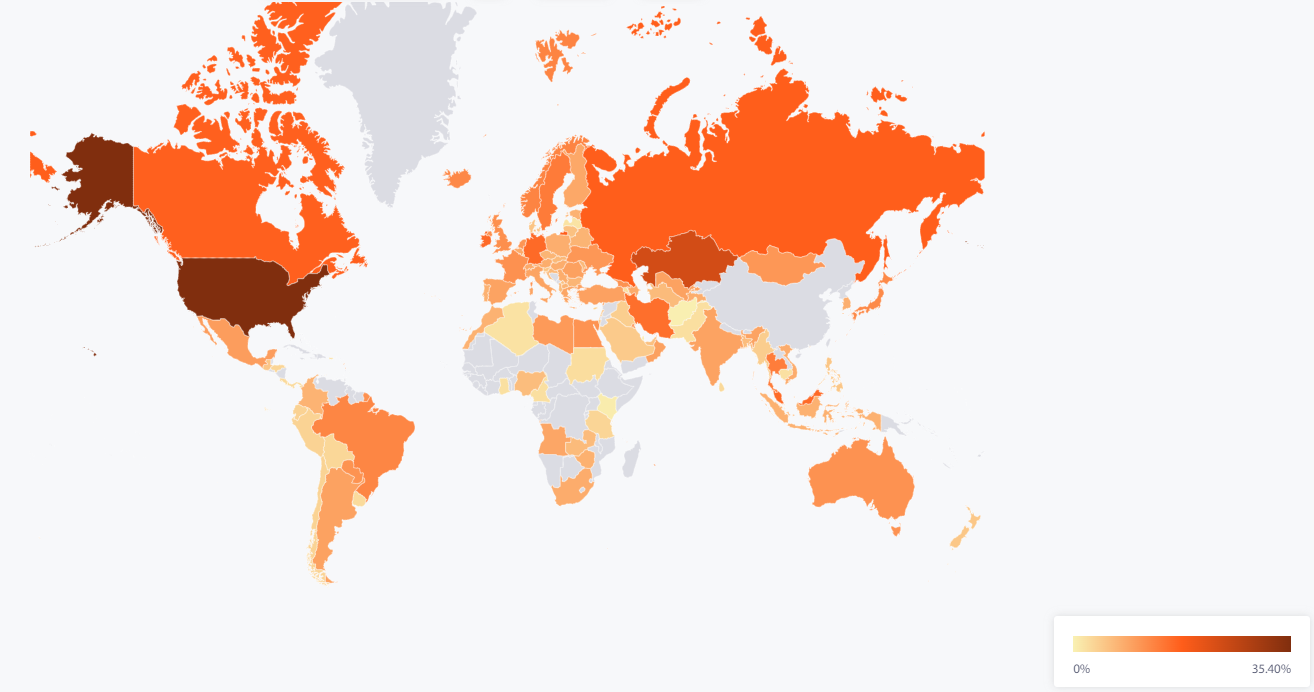

The center eastern nation encounters rigorous sanctions from the United States. Iran’s service, nonetheless, is to transform what power it does not require (Iran has a wealth of nonrenewable fuel sources) right into cash money using purchasing bitcoins from bitcoin miners (that make use of fossil-fuels in their mining). These bitcoins can after that be utilized to acquisition whatever they please, consisting of imports. And the United States can do absolutely nothing regarding it. Russia, for its component, is the 3rd biggest cryptocurrency miner in the globe (typical regular monthly hashrate share of 11% since Jul-21, according to University of Cambridge). To mix the pot a bit much more, Putin showed up to soften his position on cryptocurrency when the Russian reserve bank suggested a restriction on the market: “Of course , we also have certain competitive advantages, especially in the so-called mining, I mean the surplus of electricity and well-trained personnel available in the country”. Hmm.

Cambridge Bitcoin Electricity Index, with Russia the 3rd biggest crypto miner in the globe.

In concluding, it’s very easy to see the course in the direction of a shop of worth for Bitcoin, also if today has actually revealed that, while it’s arriving, it hasn’t fairly attained the safe-haven condition yet. But Satoshi allow the genie out of the container when he developed the blockchain in 2009, as well as geo-political stress in this progressively fragmented as well as disorderly globe (not to point out a specific coronavirus as well as all the vaccination requireds as well as various other effects substantiated of the pandemic) have actually regurgitated all kind of effects as well as possible usage instances for Bitcoin.

Crypto can be excellent! Ukraine’s crypto pocketbooks have, since time of creating, got $31.7 million in contributions, according to blockchain analytics company Elliptic. They are likewise currently approving contributions in Polkadot, with even more to be included quickly

We can dispute whether the effects are excellent or poor (as well as like many points on the range of Bitcoin, there are an option of both), yet something which is ending up being progressively clear is the essential worth as well as myriad usage instances that an option to fiat supplies.

Yes, there are benefits as well as drawbacks, yet in regards to the rate, if you zoom out sufficient, Bitcoin has actually just trended one means traditionally – up. And with the means the globe is heading, I definitely don’t see lots of factors that the future will certainly be any type of various.