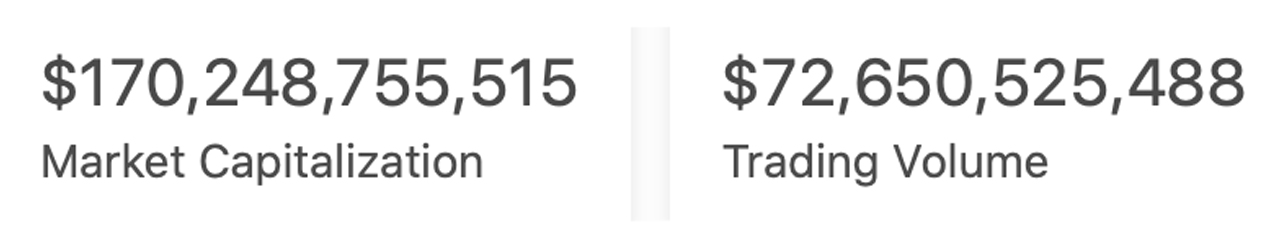

As crypto-assets expanded tremendously in worth in 2014, the growth of the stablecoin economic climate swelled too as well as today, there’s $170.24 billion well worth of stablecoins in blood circulation. Data suggests that over the last one year, a variety of stablecoin appraisals expanded greatly.

12-Month Stats Show Stablecoin Market Valuations Saw Massive Growth

Last year, various crypto properties touched all-time high (ATH) costs as present information highlights the crypto economic climate’s significant growth in 2021. Moreover, fiat-pegged symbols, typically described as stablecoins, have actually likewise seen substantial growth as central custodians as well as decentralized methods have actually provided billions of symbols considering that in 2014.

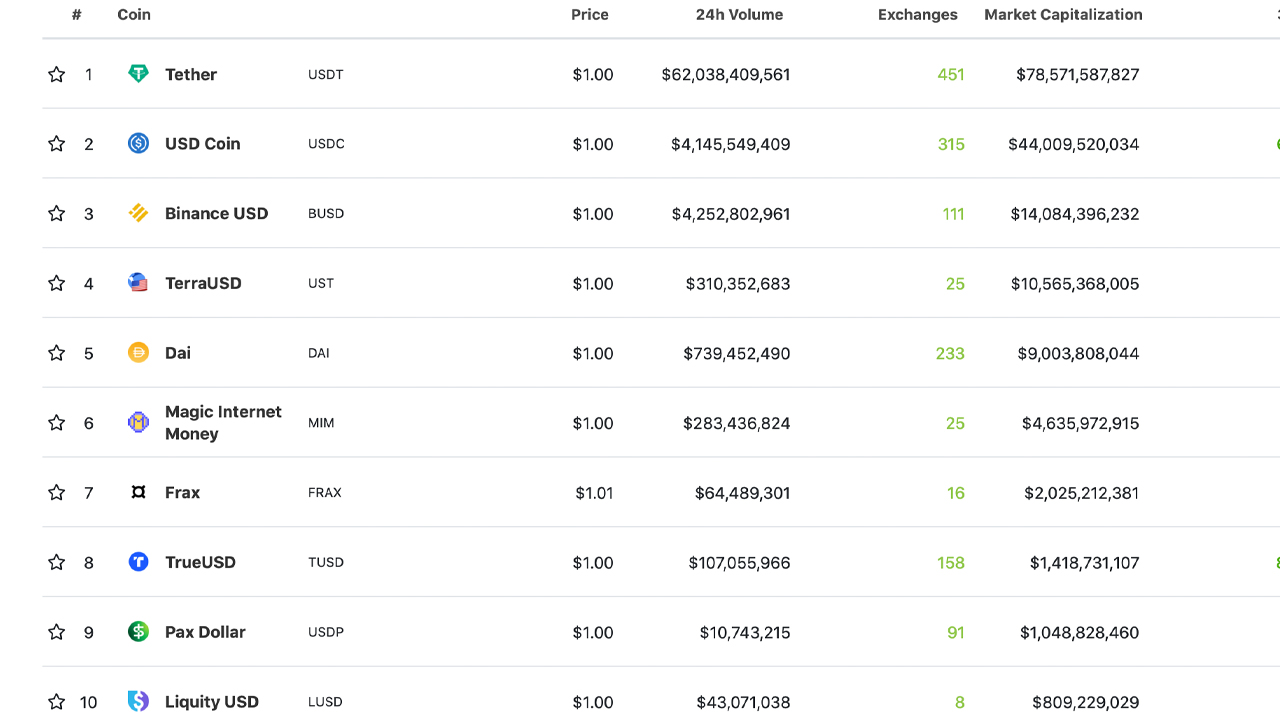

For circumstances, on January 11, 2021, secure’s (USDT) market cap was $24.4 billion as well as it has actually expanded 221.31% considering that in 2014. Usd coin (USDC), the second-largest stablecoin property in regards to market evaluation, had a market cap of $4.4 billion on the very same day in 2014. Today, USDC’s market cap is $43.9 billion, which is a rise of 897.72%.

The stablecoin provided by Binance (BUSD) just had a $1 billion market cap a year back as well as currently it’s $14 billion, boosting 1,300% this previous year. Terra’s stablecoin UST had a market evaluation of $138 million on January 11, 2021, as well as today the marketplace cap is $10.5 billion.

Over the Last Year, Fiat-Pegged Token Market Caps Jumped Higher Than Most Crypto Gains

Makerdao’s DAI token went from $1.3 billion to today’s $9 billion as it expanded 592.30% over the in 2014. MIM, or else called Magic Internet Money, is a stablecoin that’s not also a years of age yet is the sixth biggest stablecoin out there.

MIM began issuance in September 2021 with $5.4 million as well as today, MIM’s market cap is $4.6 billion. Furthermore, the stablecoin frax (FRAX) has a $2 billion market cap presently yet in 2014 it was just $92 million.

It’s secure to claim several of the dollar-pegged token market caps that saw enormous growth over the in 2014 have actually seen their market cap gains expand greater than the gains of standard crypto properties like bitcoin or ethereum.

Currently, stablecoins stand for 8.24% of the whole crypto-economy worth simply over $2 trillion today. Stablecoin worldwide profession quantity throughout the last 1 day was around $72.6 billion, which is 61.94% these days’s $117.2 billion in quantity throughout the whole crypto economic climate.

What do you think of the stablecoin market caps that have expanded 500% to 1,300% over the in 2014? Let us recognize what you think of this topic in the remarks area listed below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Coingecko, tradingview,

Disclaimer: This short article is for informative objectives just. It is not a straight deal or solicitation of a deal to get or market, or a referral or recommendation of any kind of items, solutions, or business. Bitcoin.com does not offer financial investment, tax obligation, lawful, or audit guidance. Neither the firm neither the writer is accountable, straight or indirectly, for any kind of damages or loss created or affirmed to be brought on by or about making use of or dependence on any kind of material, products or solutions pointed out in this short article.