Today marks 240 days since an occasion the Ethereum neighborhood has come to know as “the merge.” And its results on the full ETH provide are clear.

Arguably probably the most important improve in its historical past, the merge noticed the Ethereum community transition from a Proof of Work (PoW) consensus mechanism to 1 based mostly on Proof of Stake (PoS). Now, eight months on from the pivotal occasion, the long-term penalties of the merge have gotten obvious.

ETH Supply Declines

According to the Ethereum analytics dashboard ultrasound.cash, practically 650,000 ETH has been burned because the merge. In the identical time span, just below 424,000 new ETH have been minted. The result’s a internet provide change of round -226,000 ETH.

As a proportion of the full provide, the numbers signify a lower of 0.213% or 0.285% annualized.

Had the merge not occurred, ultrasound.cash estimates that the full ETH provide would have elevated at a fee of three.244% per yr in the identical interval.

Long-term Ether holders will doubtless welcome the information. After years of accelerating provide, the upper burn fee in the previous 240 days represents a deflationary trajectory. This may reward traders by pushing the worth of ETH up.

Driving Ethereum’s post-merge provide dynamics is a technical change that noticed the community substitute miners with validators. Crucially, validator rewards are considerably lower than the mining rewards issued beneath the PoW system.

This is as a result of working a validating node isn’t as economically intense as working a mining node.

According to the Ethereum Foundation, earlier than transitioning to PoS, miners have been issued round 13,000 ETH a day. Since the merge, nevertheless, the one recent Ether issued is the roughly 1,700 ETH a day that goes to stakers.

In addition to the decrease reward mechanism enacted by PoS versus PoW consensus, larger burn charges are additionally driving ETH deflation.

Evolving Ethereum Mechanics

In the months because the merge, the dynamics of PoS-era ETH provide have come into sharper focus. But the query of how lengthy the community can keep deflationary economics stays.

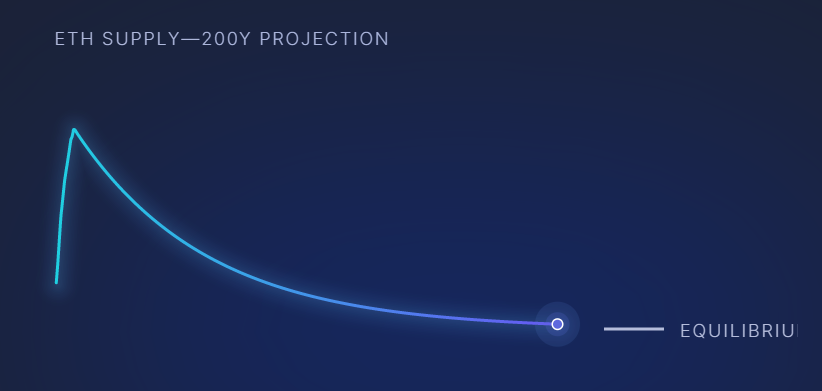

According to present assumptions, then issuance as a proportion of the circulating provide will rise till it equals the speed of Ether burned. This will finally result in a circulating provide equilibrium the place issuance equals burn fee.

Based on up to date common staking rewards and burn charges, the creation and destruction of ETH are set to converge at round 709,000 ETH per yr.

Mathematical fashions have positioned the full circulating provide at equilibrium as between 27.3 and 49.5 million ETH.

Considering as we speak’s provide of over 120 million ETH, if present developments proceed the full provide will proceed shrinking. Under the above assumptions concerning equilibrium, the deflationary trajectory will thus proceed for a few years.

Disclaimer

In adherence to the Trust Project tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. However, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material.