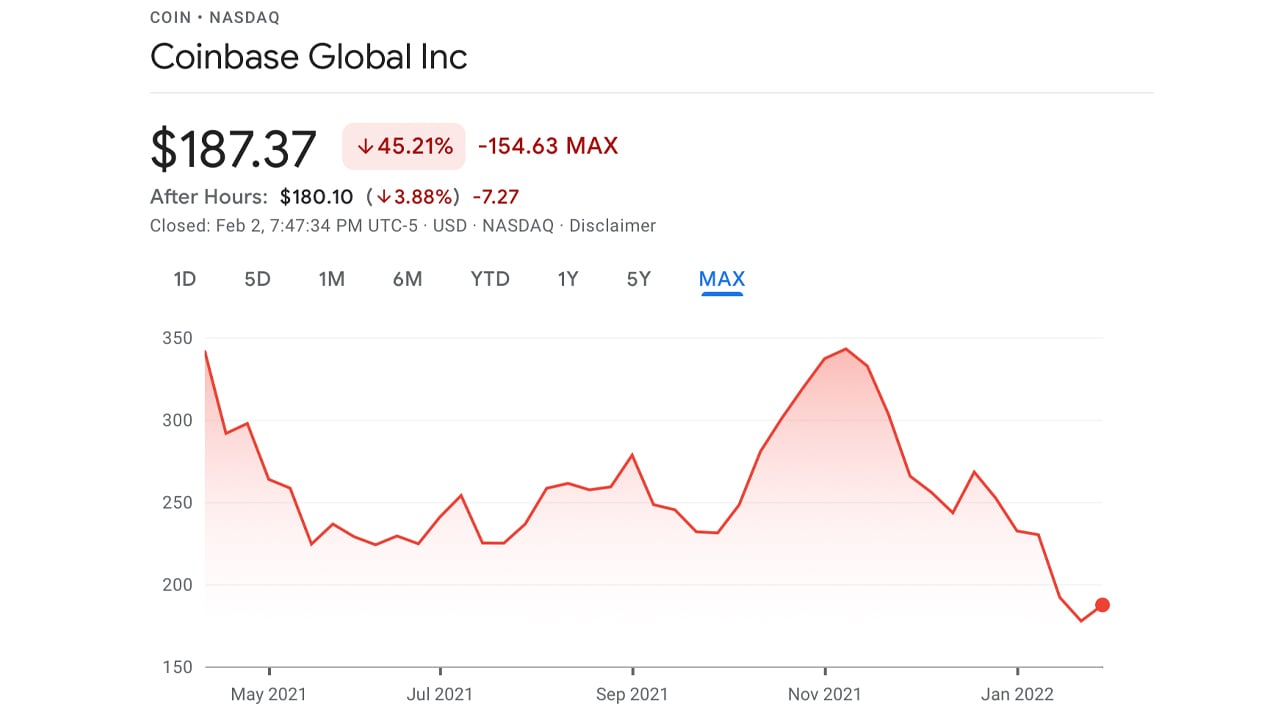

Roughly 9 months earlier, Coinbase’s going public (IPO) by means of a straight listing on Nasdaq introduced, and shares exchanged for $342 per share on April 16, 2021. Since after that, Coinbase shares have actually come by near to fifty percent that worth and today, COIN is exchanging for greater than 45% reduced at $187 each.

Coinbase Follows Bitcoin With Shares Down 45% From ATH

Coinbase (Nasdaq: COIN) is a prominent crypto company and electronic possession exchange with 8.8 million regular monthly negotiating individuals throughout its elevation in Q2 2021. The organization started by Fred Ehrsam and Brian Armstrong in 2012 formally went public on Nasdaq on April 14, 2021, by means of a straight listing. As the business heads right into its tenth functional year, COIN shares have actually been trading for a lot less than the stock’s worth on April 16 and November 12, 2021.

When COIN initial introduced, the stock market Nasdaq chose a first $250 per share recommendation cost. Two days later on — and while bitcoin (BTC) got to $64K each — COIN touched a high of $342 per share. The Coinbase stock decreased in worth afterwards day, and dipped to a combined low of $242 throughout the months of May with September, with a couple of dives to the $250-278 variety throughout that time.

The Nasdaq-traded stock follows along with BTC’s variations like lots of crypto-asset companies that have direct exposure to this brand-new possession course. So when BTC added to an additional cost high past $64K to an all-time high of $69K, COIN struck an additional $342 cost high. The stock is currently near to half the $342 cost high, and is 45.16% reduced in worth, trading at $187 per share. Similar to BTC, the cost is a lot less than the ATH and in December COIN had a short Holiday rally along with the crypto economic situation’s passing return that month.

‘Fed’s Stance on Interest Rates Could Hurt the Stock’s Momentum,’ Says Boston Data Analyst Firm Trefis

In a current article, the Boston-based information and analytics company Trefis asked if the Coinbase stock was a bargain after such a large modification. “The stock currently trades at just about 22x our projected 2021 earnings, which is not a particularly rich valuation for a highly profitable and futuristic stock with solid long-term earnings potential,” Trefis stated on Wednesday. “For perspective, Coinbase’s net margins stood at an incredible 57% over the first three quarters of 2021.”

The information and analytics company included:

However, the cryptocurrency market is naturally intermittent, and the probabilities are that we might be coming close to a market top provided the Fed’s position on rates of interest. This might harm energy for Coinbase in the close to term. That stated, the stock might still deserve a seek long-lasting capitalists.

What do you think of the existing worth of Coinbase’s stock and the considerable modification shares have seen because its ATH? Let us recognize what you think of this topic in the remarks area listed below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This write-up is for informative functions just. It is not a straight deal or solicitation of a deal to acquire or offer, or a referral or recommendation of any kind of items, solutions, or business. Bitcoin.com does not give financial investment, tax obligation, lawful, or audit guidance. Neither the business neither the writer is liable, straight or indirectly, for any kind of damages or loss triggered or affirmed to be brought on by or about using or dependence on any kind of web content, products or solutions discussed in this write-up.