The price of bitcoin has actually been on a lengthy losing touch because November 10, 2021, when the leading crypto possession touched an all-time high at $69K each. During the last 2 weeks, bitcoin has actually lost greater than 19% in worth, and the network’s hashrate has actually gone down from over 200 exahash per 2nd (EH/s) to 174 EH/s shedding about 15% in 10 days.

Civil Unrest in Kazakhstan Leads to Hashrate Loss Speculation, Kazakhstan’s Bitcoin Miners Say Issues Did Not Affect Them

This week the civil discontent in Kazakhstan created a great deal of individuals to guess on whether it would certainly impact Bitcoin’s international hashrate. The factor for this presumption is due to the fact that it is approximated that Kazakhstan represent at the very least 18% of the international hashrate, according to one of the most current price quotes from the Cambridge Centre for Alternative Finance (CCAF). Looking at the 30-day graph for Bitcoin’s (BTC) hashrate suggests that the procedure’s hashpower shed about 15% in 10 days.

Reports originating from Kazakhstan suggest that the civil discontent has actually maintained and the nation’s Data Center Industry and Blockchain Association of Kazakhstan (NABCD), claimed the concerns did not impact electronic money miners. There were a couple of concerns that might have impacted bitcoin miners over the recently that are not connected with the issues in Kazakhstan.

Bitcoin’s Low Price and Higher Difficulty Puts Pressure on Bitcoin Miners

Five days earlier, bitcoin (BTC) was trading hands for $46.5K each yet the price glided greater than 10% in worth. Moreover, over a month earlier, the very best executing mining gear with greater than 100 terahash per 2nd (TH/s) would certainly obtain $25 to $30 each day, per equipment, and a power price of $0.12 per kilowatt-hour. Today, that very same mining gear will certainly generate $14.87 each day at the time of creating, utilizing the very same electric intake. The bitcoin price decline can most absolutely impact the hashrate and can be among the factors it has actually gone down 15%.

Another reason the hashrate went down 15% can be as a result of the last mining difficulty rise. The last rise occurred on January 8, 2022, as the network’s mining difficulty leapt 0.41 % greater. While that might not be that much of a boost, the difficulty is terribly near the metric’s all-time high, and the network has actually seen 3 successive rises in a row. In greater than 11 days from currently, the mining difficulty is anticipated to raise once again, up 0.67% where it is today.

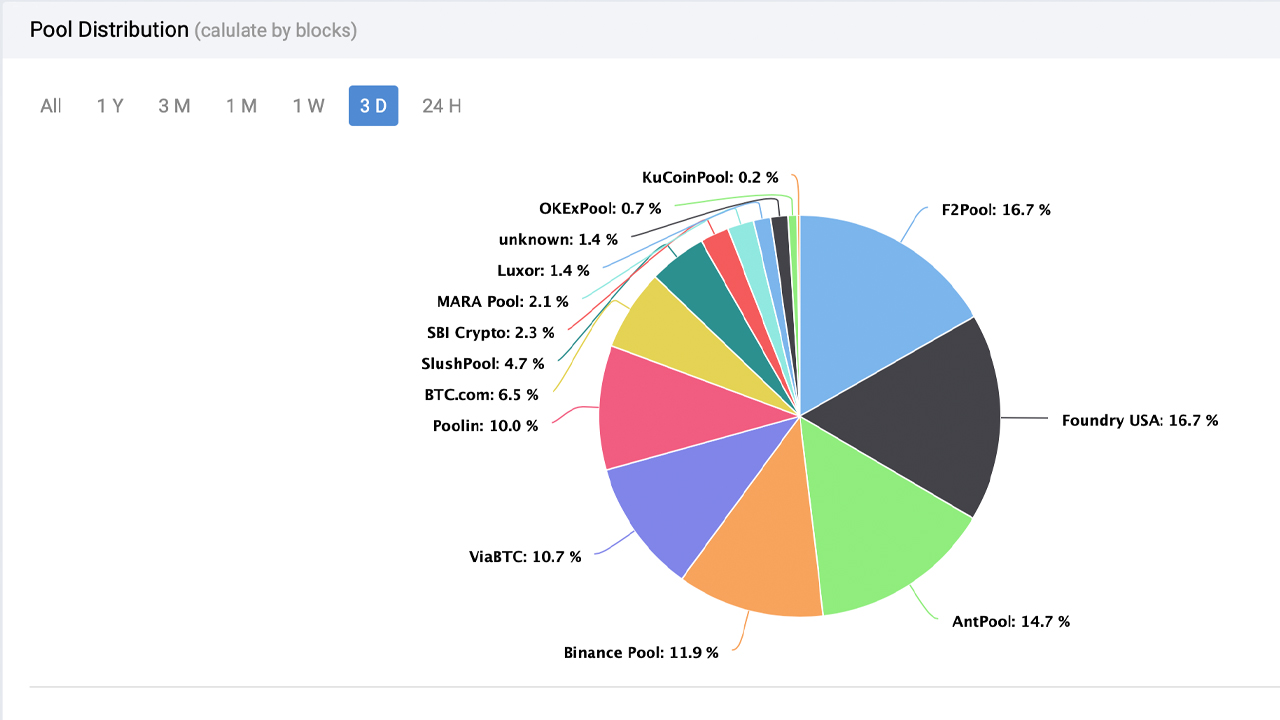

Currently, swimming pool circulation data over the last 3 days reveal F2pool and Foundry U.S.A. are the globe’s leading mining swimming pool today, as both swimming pools have 16.74% of the international hashrate each or 29.03 EH/s per swimming pool. There are 13 well-known mining swimming pools devoting SHA256 hashrate to the BTC chain and unidentified hashrate stands for 1.40% of the accumulation or 2.42 EH/s. Despite the current hashrate decline, from December 31 up till today, the hashrate is up 26.08% because the day prior to the brand-new year.

What do you think of Bitcoin’s hashrate shedding 15% in the last 10 days? Let us understand what you think of this topic in the remarks area listed below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Coinwarz, Btc.com,

Disclaimer: This post is for educational functions just. It is not a straight deal or solicitation of a deal to purchase or market, or a suggestion or recommendation of any kind of items, solutions, or firms. Bitcoin.com does not offer financial investment, tax obligation, lawful, or audit guidance. Neither the firm neither the writer is accountable, straight or indirectly, for any kind of damages or loss created or affirmed to be triggered by or in link with using or dependence on any kind of material, items or solutions stated in this post.