Bitcoin (BTC) has made a big transfer available in the market because it shattered the essential $27,200 degree.

This breakout has sparked hypothesis amongst merchants and buyers in regards to the future path of Bitcoin’s worth.

One key indicator to look at within the coming days is the 50-day Exponential Moving Average (EMA), which has the potential to behave as a assist degree and set off a possible bounce-off.

As Bitcoin continues its worth motion, market members eagerly await additional developments to evaluate the energy of the present bullish momentum.

Paul Tudor Jones: Bitcoin within the US Faces “Real Problem”

Billionaire hedge fund supervisor Paul Tudor Jones believes that Bitcoin is dealing with important challenges within the United States because of the hostile regulatory setting.

Furthermore, his expectation of decrease future inflation diminishes the constructive outlook for the cryptocurrency.

Taking these components into consideration, Jones expressed doubts about Bitcoin’s attractiveness within the coming months.

The regulatory panorama within the United States has undergone modifications following the downfall of FTX in November 2022, resulting in elevated warning surrounding the cryptocurrency market.

Recent statements from hedge fund supervisor Paul Tudor Jones exhibit a extra cautious stance in direction of Bitcoin in comparison with his earlier remarks.

He emphasised the significance of holding money whereas expressing confidence within the Federal Reserve’s means to deal with considerations about inflation.

While Jones acknowledged the approaching challenges for Bitcoin, he additionally expressed perception in its long-term potential.

He famous that its most important enchantment lies in the truth that people can not manipulate its provide, which is why he intends to carry onto his Bitcoin holdings.

Crypto Investment Funds Experience 4 (*50*) Weeks of Outflows

According to a report revealed by CoinShares on Monday, Digital Asset Investment Funds skilled web outflows of $54 million final week, marking the fourth consecutive week of outflows.

The constant outflows of such a big quantity point out that the destructive sentiment isn’t restricted to some buyers, however reasonably an increasing number of people are divesting from crypto funding funds.

The report highlights that out of the $54 million exiting the market, $38 million belonged to Bitcoin-related merchandise.

In the previous 4 weeks, the full outflows of Bitcoin have reached $160 million, accounting for about 80% of the full outflows throughout all cryptocurrencies throughout the identical interval.

As the online outflows of crypto funding funds proceed to extend, cryptocurrency costs have skilled a notable decline, falling from $28,000 to $26,000 inside a span of 10 days.

US Debt Ceiling Negotiations and Retail Sales Data Influence the USD Market

On Tuesday, the US Dollar Index (DXY), which measures the worth of the buck towards a basket of six main currencies, rose by 0.04% to achieve 102.45.

Today, the US Economic Docket will launch a extremely influential report on Retail Sales for the month of April. It is predicted that Retail Sales in April will present a progress of 0.8%, with Core Retail Sales projected to extend by 0.5%.

In addition, essential US Debt Ceiling Talks are set to begin between House Republicans and the White House on Tuesday.

President Joe Biden is scheduled to fulfill with House Speaker Kevin McCarthy and different congressional leaders to debate the debt ceiling.

On Monday, US Treasury Secretary Janet Yellen reiterated her considerations, stating that the US might probably default on its obligations in early June if Congress fails to take motion.

The US greenback has been gaining some bets forward of the discharge of the US debt ceiling speak’s outcomes and the US Retail Sales information on Tuesday.

Bitcoin Price

Bitcoin is at present buying and selling at $27,126, experiencing a 0.48 p.c lower on Tuesday. Following a two-day restoration, the BTC/USD pair confronted some strain on Tuesday, influenced by combined sentiment prevailing available in the market.

The $26,800 resistance degree on the four-hour chart, which has now changed into a assist degree, presents a possible reversal level for Bitcoin.

The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), two essential technical indicators, at present counsel that the market is coming right into a shopping for zone.

This means that if Bitcoin manages to carry above the $26,800 degree, there’s a excessive chance of a bullish rebound concentrating on $27,800 or $27,500.

It is price noting that the 50-day Exponential Moving Average (EMA) acts as a big resistance level round $27,500, indicating {that a} bearish sentiment nonetheless prevails available in the market.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

The Cryptonews Industry Talk workforce has curated an inventory of promising cryptocurrencies for 2023 that present robust prospects. These cryptocurrencies exhibit substantial potential for progress within the close to and distant future.

Disclaimer: The Industry Talk part options insights by crypto trade gamers and isn’t part of the editorial content material of Cryptonews.com.

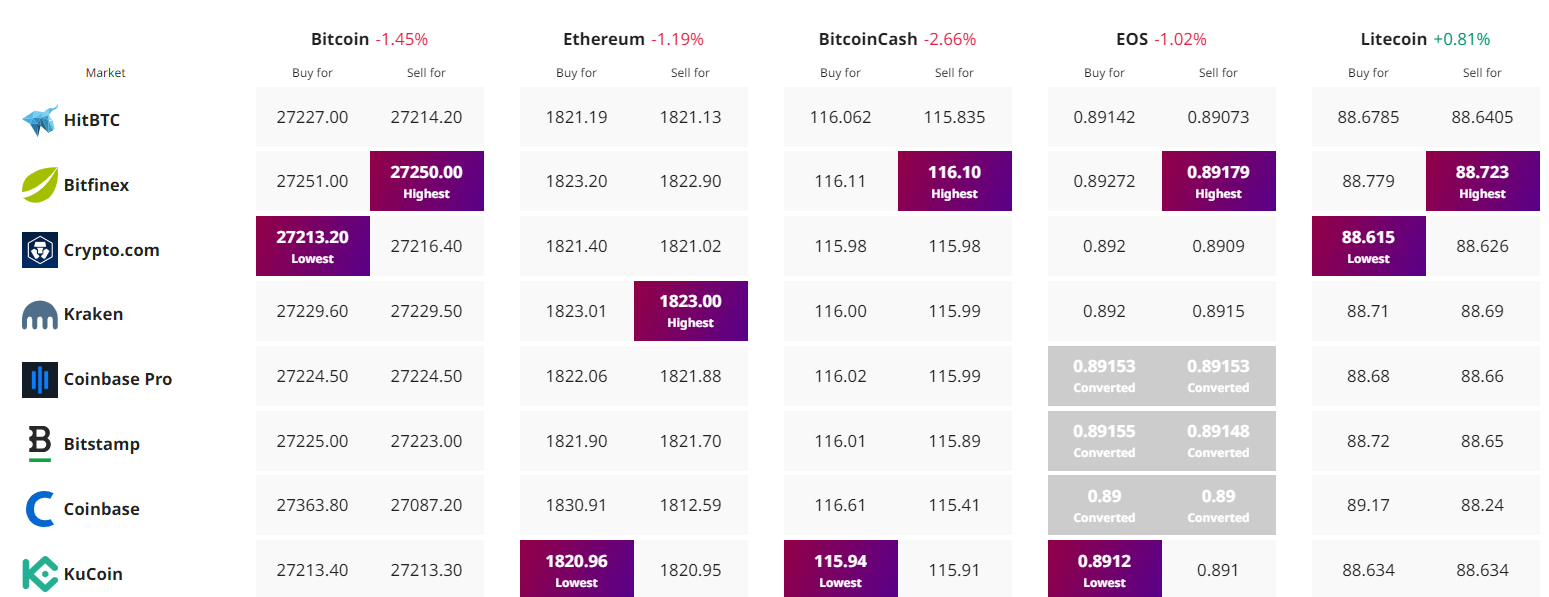

Find The Best Price to Buy/Sell Cryptocurrency