The cryptocurrency market has been experiencing some fluctuations lately, with Bitcoin and Ethereum, the 2 most generally used cryptocurrencies, going through a slowdown. Bitcoin is at present being traded at $24,000, experiencing a slight drop from yesterday as a consequence of issues over market liquidity.

Similarly, Ethereum has seen a 3% decline up to now 24 hours and is at present buying and selling at $1,600.

The cryptocurrency market has lately skilled some ups and downs, with the 2 most generally used cryptocurrencies, Bitcoin and Ethereum, going through a slowdown.

Additionally, different common cryptocurrencies reminiscent of Dogecoin, Solana, Ripple, and Litecoin have all misplaced floor.

However, the declines have been pushed by ongoing issues about Credit Suisse, a financial institution in Europe that’s going through challenges. Investors are anxious that this might result in a banking disaster, which may have an effect on Bitcoin costs within the quick time period.

Bitcoin Drops to $24,000 as Crypto Market Faces Downward Stance Amidst Signature Bank Closure

Bitcoin’s value has skilled a vital decline, and the cryptocurrency market has been typically downward these days. Along with the lower in Bitcoin’s worth, there was some information in regards to the closure of Signature Bank.

Some buyers have been involved that the closure may be associated to cryptocurrency, which may have additional impacted the market. However, the New York Department of Financial Services (NYDFS) has clarified that the closure will not be linked to cryptocurrency.

The New York Department of Financial Services (NYDFS) has reassured buyers that the current closure of Signature Bank will not be associated to any cryptocurrency issues.

Nevertheless, the cryptocurrency market has been struggling, with Bitcoin’s worth experiencing a vital drop. Investors are monitoring the scenario carefully, however the market seems to be going through challenges within the quick time period.

US PPI and Economic Uncertainty Weigh on BTC

The current US Producer Price Index knowledge has been constructive, however buyers stay cautious as a consequence of issues about world banks and the general state of the financial system. Despite a transient spike in worth, Bitcoin and different cryptocurrencies skilled a value decline.

This downward development could be attributed to a number of components, together with ongoing troubles with world banks, notably issues surrounding Credit Suisse, which has raised worries about market liquidity. As a end result, some buyers have gotten uneasy and promoting their holdings, resulting in a drop within the worth of cryptocurrencies reminiscent of Bitcoin.

Furthermore, the macroeconomic setting stays sluggish, and financial uncertainty and banking issues have created a cautious buying and selling ambiance. As a end result, buyers have gotten extra cautious about the place they make investments their cash, which is contributing to the downward development of Bitcoin and different cryptocurrencies.

