The United Kingdom has eased the trail for crypto advertising belongings with its new regulatory framework in a big shift. It provides readability for fintech enterprises navigating the blockchain trade.

The new wave of regulation goals to guard shoppers whereas selling accountable development throughout the crypto trade.

UK Releases Crypto Marketing Rules

The Financial Conduct Authority (FCA), the UK’s monetary watchdog, has launched a collection of guidelines making certain transparency and threat consciousness for traders in the crypto market. As of October 8, companies should implement a cooling-off interval for first-time traders.

The aim is to protect the so-called “newbies” from impulsive choices which will outcome in vital monetary losses.

Additionally, well-liked “refer a friend” bonuses that have been largely thought of misleading have been faraway from the advertising arsenal of crypto companies. The focus has shifted in direction of making certain potential traders possess the required information and expertise earlier than venturing into the crypto market.

The FCA’s Executive Director of Consumers and Competition, Sheldon Mills, emphasised the significance of traders’ autonomy in making monetary choices however warned about potential losses. He added that the brand new guidelines intention to provide individuals enough time and threat warnings to make knowledgeable choices.

(*2*) mentioned Mills.

A Clear Regulatory Framework

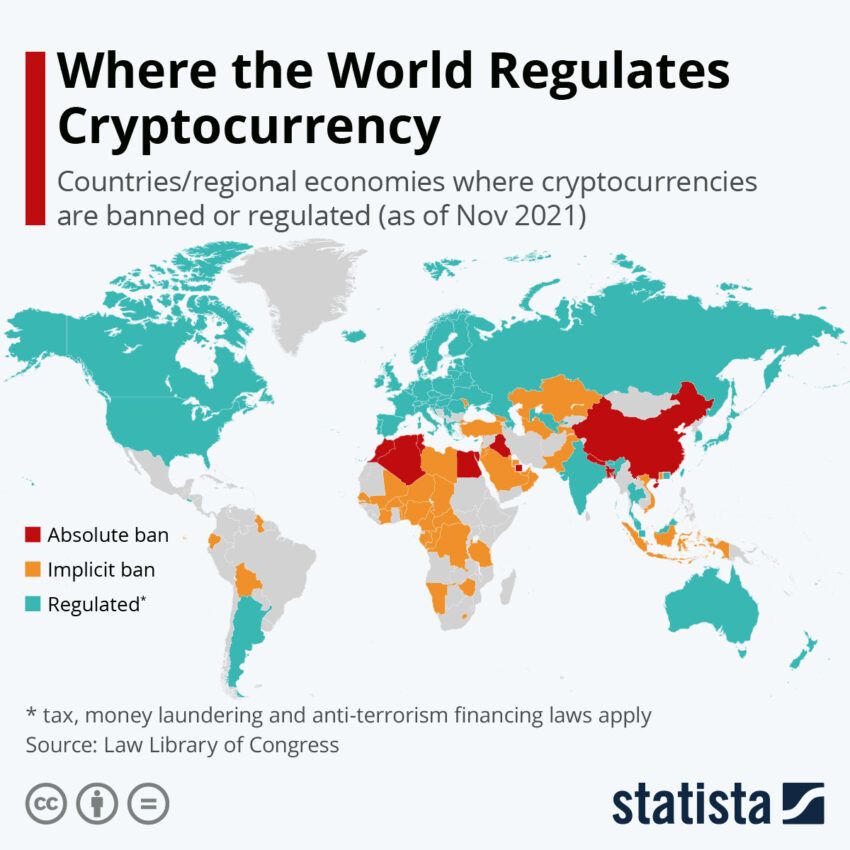

The new laws aren’t restricted to crypto companies primarily based in the UK. Overseas companies focusing on UK shoppers should additionally align their promotional methods with these laws.

Such widespread utility ensures that the principles are honest and evenly utilized to all market individuals. Here is a abstract of the brand new crypto advertising guidelines in the UK:

A compulsory cooling-off interval for first-time traders.

