The crypto market, led by Bitcoin (BTC), continues to be at risk to a more temporary drawback provided the losses seen over the previous 24 hr. This expectation is most likely to combat any type of prompt recuperation strategies for Ethereum, IOTA, and Vechain.

Vechain price analysis

The VET/USD set has actually slid by 4% over the last 24 hr, and by 22% today.

As of creating, VET/USD is trading at $0.178, listed below both the 200 SMA and 100 SMA on the 4-hour graph. The cryptocurrency is additionally covered by a bearish fad line while the RSI is listed below 50, recommending bears supervise. If vendors breach assistance at $0.17, VET can backtrack in the direction of $0.15.

VET/USD 4-hour price graph. Source: TradingView

Although the price of VET has actually endured significant losses in the previous week, the total expectation recommends an uptick is feasible if bulls handle to maintain the bears away near $0.17. The vital price degrees to see on the advantage would certainly go to $0.20 and $0.21.

IOTA price analysis

IOTA’s price since creating is $1.89, around 1.03% down on the day and 12.4% at a loss over the recently. Bears presently cover the activity near the 20-day EMA at $1.97, having actually dragged the MIOTA/USD set listed below the 50 SMA and a favorable assistance line.

The RSI is inflecting downwards listed below the balance indicate contribute to the bearish expectation for the IOTA market. If the down trajectory holds short-term, IOTA may decrease in the direction of $1.60 and after that $1.40.

IOTA/USD 4-hour graph. Source: TradingView

IOTA is a unique cryptocurrency and current upgrades are readied to make it much better fit to venture fostering. This may be essential to its market moving forward. In the short-term, a break greater can take costs over $2.00, with targets at $2.20 and $2.40.

Ethereum price analysis

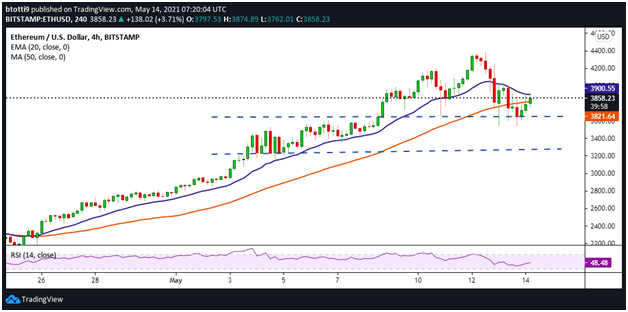

Ethereum’s retracement from a height over $4,200 occurred as BTC dipped listed below $50k on 12 May. While bears have actually handled to maintain costs listed below $4k, the total image declares for ETH/USD.

Notably, the ETH market is established for a $730 million choices expiration on 14 May, a circumstance most likely to see more acquiring stress for Ether. Bulls have actually pressed ETH’s price over the 50 SMA ($3,821) and can damage resistance at the 20-day EMA ($3,901).

ETH/USD 4-hour graph. Source: TradingView

The RSI is wanting to tip over 50, which can assist the bulls’ strategies for a retest of the $4k degree and potentially brand-new highs near $4,500. Contrary to this, ETH/USD may go down to $3,650 and $3,260.