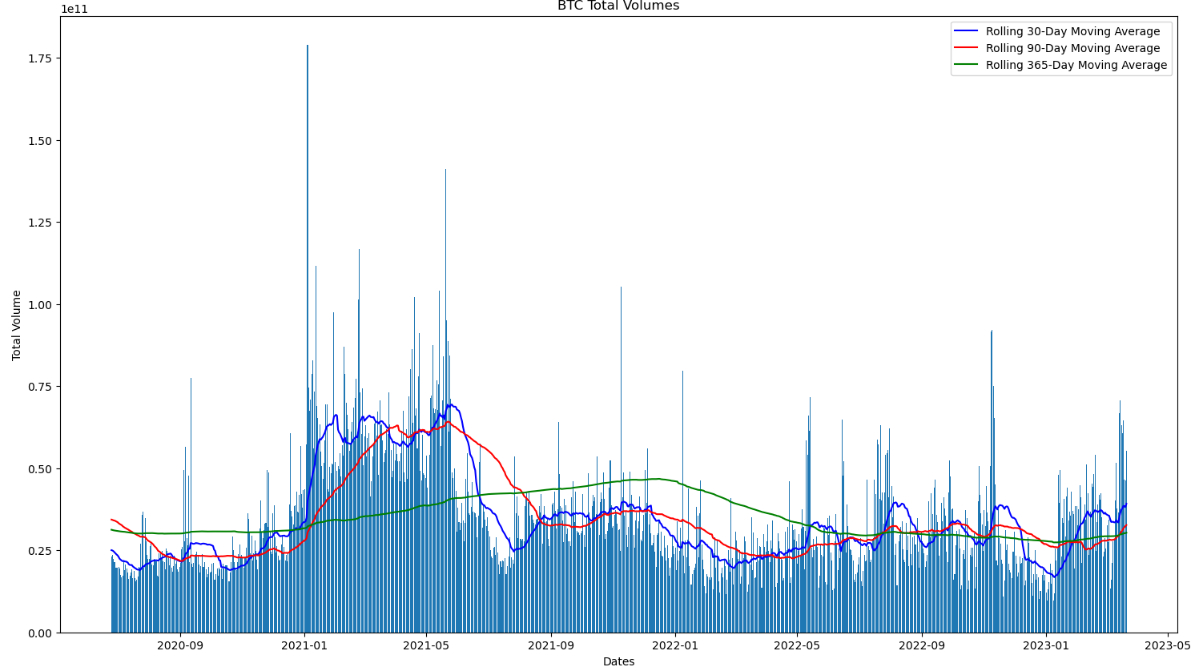

Bitcoin’s bull run since the begin of 2023 which has seen its worth bounce by near 70% has been accompanied by an increase in Bitcoin buying and selling volumes.

Daily buying and selling volumes lately hit their highest degree since the aftermath of the FTX collapse at greater than $70 billion.

Bitcoin was final altering fingers simply above $28,000, up over 40% versus earlier month-to-month lows beneath $20,000.

Indeed, Bitcoin buying and selling volumes seem like in a definitive uptrend, with the 21 and 50-day Moving Average of volumes lately rising above the 200DMA of volumes, and the former closing in on its highest degree since mid-2021.

Rising buying and selling volumes come throughout time intervals of aggressive market motion, i.e. throughout acute bull and bear market phases.

The Bitcoin bulls might be hoping that the market stays inside the former of those phases.

