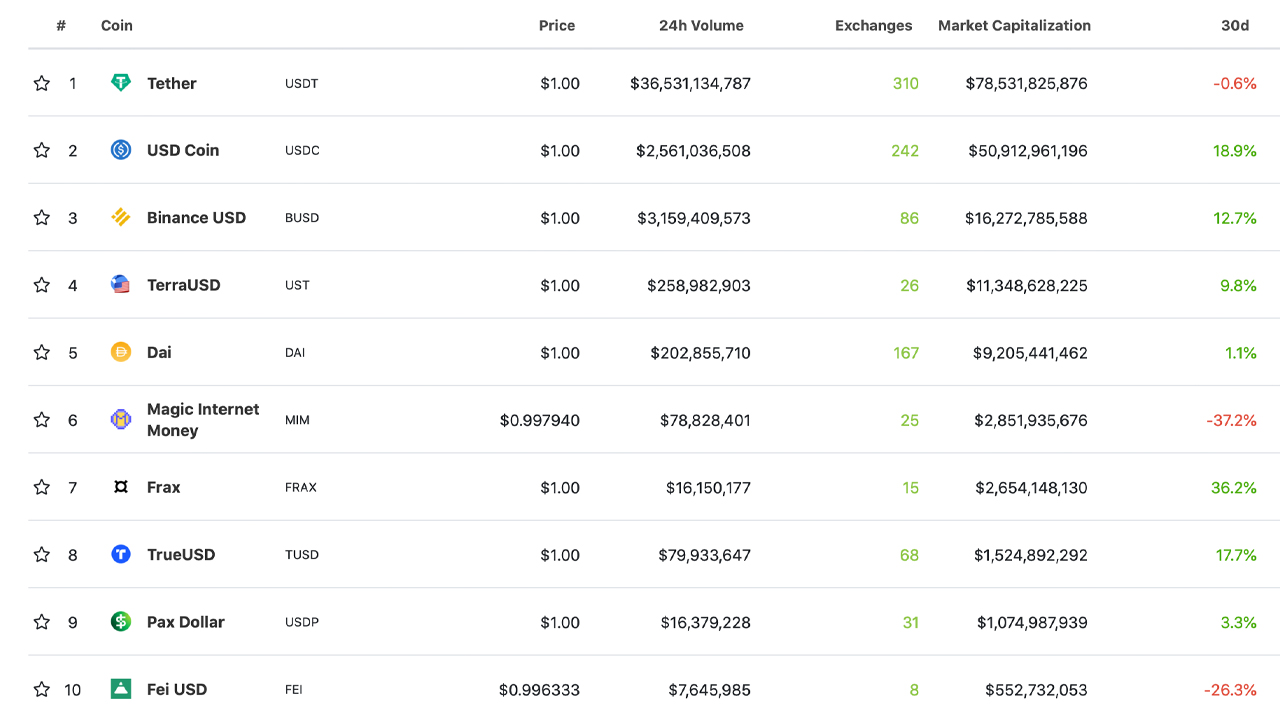

As the whole great deal of 12,333 electronic money floats simply over $1.8 trillion in worth, the stablecoin economy has actually just recently swelled to $178.8 billion or 9.9% of the whole crypto economy. Out of the leading 5 stablecoins, usd coin (USDC) saw its market capitalization leap one of the most, raising 18.9% throughout the last 1 month. The 18.9% rise has actually pressed USDC’s market capitalization over the $50 billion mark.

USDC Market Cap Rises Above $50 Billion, Stablecoin Represents 2.83% of the Crypto Economy’s USD Value

Stablecoins proceed to expand in 2022, as various fiat-pegged token tasks have actually seen their issuance degrees enhance throughout the very first month of the year. At the moment of creating, the USD worth of all the stablecoins today is $178.8 billion.

Tether (USDT) is the biggest stablecoin job in regards to market capitalization, with an appraisal of around $78.5 billion. USDT’s general assessment stands for 4.34% of the whole crypto economy’s $1.8 trillion. Tether, nonetheless, saw no development throughout the last month as the general assessment has actually stayed fixed.

USDC, on the various other hand, has actually expanded 18.9% over the last 1 month and also the marketplace assessment is currently over $50 billion. USDC’s market capitalization is 2.83% of the whole crypto economy’s USD worth.

Both USDT and also USDC mixed stand for 7.17% of the fiat worth of all the coins around today. While these caps are a lot smaller sized than bitcoin’s (BTC) 39.2% supremacy and also ethereum’s (ETH) 17.7% supremacy, they still stand for the 3rd and also fifth biggest crypto evaluations.

Stablecoin FRAX Grew More Than 36% Last Month

Meanwhile, out of the leading 5 stablecoins by market cap, the third-largest USD-pegged token, BUSD, saw its capitalization rise by 12.7% to $16.2 billion this month. Terra’s stablecoin UST enhanced by 9.8% to $11.3 billion in 1 month.

Makerdao’s DAI saw its $9.2 billion market capitalization rise by 1.1% this previous month. The Avalanche-based magic web cash (MIM) saw its $2.8 billion assessment slide 37.2% less than it was last month. The 7th, 8th, and also ninth-largest stablecoin markets saw their market caps climb.

The seventh-largest USD-pegged coin frax (FRAX) has actually a market capitalization of $2.6 billion which has enhanced 36.2% throughout the last month. Trueusd’s (TUSD) cap increased 17.7%, and also pax buck (USDP) increased by 3.3% over the last 1 month.

The tenth-largest stablecoin, fei usd (FEI), has actually lowered by 26.3% this previous month. Both FRAX and also USDC saw the biggest rises last month.

What do you think of the stablecoin economy’s rise throughout the last month and also USDC’s increase past $50 billion? Let us understand what you think of this topic in the remarks area listed below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Coingecko.com,

Disclaimer: This short article is for informative functions just. It is not a straight deal or solicitation of a deal to purchase or offer, or a suggestion or recommendation of any type of items, solutions, or firms. Bitcoin.com does not supply financial investment, tax obligation, lawful, or bookkeeping recommendations. Neither the firm neither the writer is accountable, straight or indirectly, for any type of damages or loss created or affirmed to be triggered by or about making use of or dependence on any type of web content, products or solutions stated in this short article.