Large banks like Credit Suisse are faltering and requiring bailouts, which results in the query: Is your cash actually protected in conventional banking techniques throughout a banking disaster? With Bitcoin and different cryptocurrencies gaining recognition, it’s time to take into account the position of those digital belongings as potential protected havens.

But what are the chances and dangers of storing wealth in Bitcoin throughout banking crises?

The Shaky Ground of Traditional Banks

The world monetary ecosystem is in a precarious state. The collapse of Credit Suisse, a global-systemically essential financial institution (G-SIB), has set off alarm bells worldwide.

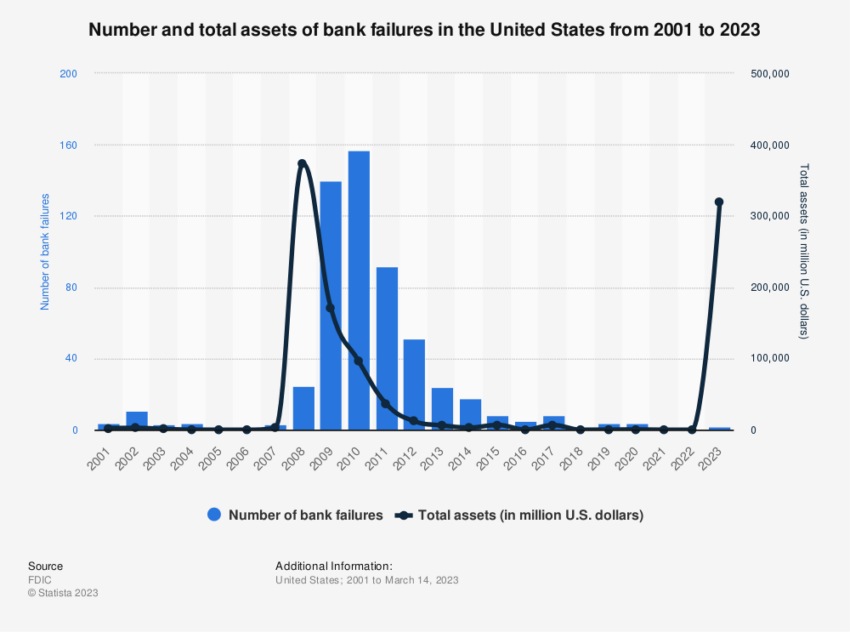

This failure, coupled with the truth that no banks fell over the last decade of quantitative easing (QE), prompts one to query the soundness of our banking techniques.

Historically, financial institution failures have been a pure a part of free markets, serving to to purge extra danger. However, with governments and central banks increasing the cash provide unprecedentedly, financial institution failures have change into a rarity.

Is this a results of safer banking practices or merely a byproduct of cash printing and authorities bailouts which have shifted the danger off financial institution steadiness sheets?

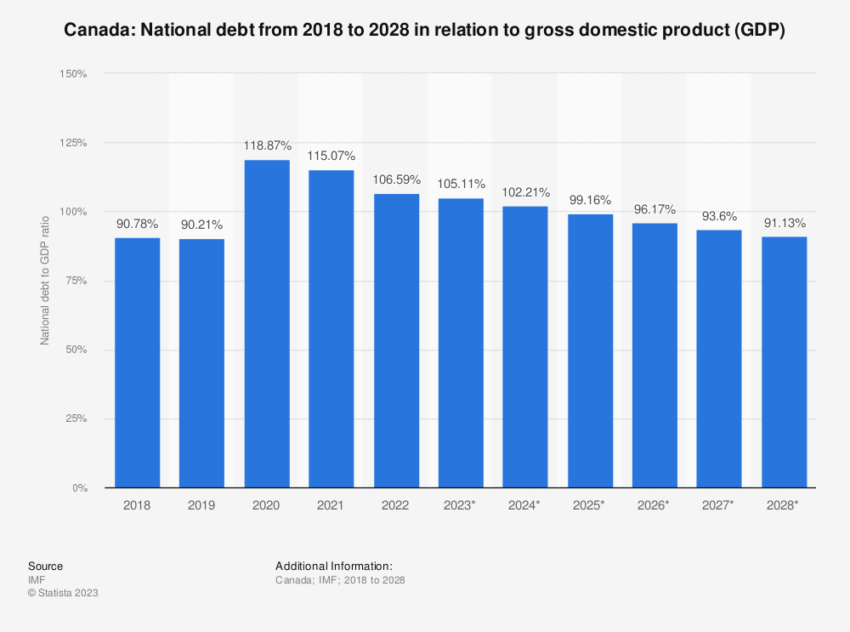

Countries like Canada have adopted the G20 consensus, participating in QE and issuing debt to finance deficit spending. Such apply has led to a surge in private and non-private debt-to-GDP ratios.

This pattern can probably inflate asset bubbles and contribute to financial instability.

