On Nov. 7, 2022, the bitcoin mining agency Core Scientific launched the corporate’s October replace after the corporate’s Form 8-Ok U.S. Securities and Exchange Commission (SEC) submitting on Oct. 26, 2022. The submitting famous that the corporate was within the technique of exploring “restructuring its existing capital structure.” The replace printed on Monday signifies that Core Scientific offered 2,285 bitcoins at a median worth of $19,639 per bitcoin.

Core Scientific Releases October Update

On Oct. 29, Bitcoin.com News reported on the bitcoin mining agency Core Scientific (Nasdaq: CORZ), as the corporate’s shares have been downgraded by the B. Riley analyst Lucas Pipes following the agency’s Form 8-Ok SEC submitting. Pipes downgraded shares of CORZ to Neutral from Buy and stated “compressed self-mining margins have exerted extra pressure on the company’s ability to meet its financial obligations.”

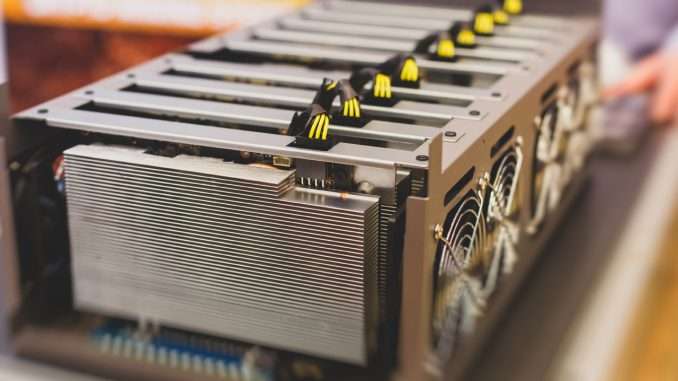

The October replace printed on Monday reveals that the publicly listed mining firm has 243,000 colocated and owned application-specific built-in circuit (ASIC) bitcoin mining rigs. During the course of final month, Core Scientific managed to mine 1,295 bitcoins with the agency’s sources. However, the corporate offered greater than it made in October because it offered 2,285 bitcoins through the 30-day span.

The BTC was offered for $19,639 per unit and the corporate raked in $44.8 million from the gross sales in October. Core Scientific holds roughly 62 bitcoin (BTC) as of October 31, 2022, and out of the fleet of 243,000 mining rigs, 143,000 are self-hosted by Core Scientific. The self-mining aspect of Core Scientific’s whole fleet of ASICs represents 14.4 exahash per second (EH/s).

The firm has a complete of 24.4 EH/s with the colocated fleet it operates and the corporate operates amenities in Georgia, Kentucky, North Carolina, and North Dakota. Core Scientific’s replace does word that the agency has “completed 287 MW of its data center build-out in Texas.” However, the October replace doesn’t disclose something about assembly the agency’s monetary obligations.

While Core Scientific did say it completed an information heart in Texas it additionally famous that it powered down the operation and different amenities it operates “to enhance electrical grid stability.” “In the month of October, the [Core Scientific] powered down its Texas and other data center operations on several occasions,” the corporate’s replace particulars. “Curtailments in October totaled 5,125 megawatt-hours.”

Core Scientific’s shares began the day at 10:20 a.m. (ET) up 5% in opposition to the U.S. greenback. CORZ, nevertheless, is down 98.82% in opposition to the dollar year-to-date.

What do you consider Core Scientific’s October replace? Let us know what you consider this topic within the feedback part beneath.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational functions solely. It shouldn’t be a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any injury or loss prompted or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.