This time final week, Bitcoin appeared prefer it is perhaps on the verge of mustering a key short-term bullish breakout. The world’s largest cryptocurrency by market capitalization had fashioned a bullish short-term ascending triangle sample and appeared prefer it was about to break above the important thing $25,200-400 space, opening the door for a fast run increased in the direction of the following main space of resistance round $28,000.

As issues occurred, a mix of macro headwinds (a month of robust US knowledge and hawkish Fed communicate that pushed US yields and the greenback increased and US shares decrease) and US regulatory issues amid a widening crypto crackdown saved the bulls at bay. Bitcoin ended up falling about 3.0% final week and is already one other simply over 1.5% decrease this week.

At present ranges within the low $23,000s, Bitcoin is across the mid-point of February’s $21,400-$25,300ish vary. And merchants/buyers appear to be betting that rangebound situations will ensue for a while. At least, that’s the message that Bitcoin choices markets are sending.

Bitcoin Volatility Expectations Drop After Failure to Break $25K

According to knowledge introduced by The Block, Deribit’s Bitcoin Volatility Index (DVOL) has dropped sharply over the course of the final week, seemingly as a direct results of Bitcoin’s newest failure to break above $25,000, which might have probably resulted in vital (most probably bullish) near-term volatility. The DVOL was final at 50, down from 60 this time final week. That’s not far above the document lows it printed again in January at 42, simply earlier than the 2023 crypto rally actually acquired going.

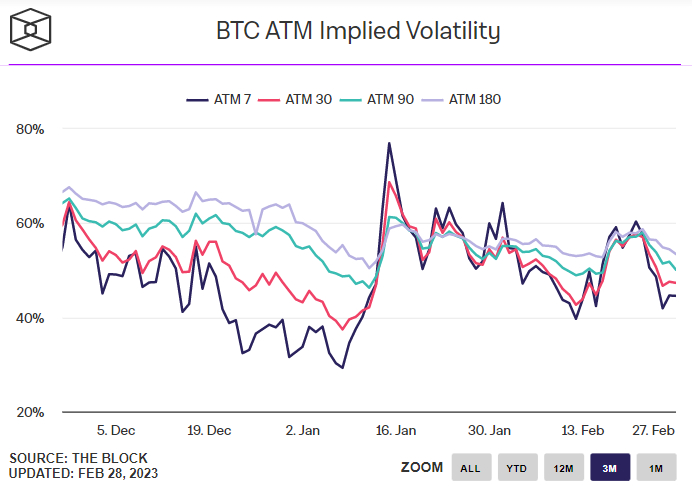

Separately, Implied Volatility in accordance to the pricing of At-The-Money (ATM) choices has additionally dropped sharply, with short-term volatility expectations experiencing the sharpest transfer decrease. According to knowledge introduced by The Block, Bitcoin’s 7-day Implied Volatility was final at 44.55%, down from 60.33% this time final week. 30, 60 and 180-Day Implied Volatility are all additionally down sharply to 47%, 50% and 53.5% from 57%, 58% and 58% respectively this time final week.

