As we embark on a pivotal week for the cryptocurrency market, each Bitcoin and Ethereum costs are within the highlight, with the US Nonfarm Payroll report serving as a key focus for traders.

The potential impression of this financial information launch may affect the trajectory of the main cryptocurrencies, as market contributors intently monitor the unfolding occasions.

Crypto Fundamental Outlook

Bitcoin, the world’s largest cryptocurrency, alongside with Ethereum, has been unable to maintain its upward rally and has misplaced a few of its worth, falling beneath $28k and $1,800 ranges. Investors eagerly await the discharge of two vital financial indicators within the United States – employment and productiveness information, that are scheduled to be launched quickly.

As a outcome, these indicators, in conjunction with different macroeconomic components reminiscent of inflation, banking turmoil, and regulatory developments, are prone to impression BTC costs within the coming days.

On the opposite hand, Ethereum builders eagerly anticipate the upcoming Shanghai improve on April 12, because it marks a vital milestone in Ethereum’s improvement.

The improve signifies Ethereum’s full transition to the Proof of Stake (PoS) consensus mechanism, aimed toward enhancing community safety, effectivity, and scalability. This development is predicted to assist ETH acquire substantial worth traction.

Risk-Off Mood In Crypto Market

The international cryptocurrency market has skilled a powerful efficiency over the previous few weeks, with one contributing issue being traders’ rising confidence in Bitcoin.

They are starting to understand BTC as a protected different to conventional banking strategies. This sentiment is primarily pushed by the collapse of a number of banks, together with Silicon Valley Bank, Silvergate Capital, and Signature Bank.

However, the latest surge within the international market seems to be dropping momentum, because it has fallen to $1.16 trillion on the time of writing, representing a 2.30% loss over the previous 24 hours.

Bitcoin (BTC) and Ethereum (ETH), two of the world’s hottest cryptocurrencies, couldn’t maintain their earlier positive factors and dropped to across the $27,000 and $1,700 ranges, respectively, early Monday.

Additionally, different main cryptocurrencies, reminiscent of Dogecoin (DOGE), Ripple (XRP), Solana (SOL), and Litecoin (LTC), skilled vital losses on the day.

BTC Price Rally Loses Steam as Investors Anticipate US Economic Indicators

Bitcoin’s worth surge appears to have decelerated as merchants train warning in putting substantial bids. This is probably going because of the upcoming launch of two essential financial indicators within the United States, employment and productiveness information.

While traders await these figures, they may most likely monitor different macroeconomic considerations that might impression the Bitcoin market, reminiscent of inflation, monetary turmoil, and regulatory shifts. These components will probably generate vital fluctuations within the worth of BTC and different cryptocurrencies.

Bitcoin Price

The present Bitcoin worth stands at $27,679, with a 24-hour buying and selling quantity of $13.5 billion. Over the previous 24 hours, Bitcoin has skilled a decline of two.79%.

On Monday, the BTC/USD pair is buying and selling inside a impartial vary, sustaining a restricted window between $27,600 and $28,900. Investors are on the lookout for a powerful basic catalyst to interrupt out of this particular buying and selling vary.

On the upside, a breakout above $28,250 may propel BTC in the direction of its subsequent rapid resistance stage of $28,900. Conversely, BTC’s rapid help will be discovered on the $27,600 mark.

Key technical indicators, reminiscent of RSI and MACD, have dipped beneath their center ranges (50 and 0, respectively), suggesting a promoting bias amongst traders.

Hence, the breakout from the $27,600 to $28,900 buying and selling vary will dictate additional worth motion.

Buy BTC Now

Ethereum Price

Ethereum’s present worth is $1,778, with a 24-hour buying and selling quantity of $6.5 billion. Ethereum has decreased practically 2% within the final 24 hours. The ETH/USD pair continues to commerce inside a broad vary, fluctuating between the $1,750 and $1,850 ranges.

Ethereum is presently struggling to interrupt by way of the resistance stage of $1,850 and has persistently traded close to the help stage of $1,750.

If the ETH/USD pair manages to surpass the $1,850 mark, it’s anticipated to face hurdles on the $1,940 stage. Support ranges for the ETH/USD pair are anticipated at both $1,700 or $1,620.

Buy ETH Now

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the most recent ICO initiatives and altcoins by recurrently checking the rigorously chosen listing of the 15 most promising cryptocurrencies to keep watch over in 2023.

This listing has been curated by consultants at Industry Talk and Cryptonews, so you may belief that it consists of solely one of the best and most promising cryptocurrencies out there.

Disclaimer: The Industry Talk part options insights by crypto business gamers and isn’t part of the editorial content material of Cryptonews.com.

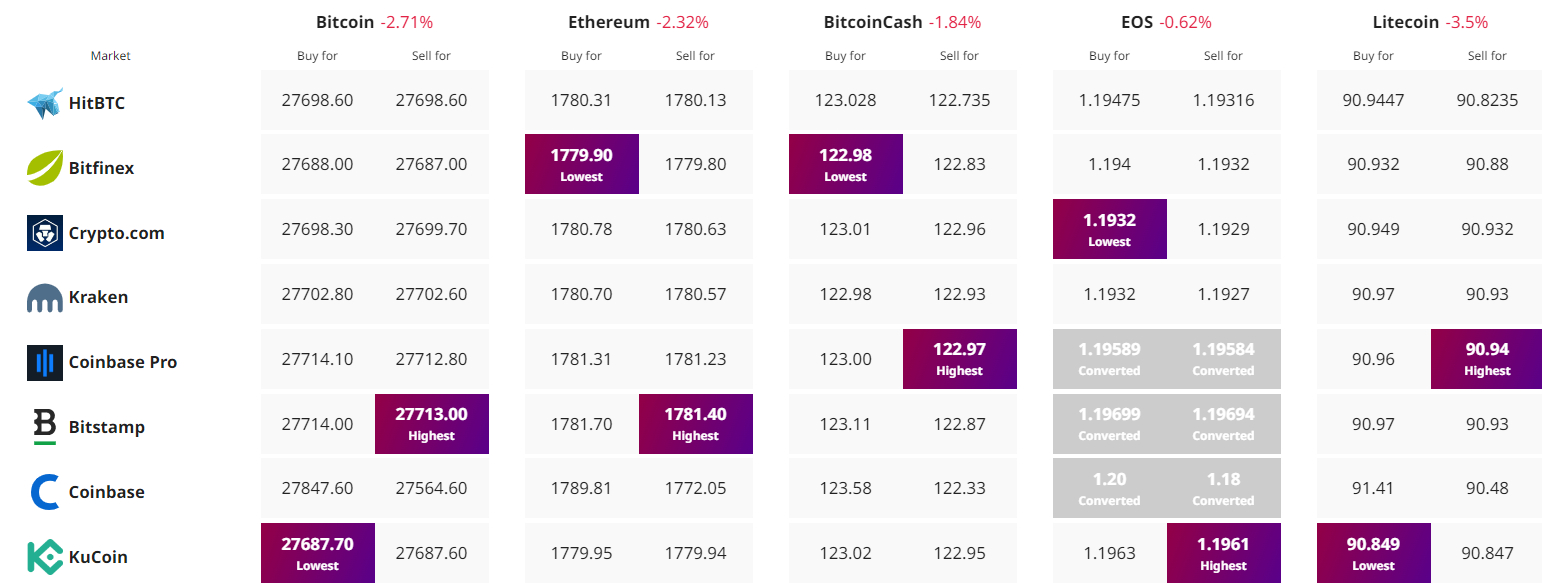

Find The Best Price to Buy/Sell Cryptocurrency