Bitcoin has tried and failed to break and maintain above the $25,000 degree now for 5 out of the final six days. Some technicians assume that this isn’t essentially a foul factor, as the world’s largest cryptocurrency by market capitalization is forming an ascending triangle construction that would proceed an explosion larger in the direction of the subsequent main resistance space round $28,000.

But others are worrying that this yr’s rally that has seen the BTC value already improve shut to 50% could also be stalling. Pricing in Bitcoin derivatives markets is a method to gauge how buyers really feel on the outlook for BTC, in addition to in the direction of its potential for volatility. Here’s what choices markets are saying proper now…

Investors Neutral on the BTC Price Outlook

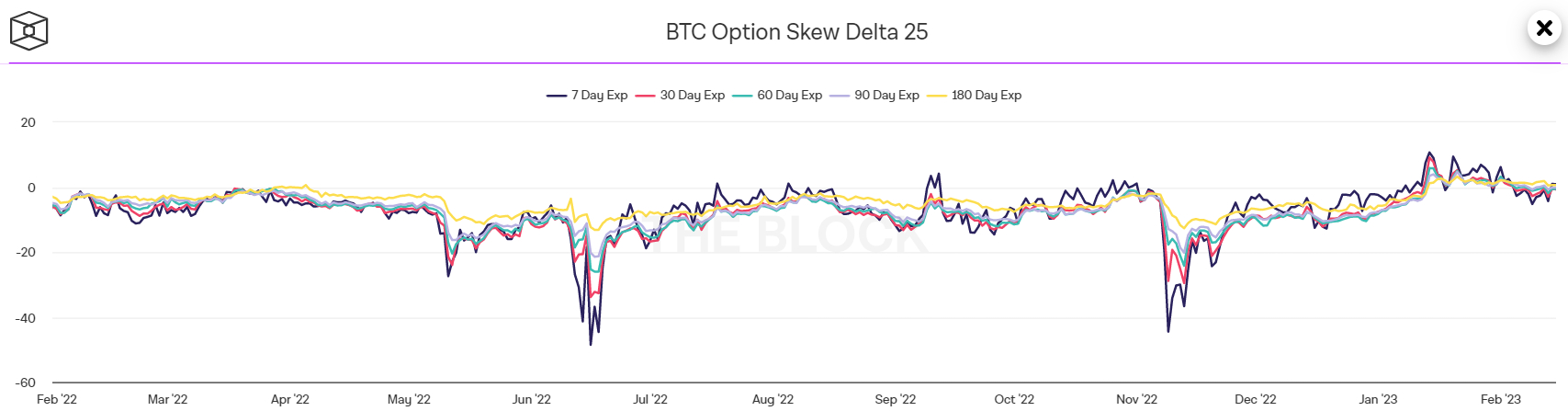

According to the extensively adopted 25% delta skew of Bitcoin choices expiring in 7, 30, 60, 90 and 180 days, buyers are at present roughly web impartial of their outlook for the Bitcoin value. According to information supplied by crypto analytics agency The Block, all 5 25% delta skews are shut to zero, up considerably from final yr’s speedy post-FTX collapse lows, but additionally down barely from highs printed earlier this yr in the yr.

The 25% delta choices skew is a popularly monitored proxy for the diploma to which buying and selling desks are over or undercharging for upside or draw back safety by way of the put and name choices they’re promoting to buyers. Put choices give an investor the proper however not the obligation to promote an asset at a predetermined value, whereas a name possibility provides an investor the proper however not the obligation to purchase an asset at a predetermined value.

A 25% delta choices skew above 0 means that desks are charging extra for equal name choices versus places. This implies there’s larger demand for calls versus places, which will be interpreted as a bullish signal as buyers are extra keen to safe safety towards (or wager on) an increase in costs.