Options Markets Mixed on the BTC Price Outlook

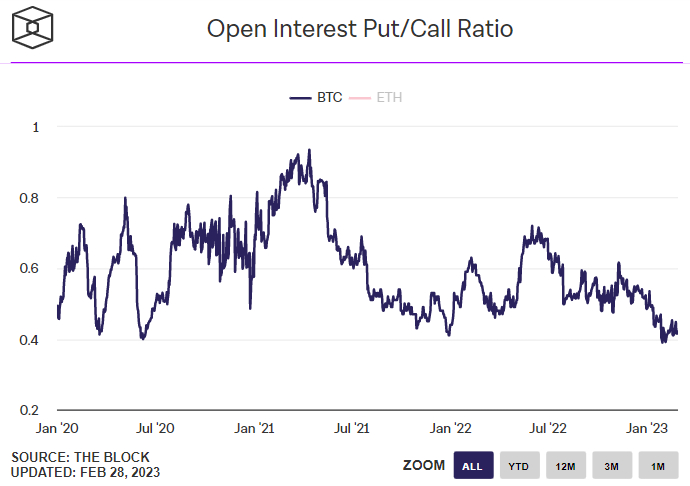

In phrases of what choices markets are saying in regards to the outlook for Bitcoin, the image is blended. On the one hand, the ratio between open curiosity usually bearish Put and usually bullish Call choices sits firmly within the favour of the latter group, and virtually to a document diploma. According to knowledge introduced by The Block, the Open Interest Put/Call Ratio was final 0.42, barely above the document lows it hit earlier this month at 0.39.

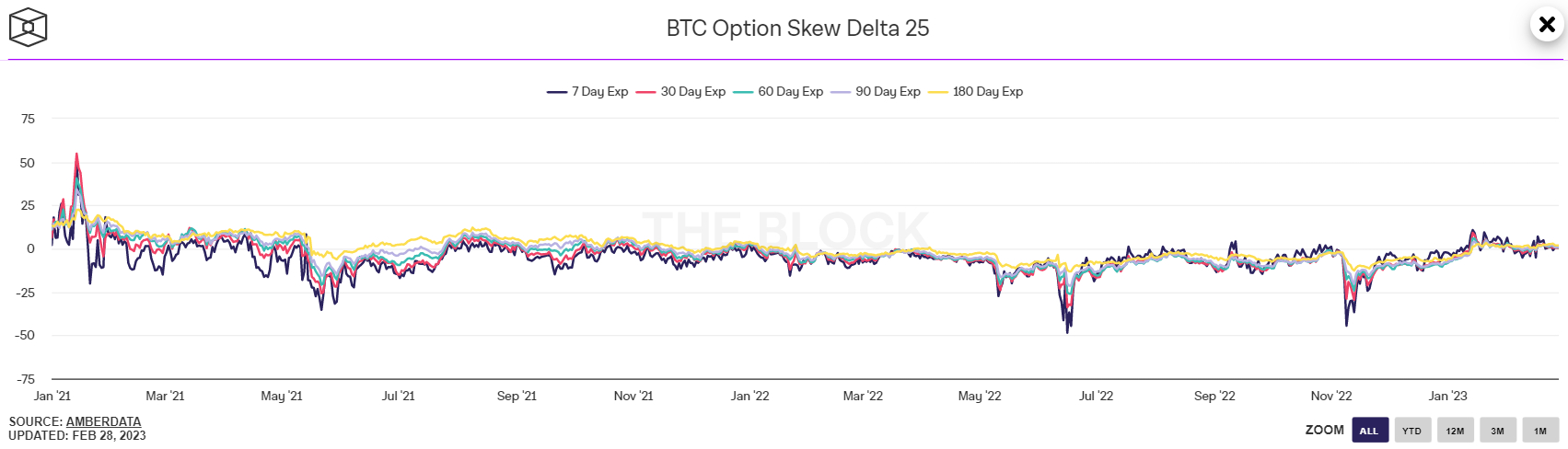

On the opposite hand, the Bitcoin 25% Delta Skew for choices expiring in 7, 30, 60, 90 and 180 days is all shut to zero, implying a impartial positioning bias. The 25% delta choices skew is a popularly monitored proxy for the diploma to which buying and selling desks are over or undercharging for upside or draw back safety by way of the put and name choices they’re promoting to buyers.

Put choices give an investor the proper however not the duty to promote an asset at a predetermined worth, whereas a name possibility provides an investor the proper however not the duty to purchase an asset at a predetermined worth. A 25% delta choices skew above 0 means that desks are charging extra for equal name choices versus places. This implies there’s increased demand for calls versus places, which may be interpreted as a bullish signal as buyers are extra keen to safe safety in opposition to (or wager on) an increase in costs.