The crypto market liquidated brief and lengthy positions price over $100 million in the final 24 hours following a quick rise of Bitcoin to $31,000, marking its first such improve this 12 months.

Short merchants suffered vastly because the BTC worth surge of the previous week dashed their expectations of additional cryptocurrency worth declines amid regulatory pressures.

Over $140M Liquidated

According to Coinglass information, out of the $141.71 million liquidated in the previous 24 hours. The brief positions account for $87.1 million. The largest liquidation occurred on Binance and was valued at $3 million.

Bitcoin alone accounted for $55.89 million of the overall liquidations. Other cryptocurrencies comparable to Ethereum, Bitcoin Cash, Pepe, and Litecoin additionally recorded a sizeable quantity of losses for traders buying and selling them.

While shorts constituted many of the liquidated positions, lengthy positions had been additionally considerably liquidated. Crypto belongings like SOL, XRP, CFX, and Doge witnessed the next variety of liquidated lengthy positions. This means that some merchants overshot their projections of a future rise in worth for these belongings.

Bitcoin ETF Applications

Over the previous week, the crypto market has witnessed a brand new wave of institutional curiosity in Bitcoin. Several conventional monetary establishments have filed purposes for a spot BTC ETF.

BlackRock’s June 15 submitting triggered an avalanche of purposes by different rival corporations. BlackRock is the world’s largest asset supervisor, with greater than $10 trillion price of belongings below its administration.

Since then, different asset administration corporations like Invesco and WisdomTree have submitted new BTC ETF filings to the U.S. Securities and Exchange Commission (SEC).

Additionally, a crypto alternate backed by a number of conventional establishments like Fidelity and Citadel Securities went dwell on June 20.

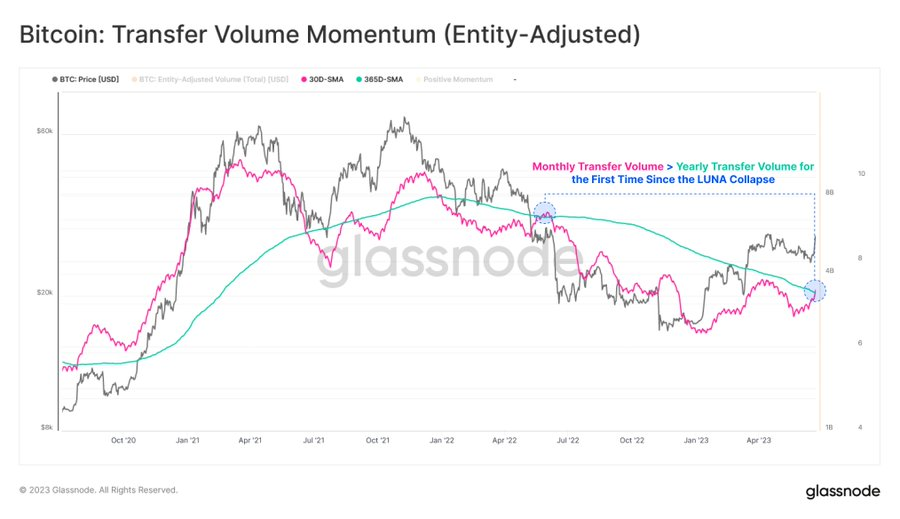

BTC Monthly Volume Above Yearly Average

Meanwhile, the renewed bullishness surrounding the market has translated into Bitcoin month-to-month switch quantity overtaking the yearly averaged baseline for the primary time because the LUNA implosion, in accordance with Glassnode information.

The blockchain analytical agency added that this “suggests an expansion in on-chain activity, typical of improving network fundamentals and growing network utilization.”

Disclaimer

All the knowledge contained on our web site is printed in good religion and for normal info functions solely. Any motion the reader takes upon the knowledge discovered on our web site is strictly at their very own danger.