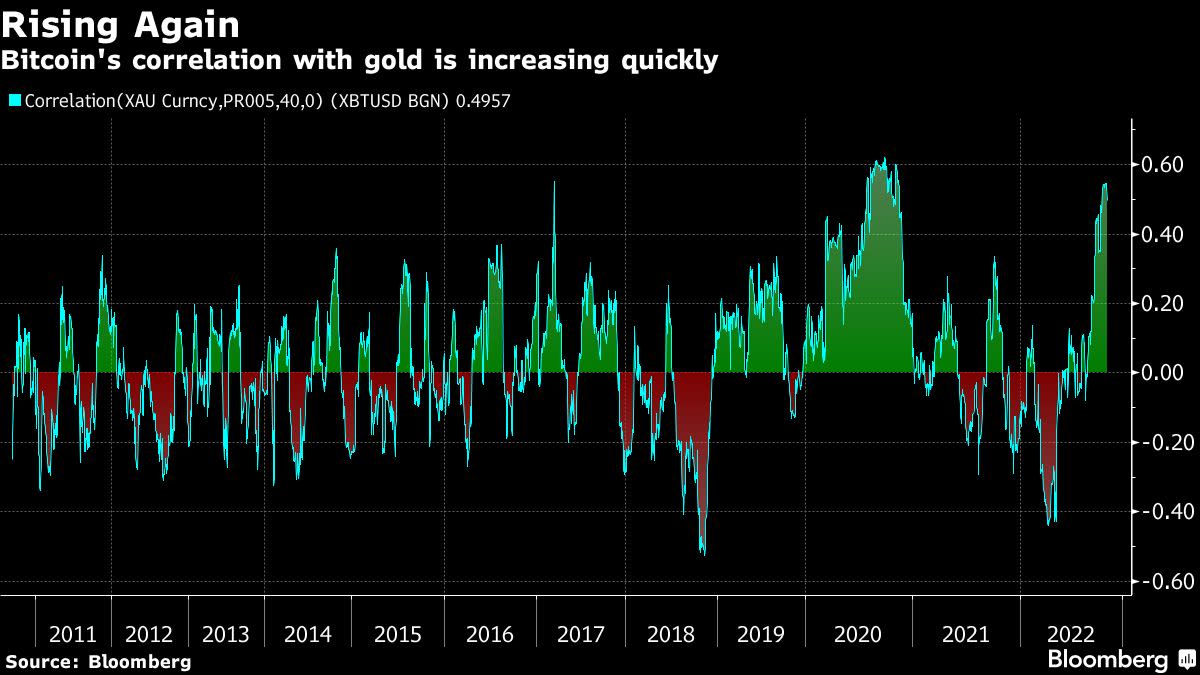

Amid the financial uncertainty affecting a myriad of nations worldwide, Bank of America Securities market strategists defined in a be aware this week that the main crypto asset bitcoin has been correlated with the well-known valuable steel gold. Bank of America analysts Alkesh Shah and Andrew Moss famous “that investors may view bitcoin as a relative safe haven as macro uncertainty continues.”

Bank of America’s Market Strategists Say Bitcoin’s Rising Correlation With Gold Indicates ‘Investors May View Bitcoin as a Relative Safe Haven’

Market strategists from Bank of America’s securities division, Alkesh Shah and Andrew Moss, detailed this week that bitcoin and gold have been extremely correlated in latest occasions. The information follows the latest report revealed by the crypto information supplier Kaiko, which says bitcoin has been much less risky than the Nasdaq and S&P 500 indices. According to the Bank of America strategists, bitcoin’s (BTC) value fluctuations, in phrases of different world property, have brought on traders to suppose BTC is a safe-haven asset.

“A decelerating positive correlation with SPX/QQQ and a rapidly rising correlation with XAU indicate that investors may view bitcoin as a relative safe haven as macro uncertainty continues and a market bottom remains to be seen,” Bank of America’s securities division analysts wrote.

On Monday, October 24, each bitcoin (BTC) and gold costs have been vary sure, and have been much less risky compared to fairness markets. BTC is buying and selling for simply above $19K per unit, whereas an oz. of .999 superb gold is exchanging fingers for 1,646.70 nominal U.S. {dollars}. Bank of America’s Shah and Moss have been monitoring the 40-day correlation with gold, which is round 0.50 this week. The 0.50 score is a lot nearer and reveals a stronger correlation to the valuable steel than the zero score the main crypto asset BTC recorded in August.

The transfer comes at a time when macro uncertainty has heightened, and analysts have warned that U.S. Federal Reserve charge hikes may trigger a U.S. Treasuries liquidity disaster. Market observers count on an aggressive charge hike subsequent month, however strategists additionally consider the Fed will pivot by December. Both gold and BTC have fallen a nice deal for the reason that two asset’s all-time value highs. Gold as an illustration tapped a lifetime value excessive in opposition to the U.S. greenback on March 8, 2022, when it reached $2,074 per ounce.

Gold has misplaced 20.49% in opposition to the U.S. greenback for the reason that all-time excessive 230 days in the past. The crypto asset bitcoin (BTC) has shed 72% in opposition to the dollar over the past yr, after tapping $69,044 per unit on November 10, 2021. Gold in the present day has an total market capitalization of round $10.895 trillion, whereas BTC’s market capitalization is round $369 billion.

What do you consider Bank of America’s Shah and Moss explaining that gold and bitcoin have been correlated over the past 40 days? Do you suppose traders understand bitcoin as a safe-haven amid in the present day’s macro uncertainty? Let us know your ideas about this topic within the feedback part under.

Image Credits: Shutterstock, Pixabay, Wiki Commons, editorial photograph credit score: Bloomberg

Disclaimer: This article is for informational functions solely. It just isn’t a direct provide or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any injury or loss brought on or alleged to be attributable to or in reference to the use of or reliance on any content material, items or providers talked about on this article.