Alfred Kammer is the Director of the European Department at the International Monetary Fund (IMF); Jihad Azour is the Director of the Middle East as well as Central Asia Department at the IMF; Abebe Aemro Selassie is the Director of the African Department at the IMF; Ilan Goldfajn was Governor of the Banco Central do Brasil (BCB) from May 2016 up until February 2019; Changyong Rhee is the Director of the Asia as well as Pacific Department at the IMF.____

Beyond the suffering as well as altruistic dilemma from Russia’s intrusion of Ukraine, the whole international economic situation will certainly really feel the results of slower development as well as faster rising cost of living.

Impacts will certainly move via 3 major networks. One, greater costs for assets like food as well as power will certainly raise rising cost of living better, in turn wearing down the worth of revenues as well as evaluating on need. Two, bordering economic situations in certain will certainly come to grips with interfered with profession, supply chains, as well as compensations along with an historic rise in evacuee streams. And 3, decreased organization self-confidence as well as greater financier unpredictability will certainly consider on property costs, tightening up monetary problems as well as possibly stimulating funding discharges from arising markets.

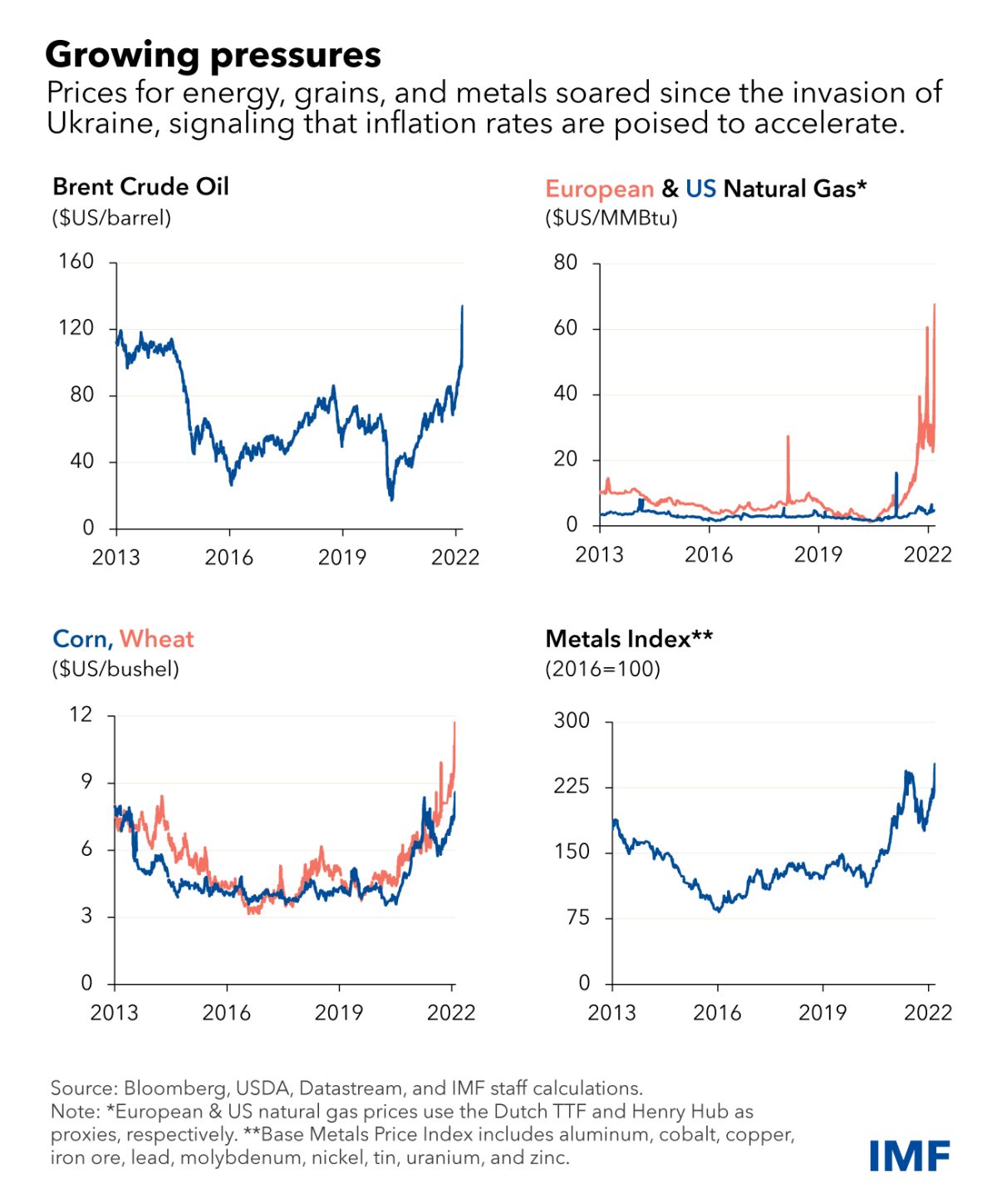

Russia as well as Ukraine are significant assets manufacturers, as well as interruptions have actually triggered international costs to skyrocket, particularly for oil as well as gas. Food prices have actually leapt, with wheat, for which Ukraine as well as Russia comprise 30% of international exports, getting to a document.

Beyond international overflows, nations with straight profession, tourist, as well as monetary direct exposures will certainly really feel extra stress. Economies reliant on oil imports will certainly see broader financial as well as profession shortages as well as even more rising cost of living pressure, though some merchants such as those in the Middle East as well as Africa might take advantage of greater costs.

Steeper cost rises for food as well as gas might stimulate a higher danger of discontent in some regions, from Sub-Saharan Africa as well as Latin America to the Caucasus as well as Central Asia, while food instability is most likely to additional boost in components of Africa as well as the Middle East.

Gauging these echos is hard, however we currently see our development projections as most likely to be modified down following month when we will certainly provide a fuller image in our World Economic Outlook as well as local evaluations.

Longer term, the war might basically modify the international financial as well as geopolitical order ought to power profession change, supply chains reconfigure, repayment networks piece, as well as nations reassess get money holdings. Increased geopolitical stress better elevates threats of financial fragmentation, particularly for profession as well as modern technology.

