The MIOTA token has actually shed versus both USD as well as Bitcoin as vendors enhance descending stress

whit rate has actually changed greatly in the previous 1 day, taping worths within the variety of $0.97 to $1.13 as revealed on crypto market information collector CoinGecko. The 48th rated cryptocurrency is trading about $1.02 sometimes of creating, with an everyday trading quantity of over $90 million as well as market cap of $2.8 billion.

According to CoinGecko information, whit’s rate is down 6.8% versus the United States buck as well as 5.4% versus BTC in the 24-hour timeline. Although bulls are fighting to maintain rates over $1 after today’s dip, the durable obstacle they encounter at existing rates recommends a fresh decrease encompassing 4 August lows of $0.82 is feasible.

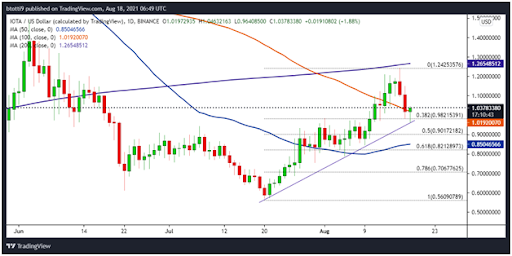

Here is exactly how MIOTA/USD views the everyday as well as 4-hour graph:

whit rate technological overview

MIOTA/USD 4-hour graph. Source: TradingView

On the 4-hour graph, MIOTA/USD is below the 50MA, yet looks most likely to try a brand-new action after recoiling from an old straight assistance line. The in contrast image is nevertheless more probable provided the RSI is suffering below 50 as well as a bearish crossover for the MACD recommends vendor benefit.

The everyday graph reveals that whit rate stays over a favorable trendline created considering that the healing from lows of $0.56 on 20 July. The uptrend saw bulls damage over numerous important resistance areas, the very first one being the 50-day relocating typical line. Price likewise passed the 100-day relocating standard prior to bulls faced headwinds near the 200-day relocating standard.

MIOTA/USD everyday graph. Source: TradingView

The unfavorable returns from the 200MA consisted of a two-day dive past the 100MA, with bulls’ efforts to maintain form warded off by raised revenue taking across the marketplace. The overview recommends that restored descending stress could lastly press IOTA/USD below the assistance trendline. The circumstance indicate a possible retest of the 50% Fibonacci retracement degree of the swing to $1.24, which would certainly imply losses to $0.90.

From right here, bulls are most likely to collect yourself for an additional go, yet if it falls short, the 50MA ($0.85) as well as 61.8% Fib degree ($0.82) need to work as brand-new need areas.