Key Takeaways

Commodities like oil, gas, wheat, as well as rare-earth elements have actually skyrocketed in rate as a result of supply-side shocks brought on by the Russia-Ukraine problem.

Soaring product costs might cause a worldwide economic crisis, paint a grim lasting market expectation for risk-on properties like Bitcoin.

Investors seem revealing passion in rare-earth elements like gold as well as palladium, which are trading near or past their historical highs.

Share this post

Oil, gas, wheat, as well as rare-earth elements are rising as well as including inflationary stress to already-high CPI rising cost of living numbers. Historically, such rises in power as well as oil costs have actually brought about worldwide economic crises, which have actually normally had a adverse influence on risk-on properties such as supplies as well as cryptocurrencies.

Russia-Ukraine Conflict Sends Commodities Soaring

Global economic climates had actually hardly started recouping from the COVID pandemic that led to over 2 years of periodic lockdowns, serious supply chain problems, unmatched cash printing, as well as record-high rising cost of living prices prior to encountering an additional worldwide dilemma activated by Russia’s intrusion of Ukraine.

Now, the battle in Ukraine as well as the expectancy of supply-side scarcities it has actually activated has actually sent out product costs rising near or past document highs. The oil rate climbed by 2% today as well as is presently trading at a 14-year high of $122.50 per barrel.

Meanwhile, the wholesale gas rate in Europe, an additional product greatly influenced by the Russia-Ukraine problem, has actually skyrocketed means past the all-time highs it made in December to €207 (around $225) per megawatt-hour, up 1,000% considering that March 2021. The rate leapt as high as €267 (around $290) per megawatt-hour on the day after briefly striking an all-time high of €345 (around $375) Monday as Russia endangered the old continent that it would certainly switch off the shutoff.

Europe imports approximately 25% of its oil as well as 40% of its gas from Russia as well as is nearly totally at the grace of its next-door neighbor when it involves both power commodities. Moreover, rising power expenses endanger to press worldwide costs of manufacturing items also greater, reducing development as well as possibly tipping the globe right into a economic crisis. The well-known macroeconomics specialist as well as financier Raoul Pal is just one of numerous experts to have actually alerted that a economic crisis is most likely amidst the Russia-Ukraine dilemma, saying in a Mar. 3 tweet that “the odds are rising every day.”

I’m battling to see exactly how we are mosting likely to stay clear of a worldwide economic crisis. The probabilities are climbing daily. Not a assurance yet however close.

— Raoul Pal (@RaoulGMI) March 3, 2022

An economic downturn is a financial tightening or a basic decrease in financial task. Stocks as well as various other risk-on properties often tend to get on terribly in economic crises. To that factor, equities have actually currently seen considerable improvements from their all-time highs. For instance, the FTSE 100 index tracking the 100 biggest firms noted on the London Stock Exchange has actually dipped 5% over the last 5 days. The Dow Jones as well as S&P500 indices have actually dipped 2.37% as well as 2.95% on the day.