On-chain Metrics Also in a Positive Trend

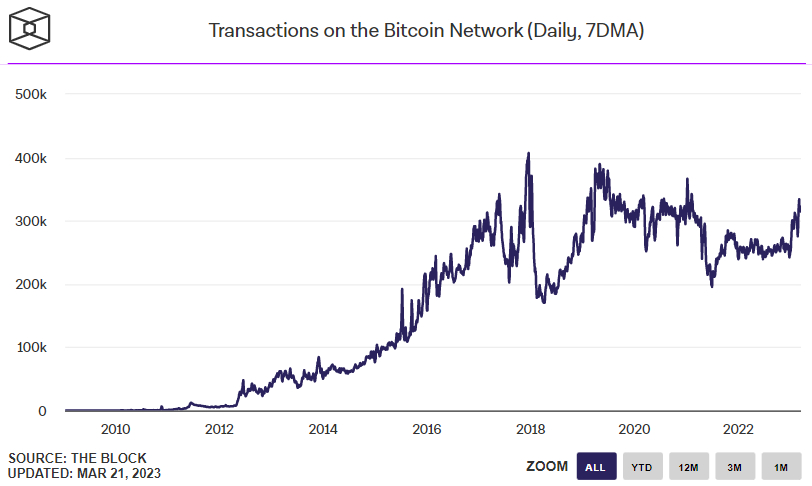

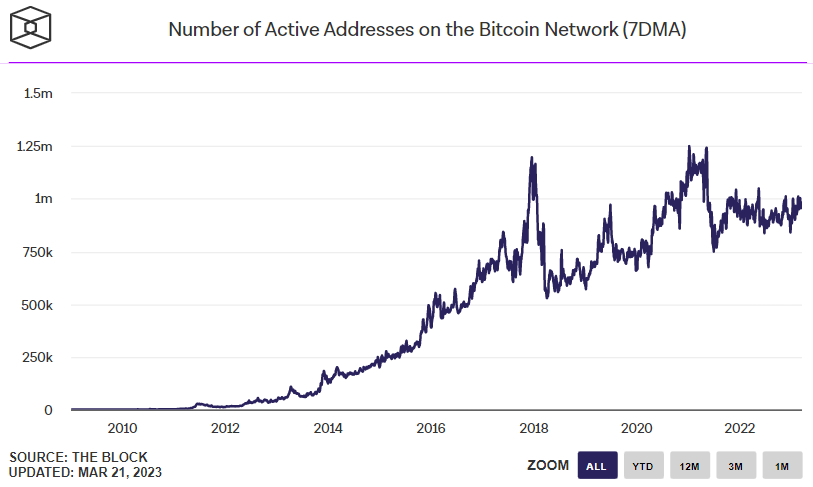

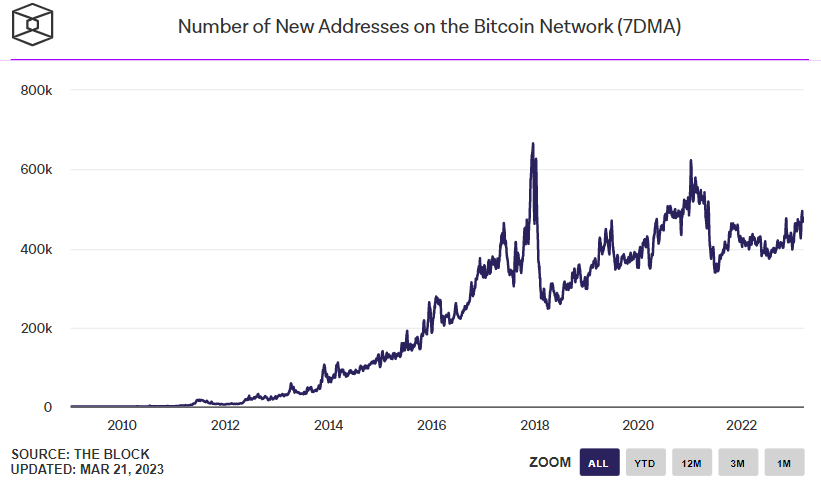

Improvements regarding Bitcoin buying and selling exercise on exchanges comes at a time when on-chain information reveals that exercise on the Bitcoin blockchain itself can also be selecting up.

As may be seen in the beneath graphs introduced by The Block, the variety of transactions happening every day on the Bitcoin blockchain lately hit its highest degree since early 2021.

Meanwhile, the rise in the variety of energetic addresses on the Bitcoin community in current weeks hasn’t been fairly as spectacular, however the metric remains to be near multi-month highs.

Elsewhere, the charge at which new addresses are interacting with the Bitcoin community for the first time has additionally been trending larger.

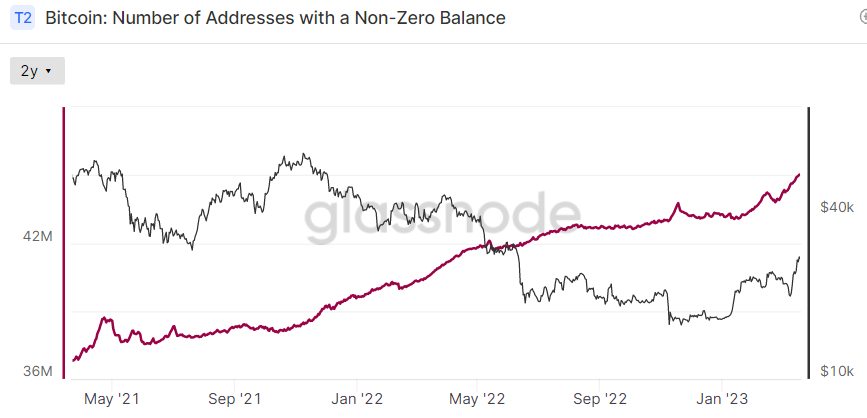

Addresses with a non-zero stability additionally proceed storming larger. According to information introduced by Glassnode, this metric lately surpassed 45 million for the first time.

Financial Crisis Worries Could Send Bitcoin Yet Higher

Despite rising technical indicators that the Bitcoin market is getting sizzling in the brief time period, analysts suppose that rumblings of a monetary disaster may but ship the world’s largest cryptocurrency by market capitalization larger.

Bitcoin has been appearing as a secure haven in current weeks, rallying in tandem with gold as buyers flip to foreign money alternate options that aren’t susceptible to a collapse of the conventional monetary system.

If US Federal Reserve Chairman Jerome Powell fumbles his communications on the outlook for coverage tightening in the aftermath of Wednesday’s coverage announcement, then that might exacerbate disaster considerations.

According to Bloomberg’s Senior Macro Strategist Mike McGlone, Bitcoin’s current robust worth outperformance versus gold is likely to be indicative {that a} new “supercycle” is setting in.

McGlone additionally posited that current relative energy versus most belongings could also be an indication that Bitcoin is transitioning to commerce extra like gold and US treasuries (i.e. a secure haven), reasonably than a threat asset.