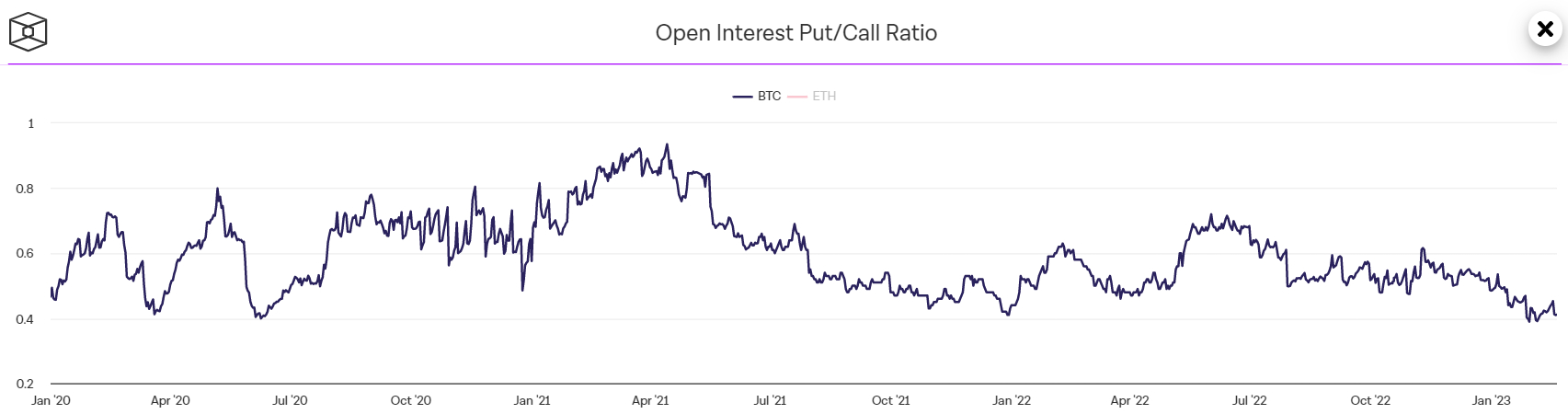

However, a separate possibility market indicator of investor sentiment is sending a extra bullish signal. According to information offered by The Block, the Open Interest Put/Call Ratio of Bitcoin choices was final at 0.41, nonetheless very shut to the report lows printed in late January/early February. An Open Interest Put/Call Ratio beneath 1 signifies that buyers favor proudly owning name choices (bets on the value rising) over put choices (bets on the value dropping).

Investors Are Positioning For Uptick in Volatility

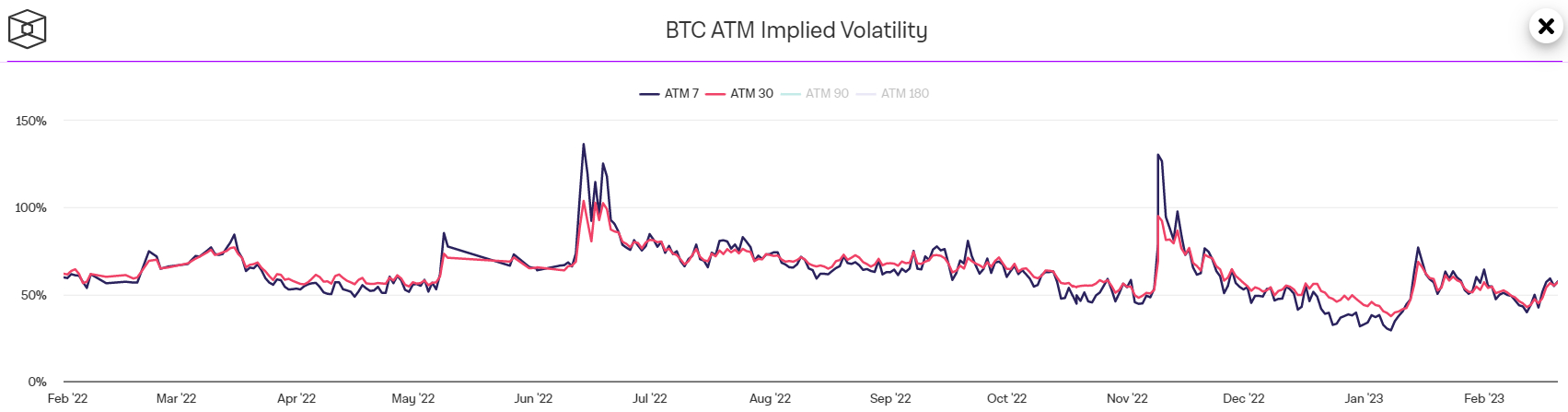

Bitcoin’s 7-day Implied Volatility in accordance to At-The-Money (ATM) choices market just lately neared its highest degree of the month, in accordance to information offered by The Block. On Saturday, it rose to just below 60%, up from earlier month-to-month lows of beneath 40%. 30-day ATM Implied Volatility, in the meantime, was additionally at roughly 60% and in keeping with its earlier month-to-month highs.

The newest uptick in volatility expectations, as per ATM choices markets, has gone hand in hand with the Bitcoin market’s restoration from earlier month-to-month lows in the $21,000s. It’s value noting that, Bitcoin ATM Implied Volatility expectations stay subdued by historic comparability and properly beneath current mid-January 2023 and November 2022 highs.