The vital long-term holders (LTHs) of both bitcoin (BTC) as well as ethereum (ETH) are still hopeful regarding the near-term cost steps of both cryptocurrencies, according to on-chain signs evaluated by Kraken Intelligence.

Despite striking all-time highs previously in November, both BTC as well as ETH are still much from reaching what has actually traditionally been taken into consideration “overbought” area, Kraken’s on-chain absorb for November stated regarding both biggest cryptocurrencies.

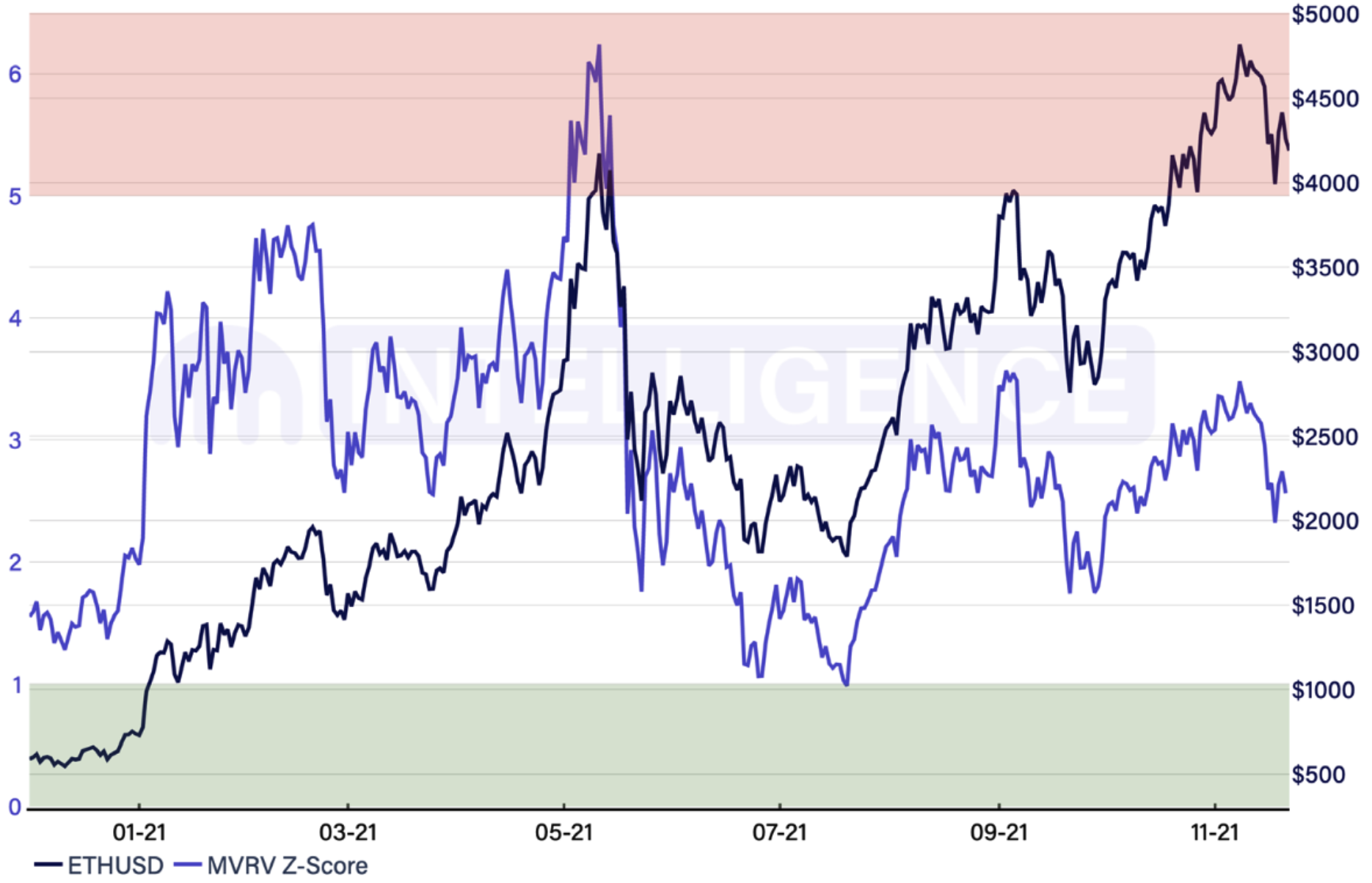

For ETH especially, the searching for that the possession is not yet overbought was gotten to by considering the supposed market price to understood worth (MVRV) Z-score.

In this formula, the Z-score is a dimension of the distinction in between a worth as well as a team’s standard, determined in common discrepancies. Further, the marketplace worth (MV) is what we typically call the marketplace capitalization of the possession, while the understood worth (MOTOR HOME) is the cost of each system of BTC or ETH when it was last relocated increased by the variety of symbols in blood circulation.

Analysts normally think about an analysis over 5 as “overbought” as well as an analysis listed below 1 as “oversold.” And according to Kraken’s computations, ETH’s MVRV Z-score is presently at 2.56 – or regarding midway in between overbought as well as oversold degrees.

According to the exchange’s group of internal scientists, this shows that ETH “still has momentum” to climb additionally from its existing cost. And not just that, yet background additionally shows that ETH has “significantly more momentum” this moment around than it did when it last hit all-time highs in May this year.

Back after that, the MVRV Z-score was abut the dual of what it is currently, Kraken’s record stated.