Banning of “refer a friend” bonuses.

Ensuring that potential traders have the suitable information and expertise.

Implementation of clear threat warnings in crypto promotions.

Ensuring adverts are clear, honest, and never deceptive.

Compliance with the brand new guidelines by all crypto companies focusing on UK shoppers, together with abroad companies.

Failure to adjust to these guidelines may result in stringent penalties, together with as much as 2 years of imprisonment, a limiteless high quality, or each.

Additionally, the FCA maintains the proper to take strong motion towards non-compliant companies. This contains itemizing them on a warning record, requesting the takedown of internet sites, and enforcement motion.

Crypto Popularity on the Rise in the UK

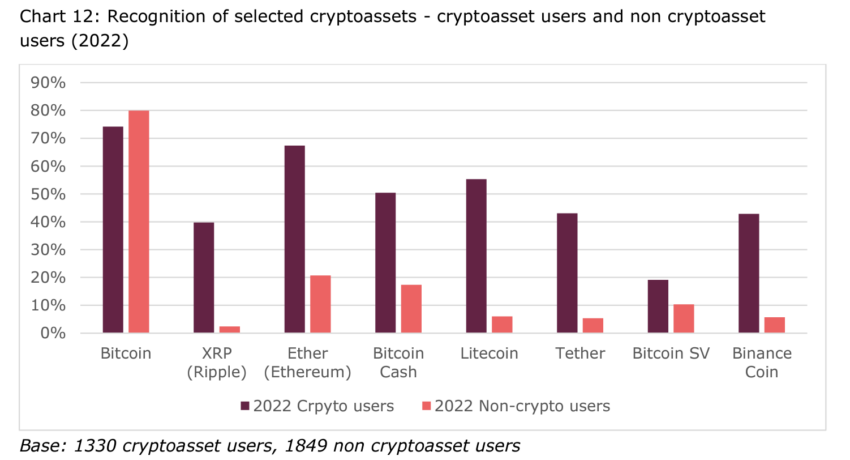

The new framework comes towards a backdrop of surging curiosity in cryptocurrencies throughout the UK. The FCA performed a survey in early 2023, exhibiting a considerable improve in the recognition of cryptos. The examine sampled 2,000 respondents, representing a cross-section of the UK’s inhabitants.

One of probably the most placing findings is that an estimated 10% of respondents reported proudly owning cryptos. This signifies a marked improve in crypto possession, up from 3% in the earlier yr’s survey.

Interestingly, the examine discovered that the typical age of a crypto investor in the UK was 37. It means that youthful generations usually tend to enterprise into this new asset class, with a notable proportion of older respondents additionally exhibiting an curiosity.

Bitcoin remained the preferred crypto, owned by round 70% of the respondents. In second place was Ethereum, owned by 35% of the respondents who held crypto. Moreover, the survey indicated that 15% of crypto traders considered their holdings as a safeguard towards inflation.

Despite the growing reputation of crypto, the survey findings revealed a regarding lack of expertise. A major 40% of respondents couldn’t accurately clarify the perform of cryptos, highlighting an pressing want for investor schooling in this complicated area. Furthermore, many respondents have been unaware of the regulatory protections or lack thereof.

More Work Needs to Be Done

The FCA has acknowledged that there’s room for additional clarification of the principles. It goals to distill the 91-page coverage doc detailing these laws right into a shorter, easy-to-follow information to encourage compliance.

Such a information can be a welcome device for companies and traders in an trade characterised by fast evolution and complicated jargon.

Despite these new laws, crypto belongings stay high-risk investments. The FCA has persistently warned that customers needs to be ready to lose all their invested cash as a result of largely unregulated market.

This regulatory shake-up displays the UK’s efforts to stability the dual targets of fostering innovation in fintech whereas safeguarding investor pursuits. It is a cautious however decided step in direction of integrating the crypto economic system throughout the mainstream monetary system, an evolution that holds implications for the way forward for world finance.

Disclaimer

In adherence to the Trust Project pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. However, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material.