Economist Joseph Barbuto has highlighted the excessive Canadian debt-to-GDP ratio. He has drawn comparisons to the US debt-to-GDP ratio throughout World War II.

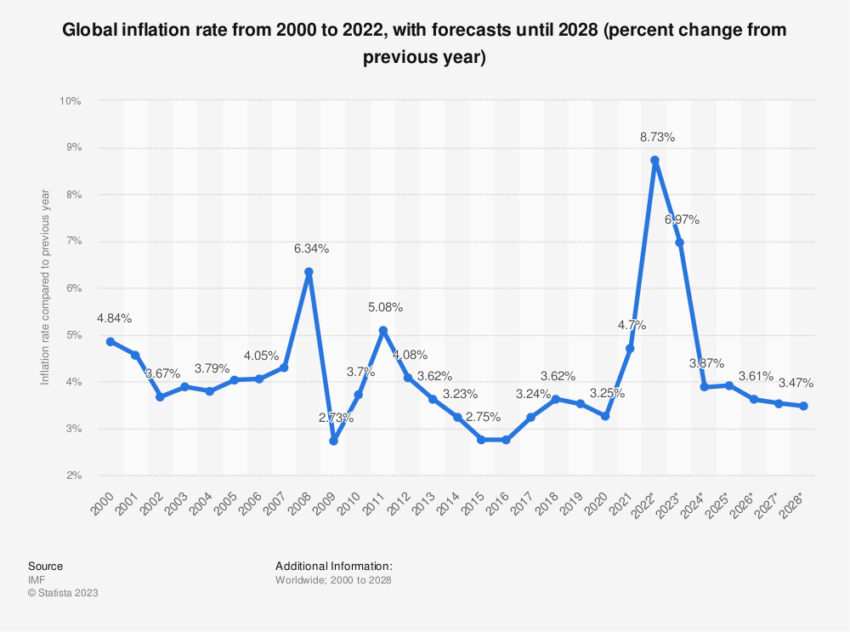

This alarming rise in debt ranges has sparked a debate concerning the effectiveness of QE. Many economists are accusing central banks of artificially manipulating charges and contributing to inflation.

The Great Withdrawal – A Sign of Lost Confidence

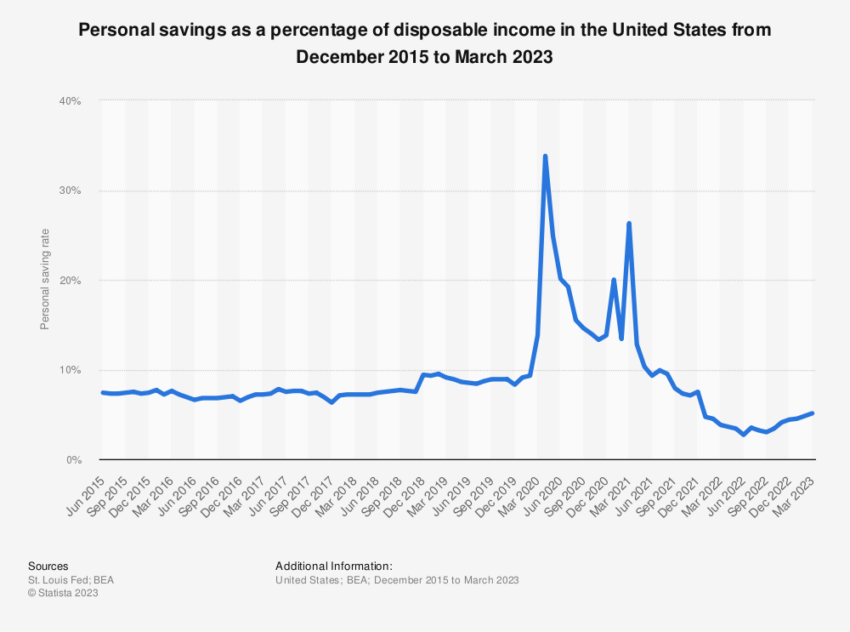

As belief in banks dwindles, individuals are more and more withdrawing their funds. High-interest charges are one other contributing issue, encouraging depositors to hunt greater yields in various funding automobiles.

This pattern has led to the rise of digital financial institution runs, with record-breaking withdrawals from conventional banks. For this cause, the banking trade’s practices are underneath scrutiny.

For instance, banks obtain about 5% curiosity on the cash they park on the central financial institution after shopping for authorities debt throughout QE. Meanwhile, depositors are given a financial savings price of roughly 0%.

This unfair discrepancy leads folks to switch their financial savings to different belongings, together with Bitcoin.

The banking disaster has resulted in three of the biggest financial institution failures in US historical past, with Silicon Valley Bank, Signature Bank, and First Republic Bank falling sufferer.

These failures have led to a collection of emergency actions by the Federal Reserve, together with bailouts and lending packages designed to stop the conclusion of losses on US treasuries.

