[ad_1]

As the world grapples with a banking disaster on the point of chaos, the Federal Reserve (Fed) has taken drastic measures to pump liquidity into the market. The initiative has led to an surprising response from the crypto market, notably Bitcoin.

Amidst rising rates of interest and a string of financial institution bailouts, the Fed’s balancing act between tightening and loosening financial coverage has left many traders questioning the security of their property.

The Banking Crisis Goes Global

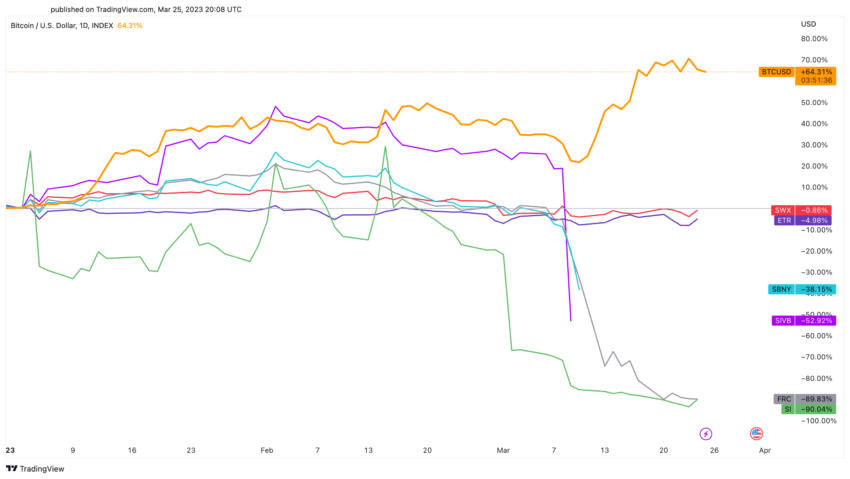

In the United States, a number of banks, together with Silvergate, Silicon Valley Bank, Signature Bank, and First Republic Bank, have come underneath great stress, requiring authorities or non-public market intervention. But the disaster has not been restricted to the US.

European banks equivalent to Credit Suisse and Deutsche Bank additionally wrestle to remain afloat.

Governments and central banks worldwide have stepped in to mitigate the disaster to offer liquidity.

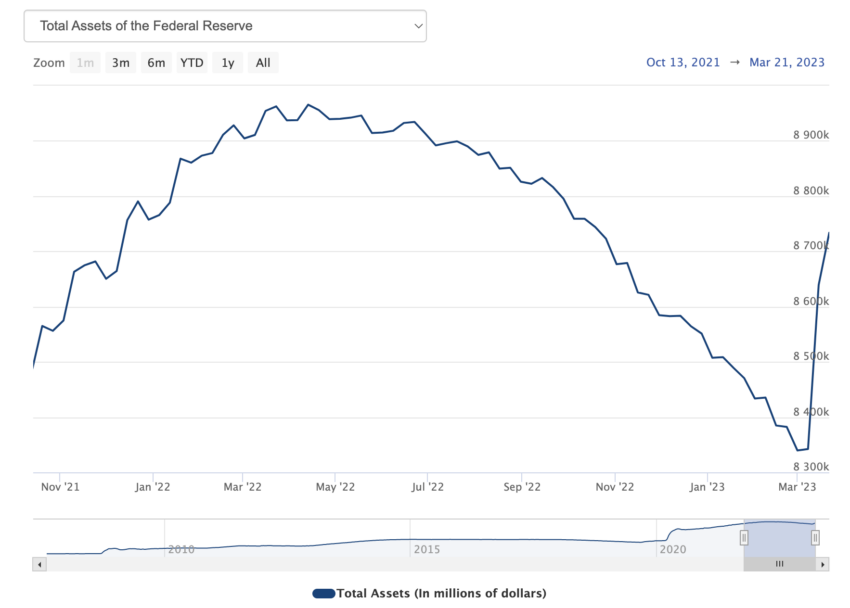

The Federal Reserve, the FDIC, and different organizations have thrown “monetary bazookas” on the beleaguered banks within the US. The transfer has seen the Fed’s stability sheet swell by $400 billion in simply two weeks.

This speedy enhance has successfully negated 64% of the progress made in quantitative tightening over the previous 12 months.

The market, nonetheless, stays unsure concerning the Fed’s technique. While rates of interest have continued to rise, the huge liquidity injection has confused the market.

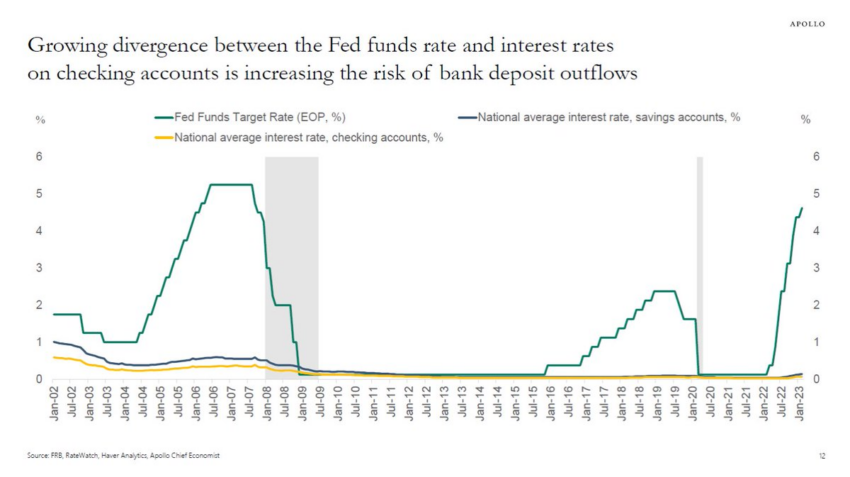

Torsten Slok, Partner and Chief Economist at Apollo, maintains that the unfold between Fed Funds and rates of interest on checking accounts is “the fundamental reason why money is being moved out of bank deposits.”

