Blur.io ’s native governance token fell 87% after the Blur.io market unlocked 360 million beforehand airdropped tokens.

At press time, BLUR had fallen over 80% to $0.63 from an all-time excessive of $5.01, reached simply earlier than the unlock.

Blur Admits to NFT Wash Trading

According to Ethereum News, some BLUR holders singled out Blur.io’s silence on the token’s tokenomics as the rationale behind the collapse.

Blur later acknowledged the presence of wash buying and selling on the platform, i.e., artificially inflating the worth of a monetary instrument by shopping for and promoting it concurrently. It mentioned it had processed $1.2 billion in non-wash-trade volumes since its launch in October 2022.

The pro-NFT market awarded BLUR tokens in care packages airdropped to merchants and bidders within the final 4 months.

Blur.io airdropped its first spherical of care packages to early merchants who migrated from rival marketplaces in Oct. 2022 after which airdropped packages to merchants and bidders within the second and third rounds. Recipients of the latter airdrops obtained extra tokens than earlier ones.

Users Can Look to Rarible DAO for Incentive Structure

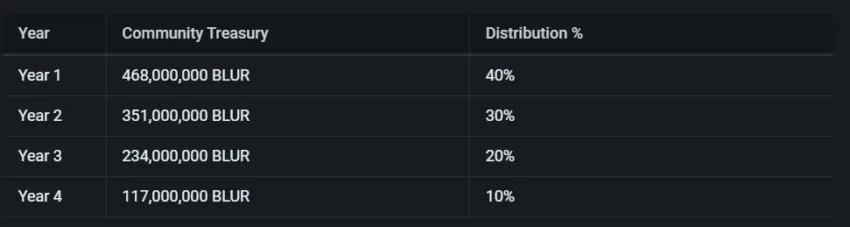

Despite consumer claims, Blur has printed a schedule for unlocking an extra 2.64 billion BLUR. The venture will launch 39% of BLUR to the DAO treasury throughout the subsequent 4 years.

Ten p.c of these tokens will go towards a finances for incentive packages, which can assist to drive engagement in response to a technique utilized by a competitor Rarible.

Creator-focused Rarible, an early pioneer within the DAO-run NFT market, encourages buying and selling by awarding RARI to entities that purchased or bought NFTs within the earlier week. RARI holders may also lock their tokens in a locking contract to earn veRARI used for voting and perks

Initially, Rarible launched its RARI token as a governance token to allow customers to vote on modifications to {the marketplace}. A core group retains the prerogative on whether or not to execute any proposals.

Last yr, Solana market Magic Eden issued particular passes to lively customers that used the platform within the earlier month. The customers may vote as half of MagicDAO on varied points, together with which tasks to function on the homepage and easy methods to handle DAO funds.

Again, Magic Eden’s crew and neighborhood ruled the venture earlier than token holders.

For Be[In]Crypto’s newest Bitcoin (BTC) evaluation, click on right here.

Disclaimer

BeInCrypto has reached out to firm or particular person concerned within the story to get an official assertion in regards to the latest developments, however it has but to listen to again.