Join Our Telegram channel to remain updated on breaking information protection

Digital asset funding merchandise noticed outflows for the second consecutive week as traders are feeling cautious in regards to the market following the failure of Bitcoin (BTC) to interrupt above $30,000.

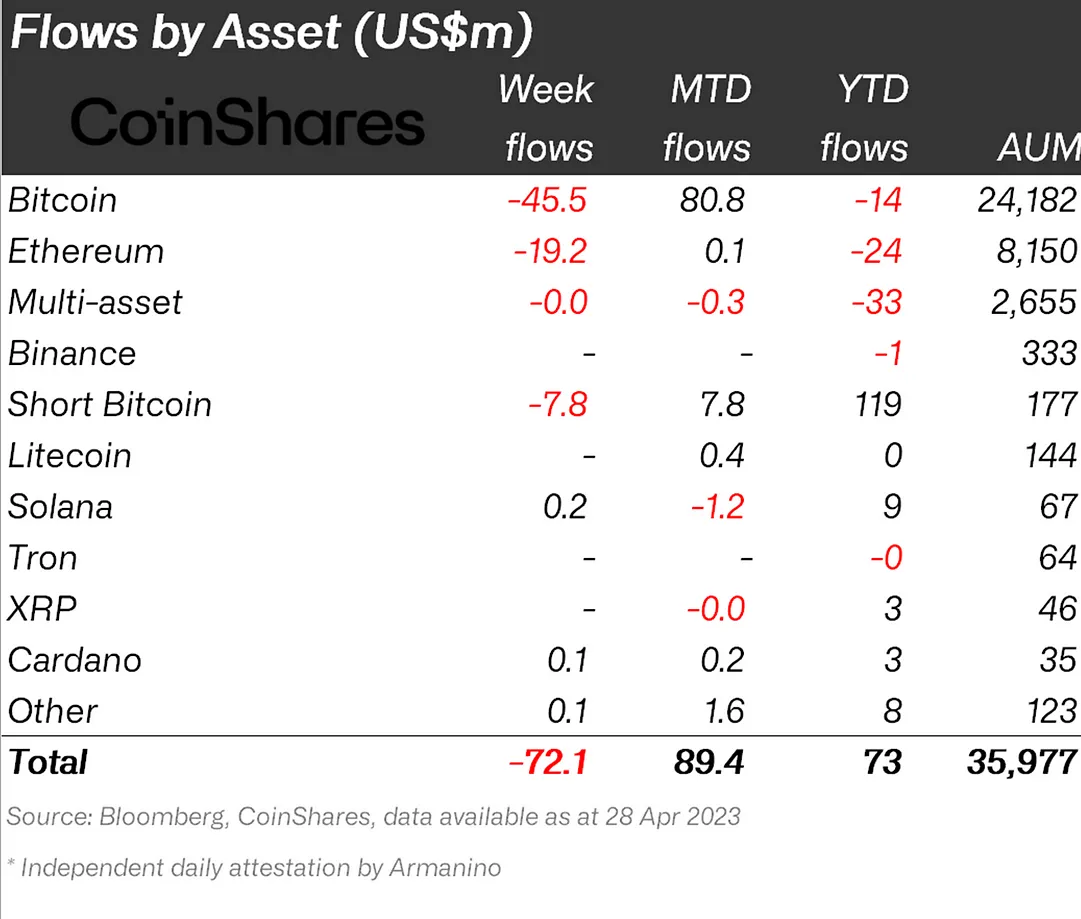

In complete, digital asset funding merchandise noticed $72 million in outflows final week, in accordance with CoinShare’s newest fund flows report.

The agency famous that the bearish sentiment might be “a reaction to the likeliness of further interest rate hikes by the US Federal Reserve” whose choice is predicted on Wednesday, May 3.

As regular, the largest change was seen for Bitcoin-backed funds, which for the final week noticed outflows of some $45.5 million.

In addition to outflows from Bitcoin funds, funds backed by Solana’s native token SOL additionally noticed minor outflows, whereas all different altcoin funds noticed both inflows or no change from the week earlier than.

Notably, short-Bitcoin was described as “the winner “ as noticed its largest outflows since December 2022 totaling US$7.8m. Short-bitcoin’s recorded web flows of $119 million year-to-date.

Funds backed by Ethereum’s ETH token additionally suffered, registering outflows totaling $19 million final week, its largest week of outflows since the Merge in September 2022.

Funds backed by altcoins resembling Solana, Cardano, Algorand and Polygon noticed minor inflows with $.2 million, $0.2 million, $0.17 million and $0.14 million respectively.

According to the report, crypto market funds skilled outflows throughout all geographies and suppliers, notably in Germany and Canada, the place outflows reached $40 million and $14 million, respectively.

Blockchain equities didn’t escape the damaging sentiment, leading to outflows of $2.5 million final week, though the year-to-date (YTD) web flows stay optimistic at $27 million.

An excerpt from the report reads:

Volumes stay subdued for the broader crypto market (50% lower than 12 months common) whereas ETP funding product volumes at US$1.7bn for the week are 16% above the 12 months common.

Bitcoin has ex[erienced significant price fluctuations over the last seven days, resulting in 5.72% weekly losses. At the time of writing, it is exchanging hands at $28,255, up a mere 0.63% over the last 24 hours.

It trades at the 50-day Simple Moving Average (SMA) around $28,300. Bulls must push the price above this level to avoid further losses. Otherwise, a daily candlestick close below the said level would bring areas around $25,000 into the picture.

Despite this grim outlook, the BTC price is still up 72% year-to-date, outperforming the S&P 500 index’s 9% and Dow Jones index’s 1.65% gains.

More News:

AiDoge – New Meme to Earn Crypto

Earn Crypto For Internet Memes

First Presale Stage Open Now, CertiK Audited

Generate Memes with AI Text Prompts

Staking Rewards, Voting, Creator Benefits

Join Our Telegram channel to stay up to date on breaking news coverage