Slok believes that this rising divergence is “highly unusual compared to previous banking crises, where the source of instability has typically been credit losses.”

Bitcoin Thrives Amid Psychological Awakening

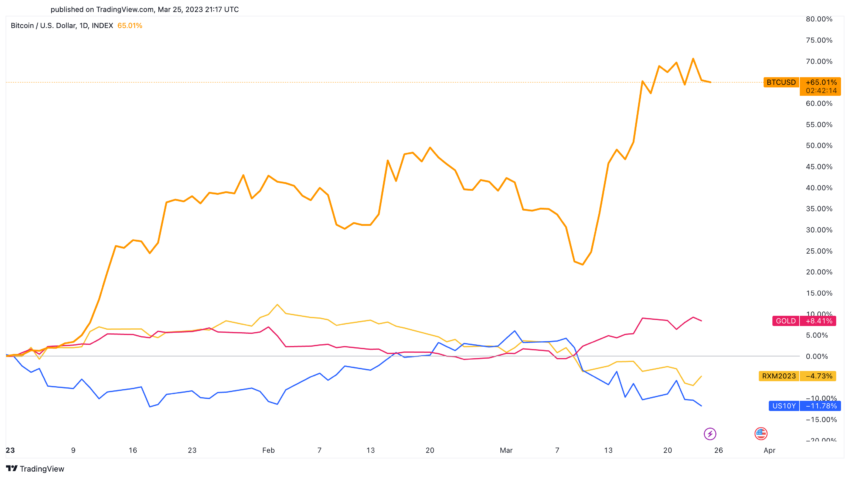

As a results of this uncertainty, many traders have turned to options equivalent to Bitcoin, gold, and actual property. The rising issues concerning the security of conventional banking have led to a “psychological awakening” within the Bitcoin group.

This, mixed with the need for larger yields, has led to an inflow of funds into cash market funds and different non-deposit property, placing additional stress on the banking system.

Economist Nouriel Roubini affirms that depositors have begun to appreciate “they can earn 4% on safe short-term T-Bills while they get close to 0% on bank deposits.” This serves as a main driver for ongoing financial institution runs.

The period of banks benefiting from free deposits is coming to a detailed, in line with “Dr. Doom.” Roubini concluded that the responsiveness of deposits to rate of interest modifications is considerably intensifying.

Despite the dire scenario, specialists consider that the banking disaster will finally be resolved, with governments and central banks working tirelessly to forestall financial institution failures each within the US and internationally.

The President of the European Central Bank, Christine Lagarde, stated at a press convention after the announcement of a 0.5 share level hike in deposit rates of interest:

“Under the baseline, the economy looks set to recover over the coming quarters. Industrial production should pick up as supply conditions improve further, confidence continues to recover, and firms work off large order backlogs. Rising wages and falling energy prices will partly offset the loss of purchasing power that many households are experiencing as a result of high inflation. This, in turn, will support consumer spending.”

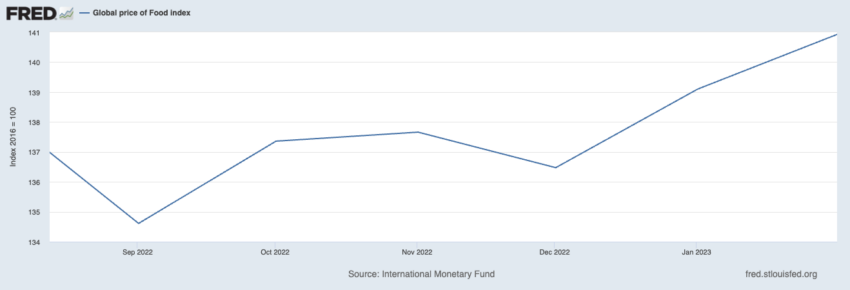

Nonetheless, the efforts to stabilize the system will seemingly result in different inflationary pressures and additional meals value will increase.

In the meantime, traders are more and more diversifying their portfolios and putting their belief in options like Bitcoin. More than 4.28 million Bitcoin wallets have been created on the community, holding a stability of 0.1 BTC or extra.

As the world continues to navigate this monetary minefield, it’s clear {that a} youthful technology is extra inclined to depend on software-driven options over human-led methods.

Investors should intently monitor central financial institution responses. Likewise, developments in Europe and different affected areas can shed some gentle as the worldwide banking disaster unfolds.

The ongoing pattern of a debt-based financial system and a fractional reserve banking system means that, in the long run, various property like Bitcoin might emerge as the largest winners.

Disclaimer

All the knowledge contained on our web site is revealed in good religion and for normal info functions solely. Any motion the reader takes upon the knowledge discovered on our web site is strictly at their very own threat.

[ad_2]

Source link