ETH’s MVRV Z-score as well as cost:

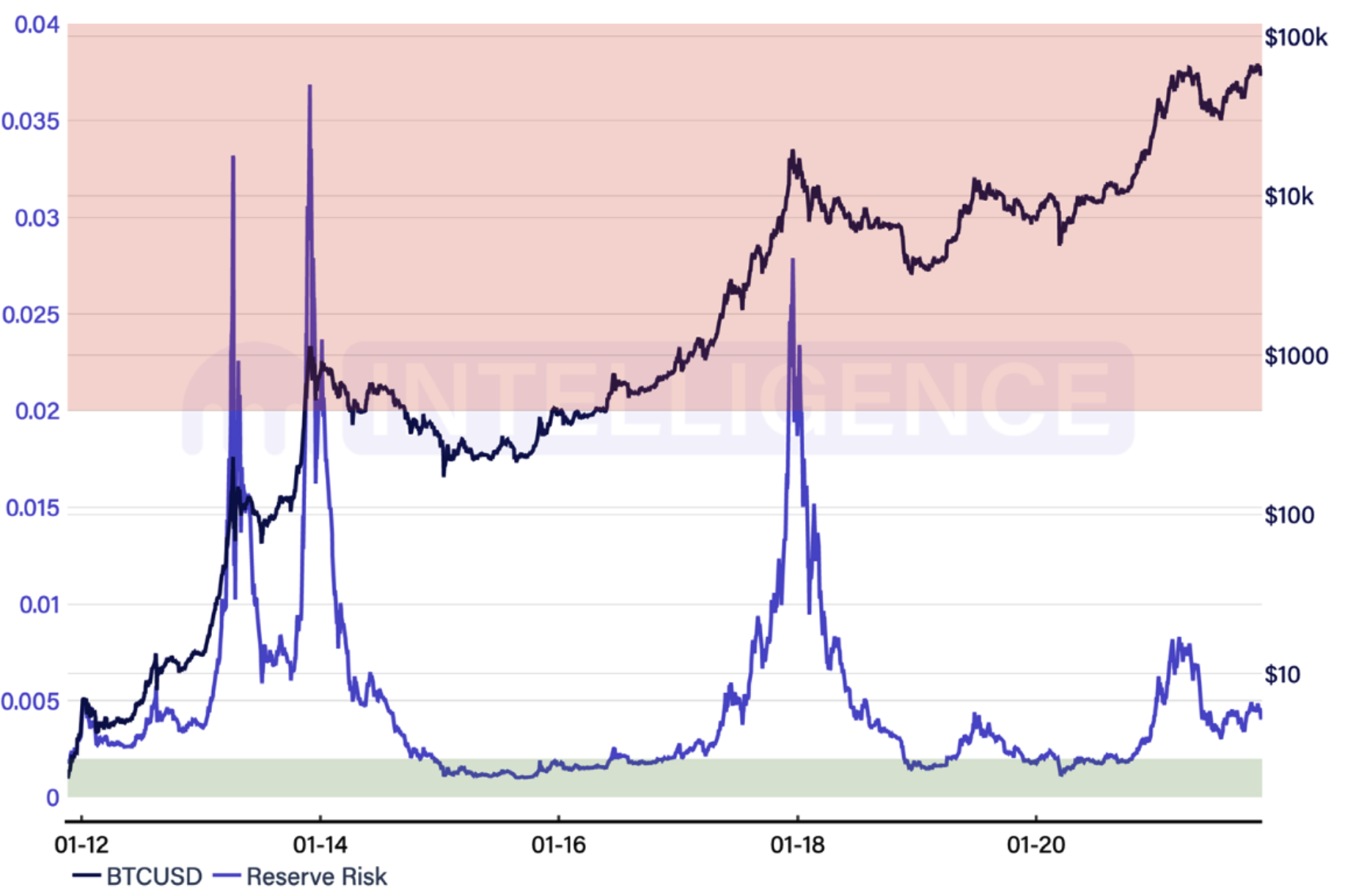

Moving over to bitcoin, Kraken considered an additional on-chain statistics referred to as the Reserve Risk as well as identified that bitcoin additionally continues to be well listed below traditionally overbought degrees.

The Reserve Risk indication is obtained by separating bitcoin’s cost by the supposed “HODL Bank,” an action of the chance expense of holding BTC as opposed to offering over the life time of the bitcoin network. And according to the indication, bitcoin’s get threat is currently “significantly below” the degree from the last all-time high in May.

Like the MVRV Z-score for ETH, bitcoin’s get threat additionally signifies that the cost has “room to run higher” prior to getting to overbought area, Kraken created.

BTC’s get threat as well as cost:

In verdict, the record kept in mind that supply of both BTC as well as ETH on exchanges go to multi-year lows, which it stated recommends that holders have sentence regarding their settings. However, it additionally cautioned that view can transform swiftly, which improvements are an inescapable component of the marketplace.

Meanwhile, as well as on a somewhat a lot more bearish note, the on-chain analytics company Coin Metrics created in its most current record that the crypto market might see offering stress surge.

“Short-term market pressure might be rising due to changing macroeconomic conditions,” the company created, while mentioning dramatically increasing United States bond returns as one instance of this. When the “risk-free” price that can be gotten from bonds climb, this can adversely affect properties with a greater regarded threat such as crypto, the company advised.

At 14:44 UTC on Tuesday, BTC is trading at USD 56,777, down 2.4% over the previous 24 hr as well as almost 11% over the previous 7 days. At the very same time, ETH is altering hands at USD 4,204, down virtually 1% for the day as well as 8.2% for the week.

____

Learn a lot more:

– Bitcoin Rally Healthy, Less Leverage Than in the Past, Say On-Chain Analysts- Still Upside Potential in Bitcoin, While ETH Faces Competition – Kraken

– Ethereum Fee Debate Heats Up as Avalanche Enters as well as Exits Top 10- BTC, ETH Find Support After Sell-Off, Long-Term Technicals Remain Strong