Europe

The toll is currently tremendous in Ukraine. Unprecedented permissions on Russia will certainly harm monetary intermediation as well as profession, undoubtedly creating a deep economic crisis there. The ruble’s devaluation is sustaining rising cost of living, additional decreasing living criteria for the populace.

Energy is the major overflow network for Europe as Russia is an important resource of gas imports. Wider supply-chain interruptions might additionally be substantial. These results will certainly sustain rising cost of living as well as reduce the recuperation from the pandemic. Eastern Europe will certainly see climbing funding prices as well as an evacuee rise. It has actually taken in a lot of the 3 million individuals that lately ran away Ukraine, per the United Nations.

European federal governments additionally might challenge financial stress from extra costs on power safety and security as well as protection spending plans.

While international direct exposures to diving Russian possessions are small by international criteria, stress on arising markets might expand need to financiers look for more secure places. Similarly, the majority of European financial institutions have small as well as convenient straight exposures to Russia.

Caucasus as well as Central Asia

Beyond Europe, these bordering countries will certainly really feel higher repercussions from Russia’s economic crisis as well as the permissions. Close profession as well as payment-system web links will certainly suppress profession, compensations, financial investment, as well as tourist, detrimentally influencing financial development, rising cost of living, as well as exterior as well as financial accounts.

While asset merchants need to take advantage of greater global costs, they deal with the danger of decreased power exports if permissions reach pipes via Russia.

Middle East as well as North Africa

Major causal sequences from greater food as well as power costs as well as tighter international monetary problems are most likely. Egypt, for instance, imports concerning 80% of its wheat from Russia as well as Ukraine. And, as a prominent traveler location for both, it will certainly additionally see site visitor costs reduce.

Policies to have rising cost of living, such as increasing federal government aids, can pressure currently weak financial accounts. In enhancement, aggravating exterior funding problems might stimulate funding discharges as well as contribute to development headwinds for nations with raised financial obligation degrees as well as huge funding demands.

Rising costs might elevate social stress in some nations, such as those with weak social safeguard, couple of task chances, restricted financial area, as well as out of favor federal governments.

