South Korea’s KEB Hana Bank is set to work with the central Bank of Korea (BOK) on the latter’s CBDC pilot and stablecoin alternatives, such as tokenized deposits.

Per the newspaper Maeil Kyungjae, Hana Bank is now “actively participating” in the BOK’s ongoing CBDC Proof of Concept project.

The newspaper noted that the BOK and Hana will “actively participate in the preparation” of a “currency system based on blockchain technology.”

The parties are now conducting “internal research” on “tokenized deposits.”

Central banks have looked to popular stablecoins for inspiration in their own CBDC projects.

But they believe they can go one better by improving the design of conventional stablecoins.

They have labeled such coins “private tokenized monies that circulate as bearer instruments.”

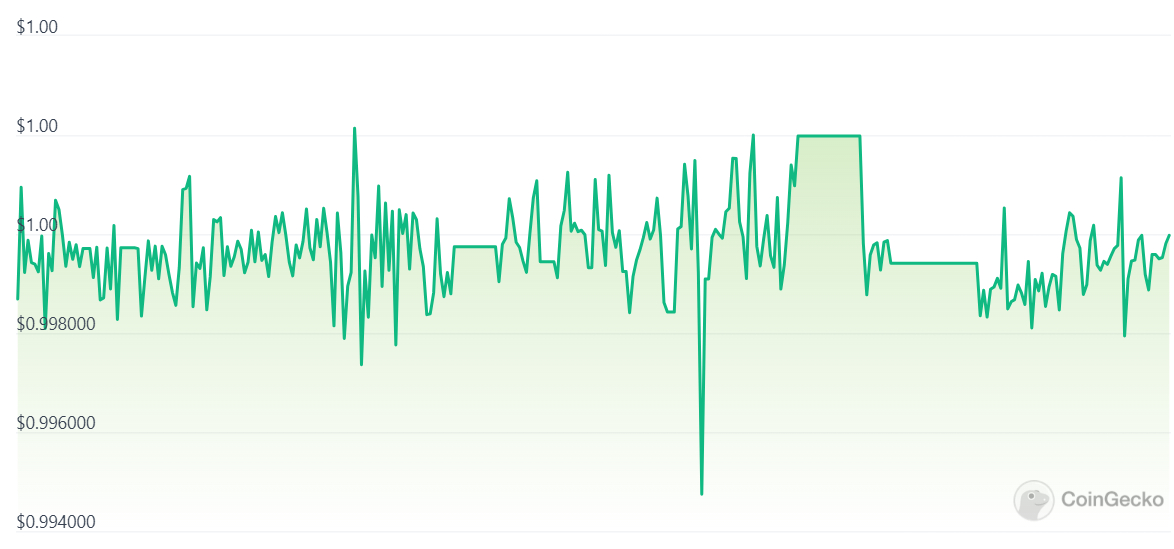

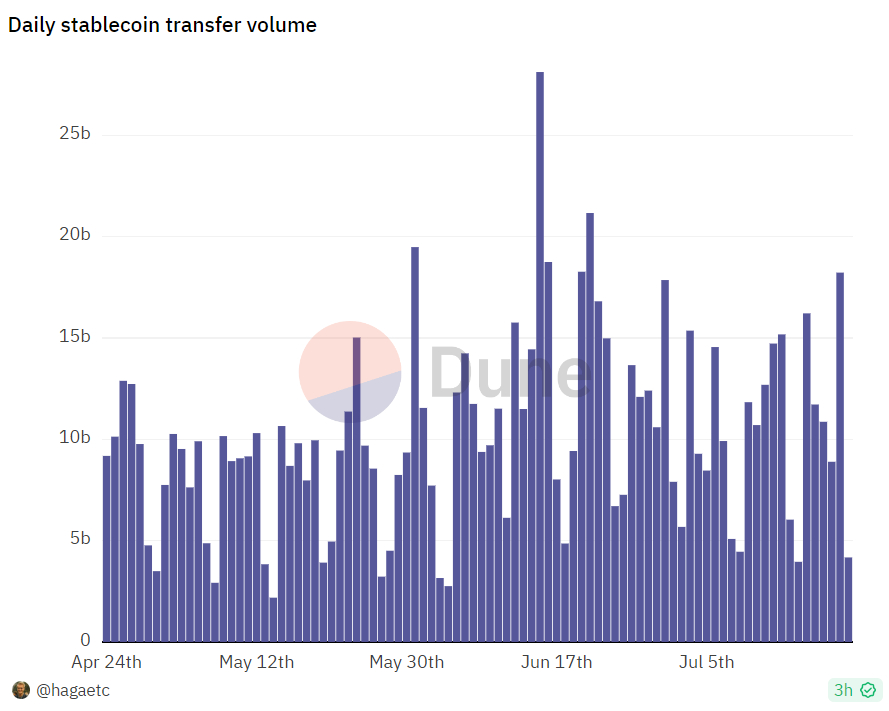

As De Blasis et al demonstrated earlier this year, popular stablecoins like the USD-pegged USDT experience some level of price volatility.

And this volatility is something central banks appear keen to avoid at all costs with their CBDC projects.

In April, the Bank for International Settlements (BIS) published a paper on tokenized deposits and their potential to displace stablecoins in the financial and banking sectors.

The BIS claimed that stablecoins “may entail departures in their relative exchange values away from par in violation of the ‘singleness of money.’”

As an alternative, tokenized deposits, also blockchain-powered, “do not circulate as bearer instruments, but rather settle in central bank money” and “are more conducive to singleness,” the BIS wrote.

The BIS also claimed that tokenized deposits may “enable expanded functionality by building on the capacity of programmable ledgers to introduce contingent execution and composability of transactions.”

The BOK appears to have taken these recommendations to heart.

And South Korean commercial banks, apparently worried that they could be frozen out of the CBDC picture, appear keen to carve out a niche for themselves in the space.

Hana has been exploring the blockchain space for around half a decade.

It has been making inroads into blockchain-powered real estate and investing in crypto sector-related research.

The BOK, meanwhile, has been working with a number of commercial banking partners on the digital KRW project.

South Korea’s Banking Sector Expresses Interest in ‘Tokenized Deposits’

Maeil Kyungjae called tokenized deposits an “emerging hot topic” in the financial world.

The BIS’ April paper was co-authored by Hyun Song Shin, a former economic advisor to the South Korean presidency.

The Hana rival Woori Bank’s Woori Financial Management Research Institute also recently published a report on tokenized deposits.

And the media outlet noted that domestic commercial banks started “showing great interest in tokenized deposits” tokens when the BOK Governor Lee Chang-yong told attendees at a BIS event in March that “tokenized deposits are needed” in the banking industry.

Last month, Hana’s Management Research Institute predicted that the domestic security token market will grow to some $27 billion next year.