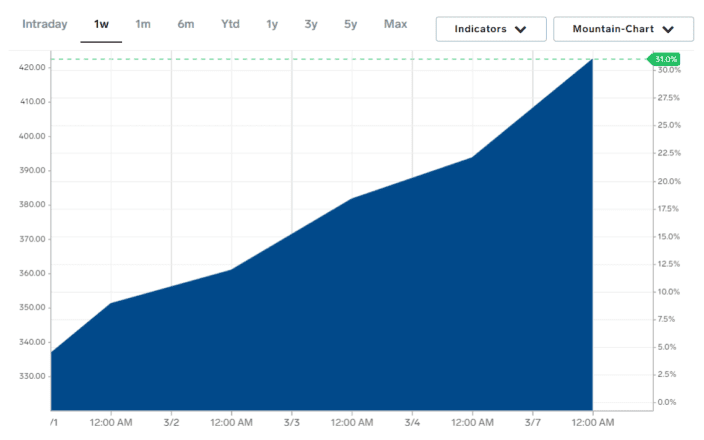

To make issues worse, Russia as well as Ukraine are amongst the biggest wheat manufacturers worldwide, audit for nearly a 3rd of the globe’s wheat exports. However, considering that the Russian attack on its smaller sized next-door neighbor, wheat manufacturing as well as exports have actually involved a online grinding halt, leading costs to skyrocket over 31% in a week as well as well past their previous all-time highs to €422 (around $459) per ounce. Russia is additionally among the biggest plant food merchants internationally, bring about a considerable rise in worldwide plant food costs. As plant food is vital for farming food, the rising costs straight effect food expenses.

The rate of base steel nickel, an additional of Russia’s biggest exports, has actually additionally escalated to over $100,000 per tonne Tuesday, leading the London Metal Exchange to stop trading for the rest of the day. The nickel rate on Mar. 1 had to do with $26,000 per tonne.

Soaring food as well as power product costs as well as the grim lasting expectation for equities show up to have actually motivated financiers to look for sanctuary in rare-earth elements. Gold has actually rallied 3.58% over the last 5 days as well as is presently trading at $2,014 per ounce, progressively nearing its document high of $2,074 videotaped in August 2020. Palladium quickly struck a high of $3,440 on Monday amidst anxieties of supply interruptions as well as is presently trading around the $3,000 mark.

While physical gold is nearing all-time highs, the marketplace appears to have actually chosen that crypto’s supposed “digital gold”—Bitcoin—is even more of a risk-on property than a “safe haven.” Similar to numerous typical supplies, Bitcoin as well as the more comprehensive crypto market has actually taken a defeating over the last couple of weeks. The leading crypto is presently trading at around $38,700, around 43.7% below its November top.

Disclosure: At the moment of composing, the writer of this item possessed ETH as well as numerous various other cryptocurrencies.

Share this post

The details on or accessed via this web site is gotten from independent resources our team believe to be precise as well as dependable, however Decentral Media, Inc. makes no depiction or guarantee regarding the timeliness, efficiency, or precision of any kind of details on or accessed via this web site. Decentral Media, Inc. is not a financial investment expert. We do not offer tailored financial investment suggestions or various other economic suggestions. The details on this web site undergoes alter without notification. Some or every one of the details on this web site might end up being out-of-date, or it might be or end up being insufficient or incorrect. We may, however are not obliged to, upgrade any kind of out-of-date, insufficient, or incorrect details.

You need to never ever make a financial investment choice on an ICO, IEO, or various other financial investment based upon the details on this web site, as well as you need to never ever analyze or otherwise count on any one of the details on this web site as financial investment suggestions. We highly advise that you seek advice from a accredited financial investment expert or various other competent economic expert if you are looking for financial investment suggestions on an ICO, IEO, or various other financial investment. We do decline payment in any kind of type for studying or reporting on any kind of ICO, IEO, cryptocurrency, money, tokenized sales, safeties, or commodities.

See complete conditions.

NFT Express: Your on-ramp to the globe of NFTs

At Tatum, we’ve currently made it very simple to develop your very own NFTs on numerous blockchains without needing to discover Solidity or develop your very own clever agreements. Anyone can release…

Bitcoin Is at Risk as Support Weakens

Bitcoin has actually turned around to a vital assistance degree that will certainly establish where it is heading following. Although this need area seems deteriorating with time, there is one factor…

Ethereum Hints at Recovery From Market Slump

The Ethereum network seems getting the task it requires for a rate recuperation. Still, Ethereum is yet to see a consistent rise in brand-new addresses to sustain the…

NFTs Soared in 2021. Now They’re Sinking

The NFT market seems dealing with the bearish belief dominating in the more comprehensive crypto as well as typical markets. Trading quantities on the biggest NFT industry OpenSea are trending down,…