Bank of Russia determined to take care of the rate of interest at 7.5% amid average inflation, estimated at 2.5% on an annual foundation in April, though this may increasingly change later this yr. The financial authority improved its forecast for the Russian financial system and now expects development solely in constructive figures, as much as 2.0% for 2023.

Bank of Russia Leaves Interest Rate Unchanged for Fifth Consecutive Time

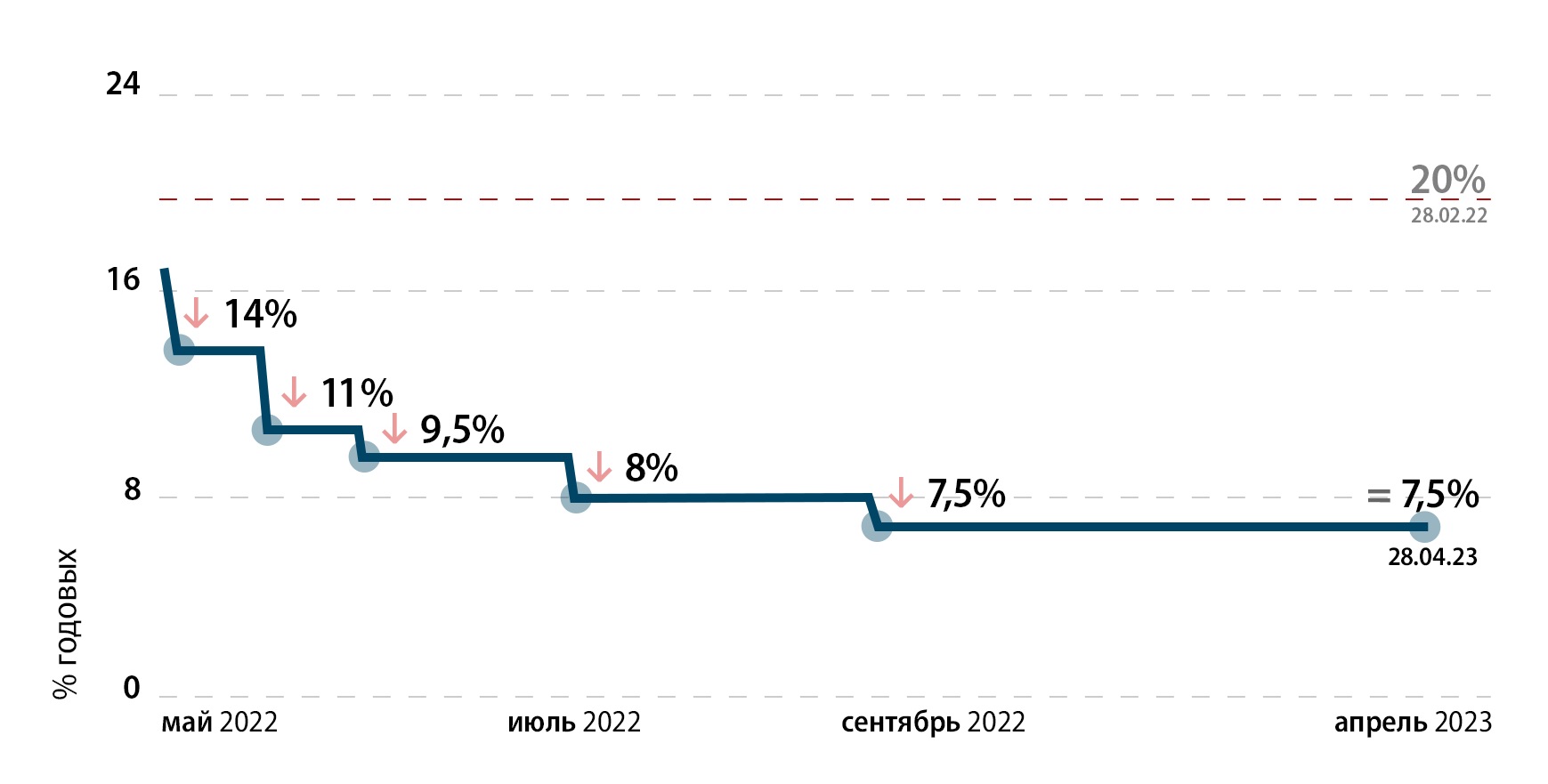

At a gathering of its Board of Directors on Friday, the Central Bank of Russia (CBR) stored its key rate of interest on the present stage of seven.5%. The determine has remained unchanged since September 2022. The regulator defined its choice with average inflation.

Due to the excessive base impact, annual inflation in the Russian Federation dropped considerably — to three.5% in March, from 11% in February, and has been estimated at 2.5% as of April 24, main Russian enterprise day by day Kommersant famous in a report.

Bank of Russia believes that the indicator was held again by the continuing adaptation of the Russian financial system to Western sanctions in addition to the elevated shares in numerous commodity teams accompanied by average shopper demand.

The financial authority expects inflation to stay beneath 4% in the approaching months and to start to regularly develop in the second half of 2023, reaching 4.5 – 6.5% on the finish of the interval. Previous forecasts have been in the 5 – 7% vary. However, expectations in the medium time period are nonetheless skewed in direction of increased inflation dangers.

These are linked to important labor shortages in some industries, the influence of geopolitical tensions on overseas commerce, together with more durable sanctions that might additional weaken demand for Russian items overseas and complicate manufacturing chains, logistics and monetary calculations. The CBR signaled that future charge hikes are doable, elaborating:

In the context of a gradual enhance in the present inflationary strain, the Bank of Russia, on the subsequent conferences, will consider the feasibility of elevating the important thing charge to stabilize inflation close to 4% in 2024.

Russian Economy Projected to Grow 0.5 – 2.0% This Year

Among the short-term dangers, the Bank of Russia highlighted “a deterioration in the growth prospects of the global economy against the backdrop of instability in the financial markets of developed countries.” At the identical time, amid quicker than anticipated enhance in home financial exercise and demand, the financial institution improved its forecast for Russia’s financial system.

The financial coverage regulator sees the sanctioned nation’s gross home product (GDP) rising between 0.5% and a pair of.0% by the top of 2023. Its earlier estimate was partially in unfavorable territory, between a decline of 1% and a rise of 1%. Expectations for the subsequent couple of years remained unchanged — GDP development in the vary 0.5 – 2.5% in 2024 and 1.5 – 2.5% in 2025.

The CBR’s choice to maintain the Russian rate of interest at its present ranges comes amid statements by officers and analysts in Europe and America indicating that additional charge will increase, earlier than pausing, are to be anticipated from the European Central Bank and the U.S. Federal Reserve in May.

Do you suppose the Bank of Russia will increase rates of interest later this yr? Share your predictions in the feedback part beneath.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational functions solely. It shouldn’t be a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any harm or loss triggered or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about in this text.