However, the intervention of central planners within the free market pricing mechanism has raised issues. The Federal Reserve is now performing as a “loan shark” for small and medium-sized banks, probably exacerbating the disaster.

Bitcoin – A Safe Haven Amid Banking Crisis?

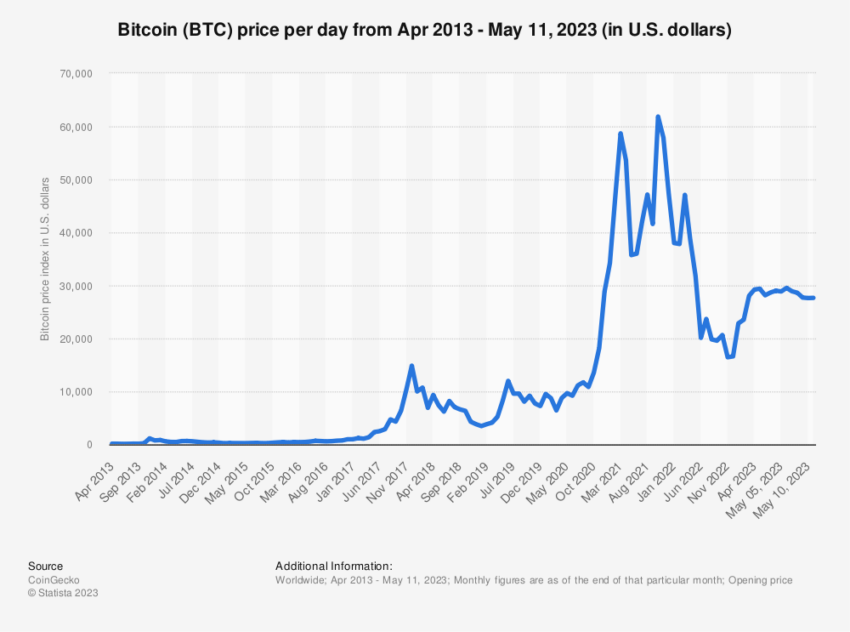

While conventional banking techniques are underneath pressure, Bitcoin emerges as a possible protected haven.

Despite its volatility, Bitcoin gives a decentralized and safe various to conventional banking. The digital asset is resistant to inflation and authorities interference, making it a horny possibility throughout banking crises.

However, the transition to digital belongings isn’t with out dangers. Like any funding, Bitcoin’s worth can fluctuate, and it’s essential to know these dangers earlier than transferring wealth into digital belongings. Nevertheless, Bitcoin could provide a level of safety in instances of banking uncertainty.

Its decentralized nature permits it to function independently of central banks and authorities management. This may provide a monetary refuge for these trying to escape a possible banking disaster.

Although Bitcoin’s worth is unstable, its worth isn’t immediately correlated to any particular economic system, which could be advantageous when conventional monetary establishments are unstable. Additionally, whereas governments can print more cash and trigger inflation, Bitcoin’s provide is finite, offering a level of safety towards foreign money devaluation.

Bitcoin’s potential as a protected haven throughout banking crises isn’t purely theoretical; real-world occasions present beneficial insights.

For instance, throughout the financial disaster in Venezuela, Bitcoin utilization soared as residents sought to guard their wealth towards hyperinflation. Similarly, Bitcoin’s worth considerably surged after the 2013 banking disaster in Cyprus as buyers regarded for protected havens.

While these cases don’t show Bitcoin’s absolute safety, they spotlight its potential position instead monetary refuge throughout banking crises. However, it’s essential to keep in mind that Bitcoin carries its personal dangers, resembling worth volatility and regulatory uncertainty.

Is Your Money Safe in Bitcoin?

Investing in Bitcoin as a hedge towards banking crises isn’t a one-size-fits-all technique. It is dependent upon particular person circumstances, danger tolerance, and understanding of cryptocurrencies.

While Bitcoin can provide potential benefits resembling inflation safety and independence from conventional banking techniques, it additionally carries vital dangers.

Therefore, for these contemplating Bitcoin as an alternative choice to conventional banking, it’s important to know the dynamics of the crypto market, the know-how underlying Bitcoin, and the potential authorized and monetary implications.

The security of cash in Bitcoin throughout a banking disaster largely is dependent upon how one defines “safe.” If security means preserving the buying energy of 1’s wealth amidst rampant inflation and banking instability, Bitcoin may probably function a viable refuge.

However, if security means sustaining a steady funding worth, Bitcoin’s volatility may pose a big danger.

While Bitcoin could provide a monetary sanctuary throughout banking crises, it’s not a assured answer. It is a comparatively new and quickly evolving asset class that must be approached completely and punctiliously, contemplating its related dangers.

Disclaimer

Following the Trust Project tips, this characteristic article presents opinions and views from trade consultants or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially replicate these of BeInCrypto or its employees. Readers ought to confirm data independently and seek the advice of with an expert earlier than making choices primarily based on this content material.