Sub-Saharan Africa

Just as the continent was progressively recouping from the pandemic, this dilemma endangers that development. Many nations in the area are especially susceptible to the war’s results, particularly due to greater power as well as food costs, decreased tourist, as well as possible problem accessing global funding markets.

The problem comes when most nations have marginal plan area to respond to the results of the shock. This is most likely to increase socio-economic stress, public financial obligation susceptability, as well as scarring from the pandemic that was currently challenging countless houses as well as organizations.

Record wheat costs are especially worrying for an area that imports around 85% of its materials, one-third of which originates from Russia or Ukraine.

Western Hemisphere

Food as well as power costs are the major network for overflows, which will certainly be significant in some situations. High asset costs are most likely to dramatically accelerate rising cost of living for Latin America as well as the Caribbean, which currently encounters an 8% typical yearly price across 5 of the biggest economic situations: Brazil, Mexico, Chile, Colombia, as well as Peru. Central financial institutions might need to additional safeguard inflation-fighting reputation.

Growth results of pricey assets differ. Higher oil costs harmed Central American as well as Caribbean importers, while merchants of oil, copper, iron ore, corn, wheat, as well as steels can bill much more for their items as well as reduce the effect on development.

Financial problems stay reasonably positive, however magnifying problem might trigger international monetary distress that, with tighter residential financial plan, will certainly consider on development.

The United States has couple of connections to Ukraine as well as Russia, weakening straight results, however rising cost of living was currently at a four-decade high prior to the war increased asset costs. That indicates costs might maintain climbing as the Federal Reserve begins increasing rates of interest.

Asia as well as the Pacific

Spillovers from Russia are most likely restricted offered the absence of close financial connections, however slower development in Europe as well as the international economic situation will certainly take a hefty toll on significant merchants.

The greatest results on bank accounts will certainly be in the oil importers of ASEAN economic situations, India, as well as frontier economic situations consisting of some Pacific Islands. This can be magnified by decreasing tourist for countries reliant on Russian sees.

For China, prompt results need to be smaller sized since financial stimulation will certainly sustain this year’s 5.5% development objective as well as Russia acquires a reasonably percentage of its exports. Still, asset costs as well as damaging need in large export markets contribute to difficulties.

Spillovers are comparable for Japan as well as Korea, where brand-new oil aids might relieve influences. Higher power costs will certainly elevate India’s rising cost of living, currently on top of the reserve bank’s target array.

Asia’s food-price stress need to be reduced by regional manufacturing as well as even more dependence on rice than wheat. Costly food as well as power imports will certainly enhance customer costs, though aids as well as cost caps for gas, food, as well as plant food might relieve the prompt influence—however with financial prices.

Global Shocks

The repercussions of Russia’s war on Ukraine have actually currently drunk not simply those countries however additionally the area as well as the globe, as well as indicate the relevance of a worldwide safeguard as well as local plans in location to buffer economic situations.

“We live in a more shock-prone world,” IMF Managing Director Kristalina Georgieva lately informed press reporters at an instruction in Washington. “And we need the strength of the collective to deal with shocks to come.”

While some results might not completely entered into emphasis for several years, there are currently clear indicators that the war as well as resulting dive in prices for necessary assets will certainly make it harder for policymakers in some nations to strike the fragile equilibrium in between consisting of rising cost of living as well as sustaining the financial recuperation from the pandemic.

___

This write-up initially showed up on blogs.imf.org.____Learn more:- Fed Can’t Stop Prices From Going Up Anytime Soon, But There’s Good News, Too- Ukraine War Raises Questions About the ‘End of Monetary Regime’ as well as Role of Bitcoin

– Bitcoin, the Ukraine Crisis as well as the Central Bankers Dilemma- Could the Ukraine Invasion Spark a Global Financial Crisis?- As Inflation Is Here to Stay, Bitcoin, Ethereum, as well as Gold Investors Will Win, But Brace for Volatility – BitMEX

– Bitcoin in an Interest Rate Rising Environment- How Raising Interest Rates Curbs Inflation – as well as What Could Possibly Go Wrong