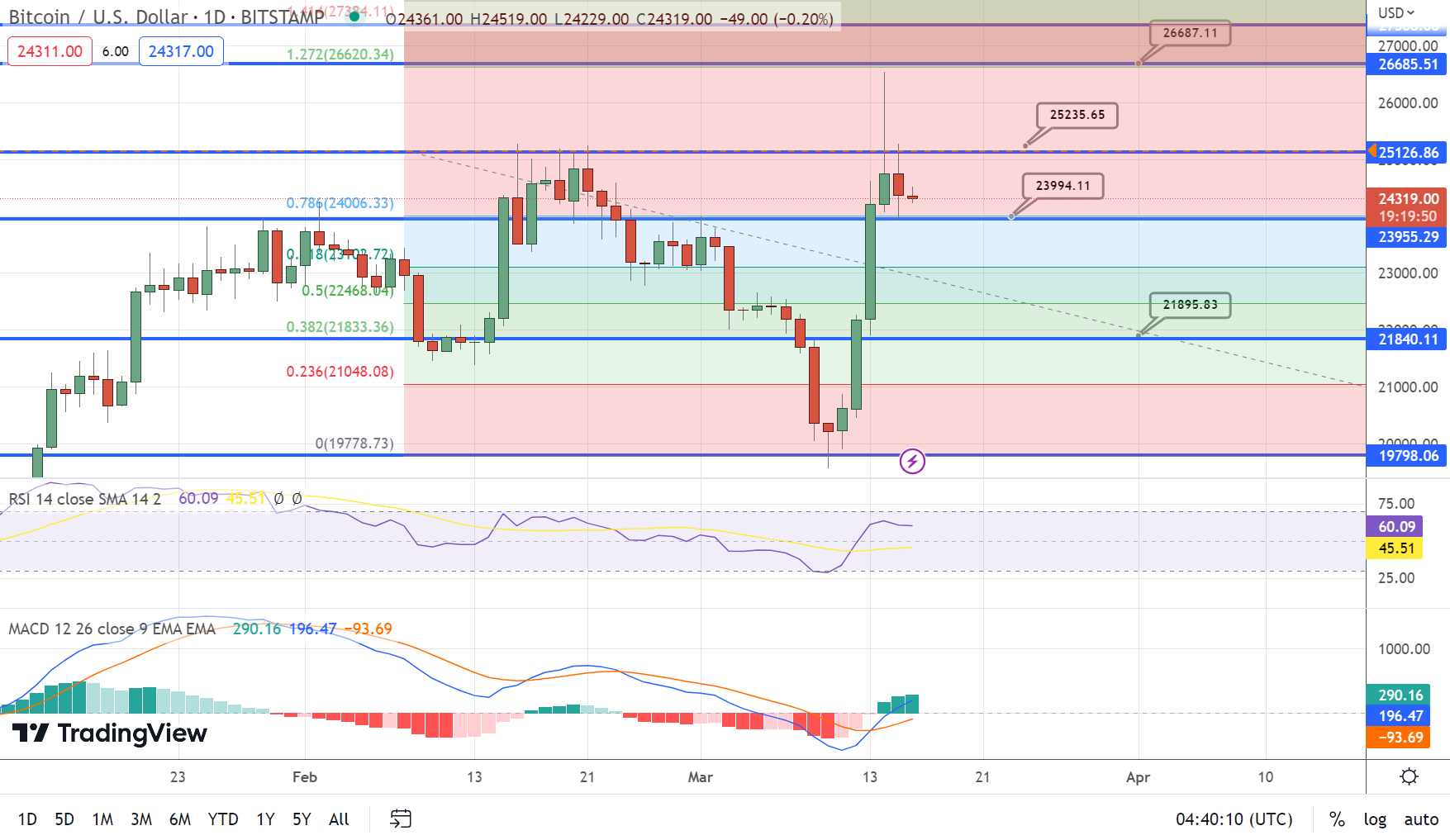

Bitcoin Price

Following a transient consolidation at $26,500, the Bitcoin value has skilled a sharp decline. As a end result, it has been on a short-term destructive development because it broke beneath the $25,000 and $25,500 help ranges.

If the worth can shut over $25,200, it might set off a new uptrend above $26,000, with a important resistance stage at the $26,500 zone. If $26,000 is damaged, $27,500 won’t be far behind.

Yet, Bitcoin may see one other dip if it can’t break by means of the $25,200 resistance stage.

Currently, $24,000 is offering near-term help on the draw back, with the $23,500 space and the 100-hourly easy transferring common offering further, extra substantial help not far behind.

Whenever the worth drops beneath $22,600, the promoting stress is prone to improve. If losses persist, the worth would possibly drop beneath $22,000.

Buy BTC Now

Ethereum Price

After breaking by means of the $1,600 barrier, Ethereum’s value started a vital ascent. For ETH to advance even farther into a constructive zone, similar to bitcoin, it needed to break by means of the essential $1,700 barrier zone.

The value lastly broke by means of the $1,745 barrier and was buying and selling towards $1,800. A peak was established near $1,784, after which there was a retracement to the destructive.

If Ethereum cannot break by means of $1,745, we may see one other drop. In the quick time period, the development line and the $1,695 value level will present as early help for the market.

Buy ETH Now

Top 15 Cryptocurrencies to Watch in 2023

Check out Cryptonews’ Industry Talk workforce’s curated checklist of the highest 15 altcoins to look at in 2023. The checklist is steadily up to date with new ICO initiatives and altcoins, so be sure to go to usually for the newest updates.

Disclaimer: The Industry Talk part options insights by crypto business gamers and isn’t a a part of the editorial content material of Cryptonews.com.

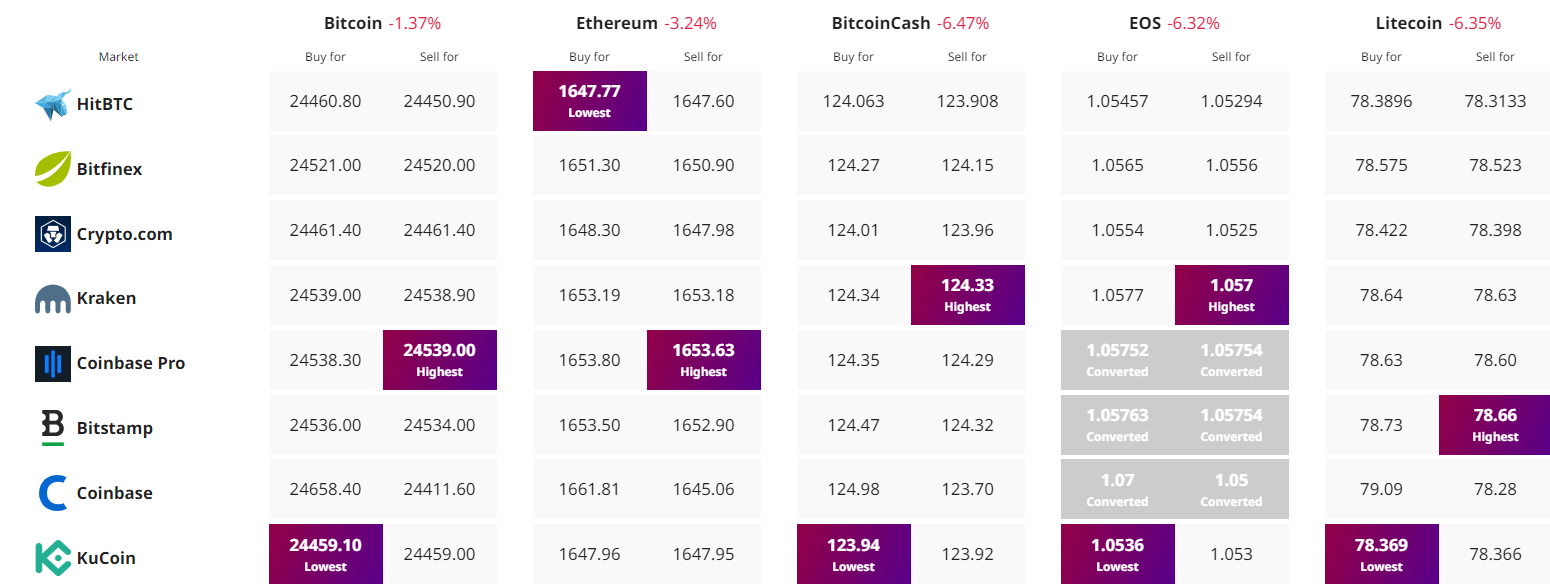

Find The Best Price to Buy/Sell Cryptocurrency