Although the cost of bitcoin (BTC) is down by nearly 50% from its all-time high in November, and also the most recent market collision most certainly has actually been really felt by BTC owners, an evaluation of trading quantities during current crashes suggest less coins are being offered this moment around than during the sharp selloff in May and also November in 2015.

Judging from a TradingSight sign referred to as ‘Bitcoin Real Volume,’ just regarding half the USD volume was seen during the week with one of the most extreme marketing stress in November 2021, contrasted to in May the very same year. Meanwhile, the marketing taking place during the most awful week for bitcoin in January this year saw also reduced quantities, the information revealed.

The sign consists of bitcoin trading volume versus both the United States buck and also a variety of USD-pegged stablecoins throughout a handful of the biggest crypto exchanges.

According to the sign, bitcoin trading volume for the week of the marketplace collision in March 2020 can be found in at USD 63.2bn, in May 2021 at USD 200.4bn, in November 2021 at USD 103.6bn, and also most lately in January 2022 at simply USD 78.7bn.

‘Bitcoin Real Volume’ during four market crashes:

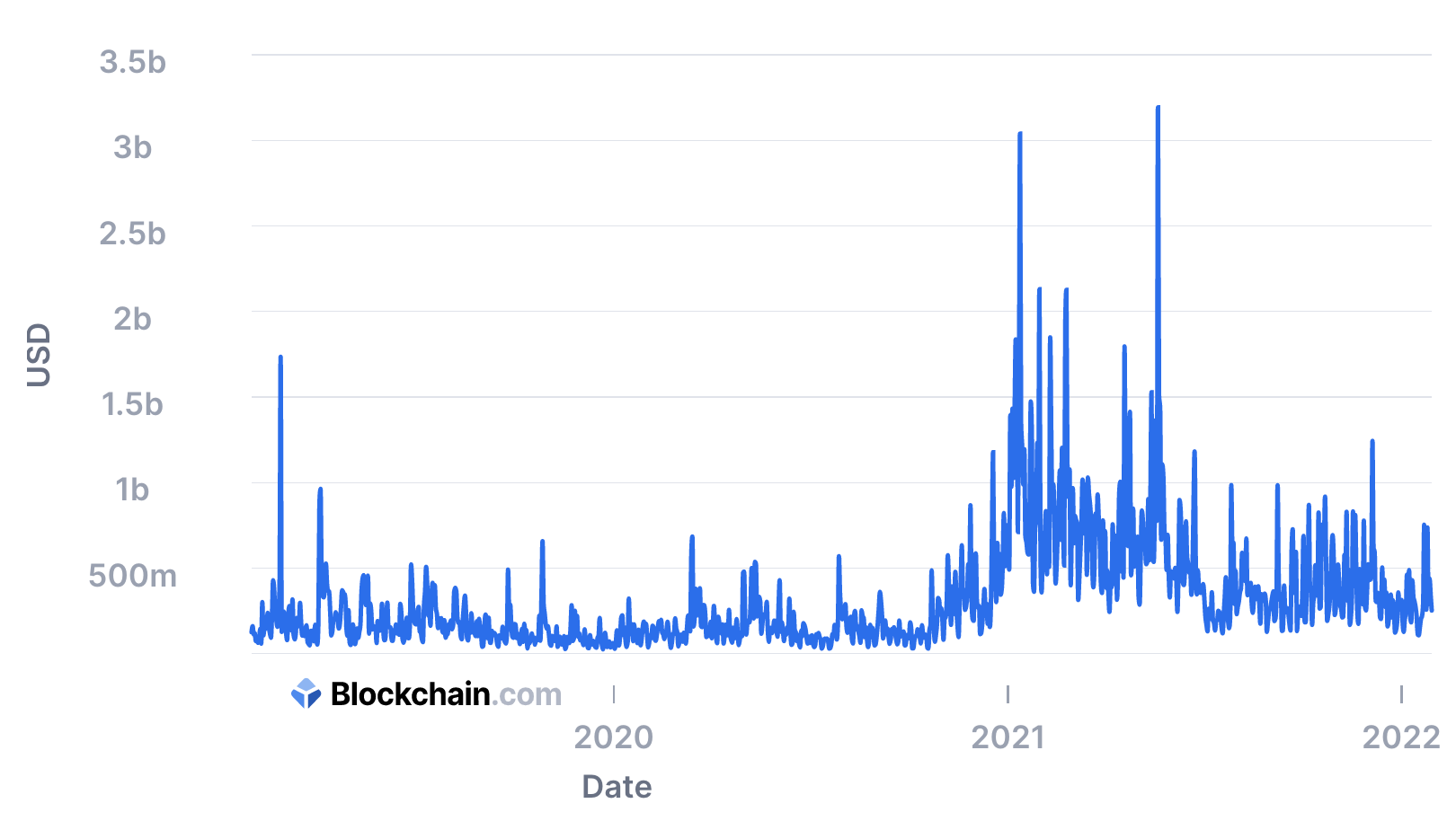

The very same basic fad was likewise mirrored in Blockchain.com’s volume sign, which tracks bitcoin trading quantities from chosen exchanges. Looking at this sign, we see volume spikes in March 2020, May 2021, November 2021, and also January 2022, which all represent market selloffs in those months.

As with the previous sign, Blockchain.com’s information likewise reveals that May 2021 saw one of the most extreme marketing in regards to exchange trading volume, with the selloffs in November 2021 and also January 2022 each lessening than the previous collision.

Bitcoin trading volume on chosen exchanges, per Blockchain.com:

Similarly, volume information from the BTC/USDT trading set on Binance, which is taken into consideration to be the biggest crypto exchange by volume, likewise revealed that the May 2021 selloff was one of the most extreme by volume.

However, a noteworthy distinction with the Binance information was that the March 2020 collision can be found in with the second-biggest volume, complied with by November 2021 and also finally January 2022.

BTC/USDT trading volume on Binance:

With the numbers revealing that May 2021 holds the document throughout all information resources inspected, it appears that much less fiat money has actually been squandered for every succeeding market collision because that month. This can suggest that the weak owners of bitcoin have actually currently offered, with more powerful owners currently staying.

The concept that weak owners are leaving bitcoin and also being changed by more powerful owners was likewise recommended in a record from crypto study company Delphi Digital from earlier in January.

They stated that long-lasting owners have actually utilized January’s reduced rates as a chance to gather even more bitcoin. This can be viewed as component of a transfer from temporary “weak hands” to long-lasting “strong hands,” the record stated.

With bitcoin’s unpredictable nature, nevertheless, it is anybody’s assumption when the trend will certainly once more kip down support of the bulls. But with much less marketing happening for every mini-crash in the coin, the moment for a lower developing out there might be obtaining closer.

At 13:11 UTC, BTC was trading at around USD 37,000 and also was down 20% in a month, cutting its yearly gains to 8%.____Learn more:- Bitcoin to Hit USD 93K This Year, According to Less Optimistic Survey- USD 100K per Bitcoin ‘Hopium’ Now Moved to Mid-2022

– This is What’s Backing Ark’s Big Bitcoin, Ethereum and also Web 3 Forecasts- How Global Economy Might Affect Bitcoin, Ethereum, and also Crypto in 2022- Two Main Macro Scenarios in Play for Bitcoin & Crypto in 2022 – CryptoContrast

– Bitcoin in an Interest Rate Rising Environment- Goldman Sachs Claims Adoption Won’t Boost Crypto Prices, Talks Down Stablecoin Plans